Climate change has long turned into a mainstream topic of society, presenting mankind with massive challenges. Our future handling of energy and the resources from which we obtain it will play a central role in this. With energy prices rising sharply due to the war in Ukraine, political pressure to expand renewable energies is growing. Nevertheless, there is still a lot to do on the way to global energy transition.

With the energy transition and the necessary ecologisation of the economy, “green technologies” are likely to remain one of the megatrends of the coming years. The ERSTE GREEN INVEST* impact fund invests in precisely those companies whose business models could benefit from this megatrend. (Please note that an investment in securities also entails risks in addition to the opportunities described.)

What is an impact fund?

Impact investing refers to investments in companies, organisations, and funds with the intention of achieving measurable, positive effects on the environment or society in addition to a financial return. Impact investment funds comply with Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (“Sustainable Finance Disclosure Regulation”).

The portfolio includes companies from the most diverse areas of the environmental economy. With the major changes that this year has brought, the focus shifted above all to the topic of energy. What this means and what else distinguishes ERSTE GREEN INVEST is discussed in the following blog post.

The big environmental themes for an ecological future

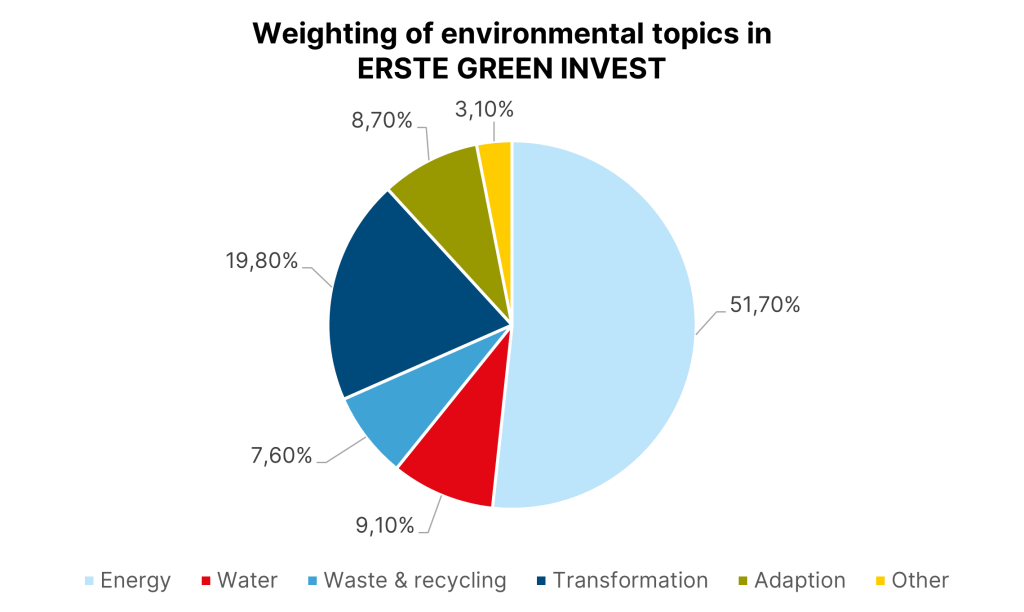

Green technologies include several sectors of the economy. In the fight against climate change, technologies from the areas of water management and recycling, for example, will be of crucial relevance, in addition to renewable energies. The fund pursues a holistic approach that is intended to cover investments across all fields of action for a future worth living. Roughly speaking, the investment philosophy of ERSTE GREEN INVEST focuses on five major environmental themes:

Energy

To achieve the Paris climate goals, energy efficiency and the expansion of renewable energy are central. In addition to a modern energy infrastructure, innovative solutions are also required in the field of mobility.

Water

Around one in four people today has no access to clean drinking water. Protecting water for a secure supply and functioning eco-systems is therefore an essential goal. The growing global population also needs solutions in the areas of irrigation and water technology.

Waste & recycling

In order to use the resources available to us as sparingly as possible, we need technologies to recover resources through recycling. The avoidance of CO2 and other environmental damage are equally as important. In addition to recycling, the focus is also on waste disposal, collection and reuse.

Transformation

In order to make the economy sustainable, it is important to transform traditionally energy- and environmentally-intensive industries. Therefore, investments are needed in pioneering transformation companies that make environmentally harmful processes of the “old economy” more sustainable.

Adaption

Adapting to the unavoidable consequences of climate change to protect people and the economy is also a central theme. This includes companies in biotechnology, flood protection, and climate technology.

Focus on energy transformation

In 2022, one of the five environmental themes took centre stage. The Russian war of aggression in Ukraine brought about a trend reversal in energy policy. Especially in Europe, “energy autonomy” and the “energy transition” became top priority issues.

