At the end of March, I wrote about what implications higher inflation expectations and higher yields had for certain sectors in the equity space.

Two months later, this topic remains the most heavily discussed one on the market. The recent global fund manager survey by Bank of America found that inflation was cited by 35% of participants as the biggest tail risk, ranking number one ahead of a possible taper tantrum, which is seen as a first step by central banks to remove some of the excess liquidity.

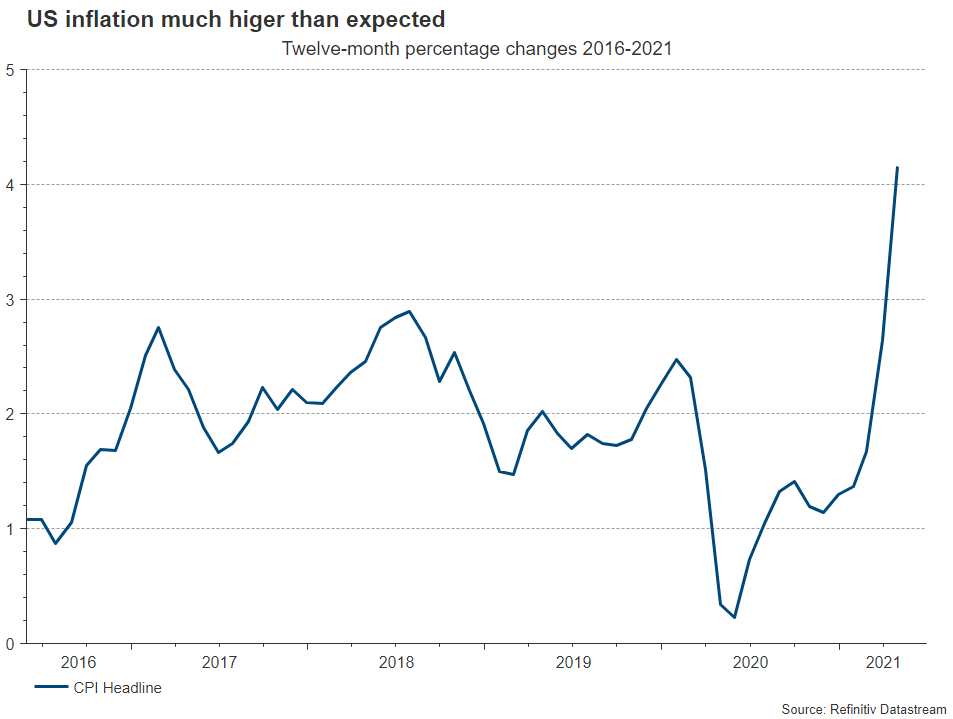

Even though an overshooting in inflation is a concern for equities and economies all around the globe, currently the focus is primarily on price increases in the US, due to the large size of the economy and the fact that the rebound in GDP has been one of the strongest globally. While the Fed has so far maintained its view that any uptick in inflation above its target of 2% will prove to be transitory, investor`s doubts were amplified by the April CPI data (consumer price index, a widely used metric to measure inflation), which increased by 4.2% year-on-year, far above expectations. Also, a recent study showed that on average the word “inflation” came up more than once per earnings call in the US this season, highlighting the increased importance of the topic.

Source: Refintiv Datastream

European banks helped by higher bund yields

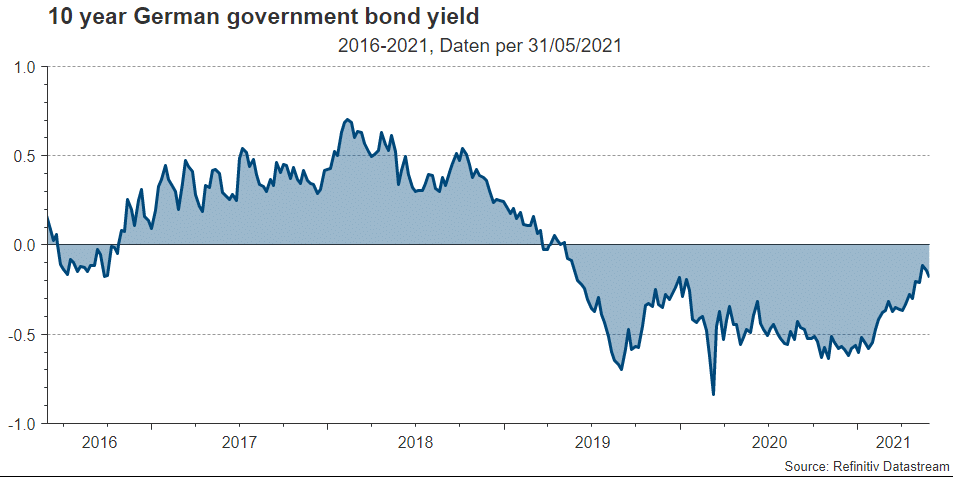

10-year yields in the US have been hovering around 1.6% since March, consolidating the upward move made since the beginning of the year. Recently, it was the European government bonds which reacted more visibly to increased inflation expectations. The German bund yield touched minus 10 basis points in May, the highest level in two years. This helped European banks extend their gains and make them the best performer in the Stoxx 600 this year. The sector has now basically regained all its losses caused by the pandemic, while US banks are trading at fresh all-time highs. In general, banks benefit from higher yields because it allows them to earn more interest both on their loan book and their bond investments.

