When investing for the future, Austrian households continue to rely on flexibility and security while accepting lower returns on their investments. As current data provided by the Austrian National Bank (OeNB) shows, although financial assets in investment funds and listed shares are increasing, only a few are taking advantage of more attractive earnings opportunities.

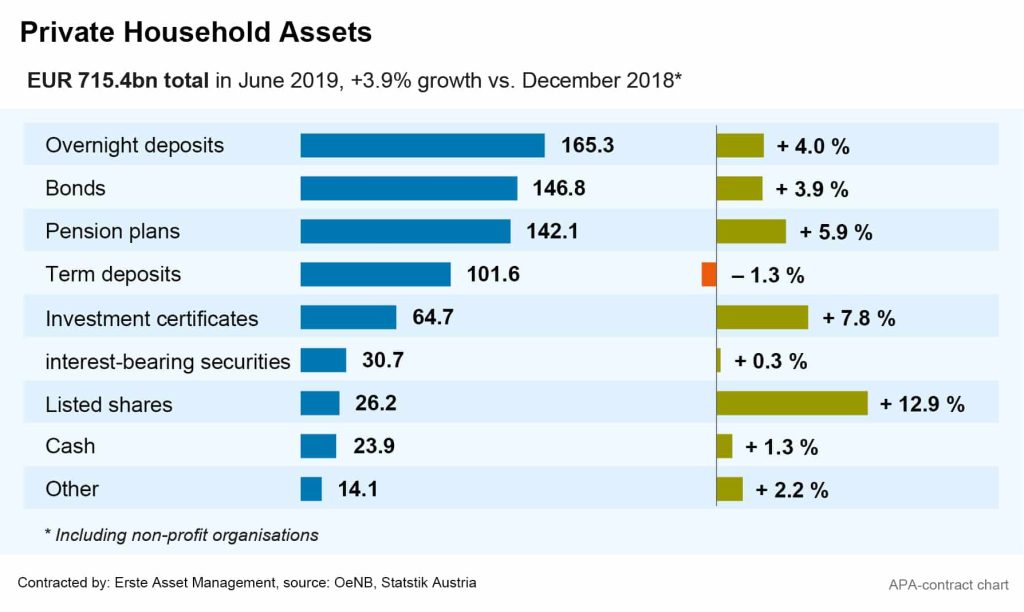

In June, the total financial assets of private households and non-profit organisations in Austria amounted to EUR 715.4bn. This means that financial assets grew by 3.9 per cent in the first half of the year. By far the largest portion of this (165.3bn) by households is in the form of overnight deposits, which increased by 4.0 per cent. The share of cash also rose by 1.3 per cent to EUR 23.9bn. This continues a trend that has been observed over a longer period of time. While the share of these asset classes remained relatively stable compared to the rest of Europe, it has risen from 31 per cent to 43 per cent in Austria over the past ten years.

Private securities still low

However, the asset components of Austrian private households that have recently seen the strongest growth were listed shares and investment certificates. In the first half of the year, the volume of shares in private portfolios increased by 12.9 per cent to EUR 26.2bn, while that of investment certificates increased by 7.8 per cent to EUR 64.7bn.

Despite the strong growth, however, tradable securities (investment funds, bonds and listed shares) continue to play only a minor role, accounting for only 17 per cent of total private portfolios. According to the National Bank, less than one tenth of the population hold investment certificates, only 5 per cent are shareholders and only 3 per cent own bonds. Last year, an additional 400 million euros were invested in tradable securities, but this accounted for only about 3 per cent of so-called capital formation.

Return potential remains untapped

By comparison, EUR 12.2bn or 85 per cent of the newly invested funds were invested in overnight deposits and cash. However, households did not make profits with it: “Even the extremely poor earnings – between 2015 and 2018, this form of investment produced a negative real return of – 1.3 per cent– did not change the high preference of households for liquid funds,” the OeNB stated in a press release.

For tradable securities – i.e. investment certificates, bonds and listed shares largely neglected by Austrians – the statisticians of the National Bank, on the other hand, show a positive real return of 1.1 per cent.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.