Political tailwind provides support

The European Union presented a comprehensive package for the diversification of energy sources this year: RePower EU. It includes measures to increase energy efficiency, accelerate the energy transition, accelerate the expansion of renewable energies and diversify Europe’s natural gas supply.

In the USA, too, a billion-dollar package was passed in summer. The core of the Inflation Reduction Act 2022 is the expansion and promotion of renewable energies. A total amount of USD 369bn has been earmarked to flow into renewable energies through various channels by 2030. For more information about the IRA 2022 and its effects, please read the article by Senior Reserach Analyst Stefanie Schock.

Energy as heavyweight in the fund

The increasing political tailwind favours some companies in ERSTE GREEN INVEST. Many of the companies benefit directly from the billions of euros in investments through the two packages in the USA and Europe. Also, companies in the renewable energy sector have so far been less affected by the weaker macroeconomic environment.

Investments in renewable energies, such as photovoltaic systems on rooftops or battery storage, have an inflationary effect on customers as they directly reduce energy costs. In addition, roof-mounted photovoltaic systems currently have a payback period of less than three years in some parts of Europe, making them more economical than ever before.

A look at the current weighting of the individual environmental themes in the fund also shows how important the topic of energy currently is. More than half of the fund volume is invested in companies that can be attributed to this sector. “Due to the positive environment and the various subsidy packages, we have significantly increased the weighting in the energy sector over the past year,” emphasises Alexander Weiss, co-fund manager of ERSTE GREEN INVEST. He continues to observe a positive momentum in sales and profits in the energy sector.

Sustainable showcase companies in the fund

The fund’s portfolio currently comprises 77 shares. On the one hand, these are established companies from the environmental sector. Around three quarters of all companies in the fund already generate profits and are therefore profitable. On the other hand, we have also included smaller, fast-growing companies. These are often from areas such as hydrogen or solar technology and are investing heavily in the expansion of capacities in order to meet the high demand.

But in what exactly does an investor in ERSTE GREEN INVEST invest? In what areas are the companies active, what technologies are they developing, and how are they contributing to a greener future? Each of the following companies in the portfolio are examples of one of the five environmental themes:

- Sunrun (solar power systems; USA)

Sunrun is based in the USA and offers private households innovative usage models to benefit from solar power systems on their houses without having to pre-finance them. By combining solar panels with battery technology, Sunrun’s systems offer protection against power outages, for example after extreme weather events.

- Xylem (water treatment; USA)

The US company Xylem is one of the leading water technology companies. The company’s technologies include the treatment of water to produce pure and drinking water, water-saving agricultural irrigation solutions, industrial pumps, and wastewater treatment plants, where Xylem not only treats the wastewater but also uses it innovatively to produce biogas. The company also builds classic hydropower turbines and heat exchangers to recover the heat contained in wastewater.

- Tomra Systems (recycling technology; Norway)

As a pioneer in the recycling economy, the Norwegian company Tomra Systems has turned the efficient use of raw materials into its business model. At the heart of the company are optical sensors for the detection of material properties for the clean separation of different resources. The company thus offers a crucial link in the raw material chain to return used packaging or materials to the resource cycle.

- Orsted (wind farms; Denmark)

The Danish Orsted Group was originally a traditional energy company and thus active in the oil and gas business. In 2009, however, the company announced a comprehensive change in corporate strategy. The aim was to radically change the energy mix, which at the time was 85% fossil fuel-based. By 2040, 85% of energy production was to be derived from sustainable sources and the remaining 15% from natural gas. In the meantime, this strategy has also been adjusted due to the already advanced implementation. As a result, all energy is to come from sustainable sources as early as 2025. With its exemplary transformation, Orsted is taking a pioneering role in the field of energy production.

- Trane Technologies (cooling systems; Ireland)

The industrial company Trane Technologies is based in Ireland and operates in a number of sectors relevant to action against the effects of climate change. For example, Trane’s various subsidiaries offer solutions in the field of cooling. The product line ranges from air conditioners, refrigerators, commercial cooling units to smart home cooling applications. As part of a sustainability programme that has been launched, the entire production line is to be climate-neutral by 2030 and the group’s energy consumption is to be reduced sustainably.

Conclusion: The energy transition offers a lot of potential

Even if a lot of work remains to be done on the way to an ecological future, the energy transition has arrived and provides a lot of growth potential. With an investment in environmental technologies, as offered by ERSTE GREEN INVEST, you can benefit directly from this megatrend.

“We are looking positively to the year 2023 and also to the years beyond.”

Alexander Weiss,

Fund Management

ERSTE GREEN INVEST

Either way, fund manager Alexander Weiss is very optimistic: “The political environment and the increased urgency in the area of energy autonomy provide strong planning security for the coming years. We are therefore looking positively to 2023 and to the years beyond.”

This article is part of the ESGenius Letter on the topic of the Energy of the Future. The other articles with information and insights on sustainable energy use can be found here.

Warnings

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.