Source: Refinitiv Datastream

Note: Past performance is no reliable indicator for future performance.

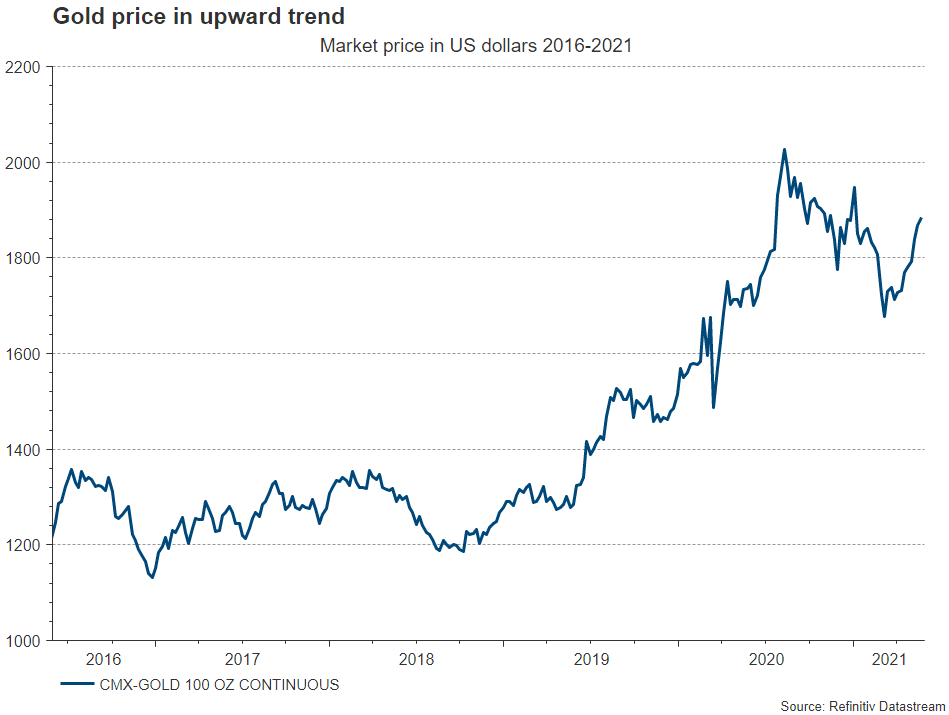

Gold rebounding

Another strong performer as of late was gold, gaining more than 11% from the lows reached in March. The precious metal – which rallied 25% last year, but performed rather poorly in 2021 – came back into favor as a rising inflation rate pushed real yields (= nominal yield – inflation rate) lower. Since gold does not pay a dividend, lower real yields reduce the opportunity cost of holding the precious metal, thereby making it a more attractive investment. The weakening of the USD – the currency in which most commodities are quoted – also played its part in the rebound of the gold price.

Source: Refintiv Datastream

Note: Past performance is no reliable indicator for future performance.

Q1 earnings crushed expectations

Even amid all the worries about inflation, major equity indices such as the S&P 500, MSCI World or the Stoxx 600 are trading around their all-time highs reached in May. Company earnings in the first quarter showed a very encouraging picture and came in way ahead of analyst expectations. In the US, more than 80% of companies beat expectations, and earnings grew by more than 50% year-on-year in absolute terms. In Europe, there are still many companies left to report, but out of those who already did, earnings grew by over 90%, also far better than expected. Compared to the strength in earnings, the overall stock market reaction was rather muted, as investors already discounted a lot of the positives beforehand.

Source: Bloomberg

The positives still outweigh the negatives

Currently our perception is that even though there are risks on the horizon, as explained above, the positives still outweigh the negatives going forward. After the strong earnings surprises, analysts will be busy in the coming months to upgrade their expectations. The vaccine rollout is progressing well, and now that Europe`s vaccination rate has caught up, it looks increasingly likely that most parts of the developed world will enjoy a relatively normal summer, which will give consumers the opportunity to spend parts of their built-up savings and to satisfy their pent-up demand. Also, companies will likely start spending more if they face an increasing demand, which can add to the ongoing economic recovery. We maintain our view that a relatively balanced portfolio is warranted at this stage, whereby sectors which stand to benefit from higher inflation (e.g. banks) should be overweight.

ERSTE REAL ASSETS: A fund to cushion inflation

Those who want to guard against the emergence of inflation have several options to do so. Real assets, such as equities, real estate and gold, are one option.

With the new ERSTE REAL ASSETS fund, investors invest in a mix of approximately 50% global equities, 17% real estate funds and 33% gold (primarily in the form of exchange traded commodities (ETCs).[1] There is regular rebalancing of the investment allocation.[2]

[1] Acquisition usually in the form of exchange traded commodities (notes). Physical delivery of the aforementioned precious metals is not permitted.

[2] The portfolio positioning of the fund corresponds to the planned positioning at the fund launch at the editorial deadline. Within the scope of active management, the portfolio positioning mentioned may change at any time.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.