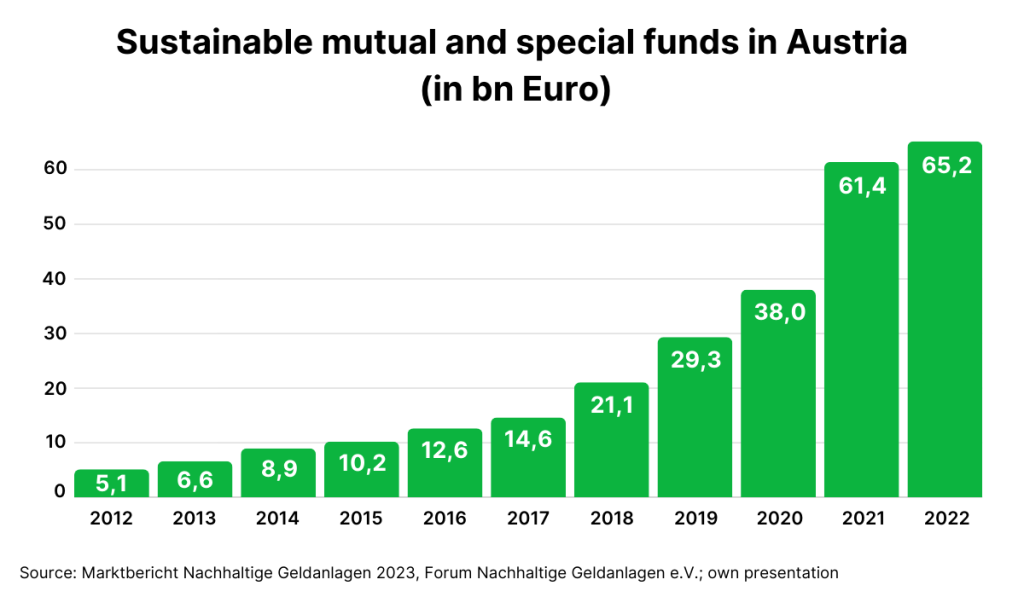

The trend in sustainable investments continues to point upwards. According to the market report (available only in German) by the Forum Nachhaltige Geldanlage (engl.: Forum Sustainable Investment; FNG), more than one in three euros invested in Austria was already invested in a sustainable investment product in 2022.

Investors are therefore increasingly focusing on environmental, social and governance criteria when it comes to their investments. But how can investors even know which products and funds are truly sustainable?

One way of separating the wheat from the chaff is to use sustainability labels. In this article, we explain why these labels exist and how they can help investors make investment decisions.

Source: Marktbericht Nachhaltige Geldanlagen 2023; Note: Past performance is not a reliable indicator for future performance.

What are sustainability labels?

Sustainability labels and certifications are now available for all kinds of products – including financial investments such as investment funds. They are used to identify products that meet certain sustainability criteria.

The specific criteria that must be met in order to receive a label or certification are determined by the respective awarding or testing bodies themselves. There are therefore different standards, guidelines, criteria and processes depending on the label. For investors who want to invest their money sustainably, it therefore makes sense to take a close look at the various labels and their characteristics.

Why do we need sustainability labels?

Sustainability labels for investment funds offer consumers an overview and provide uniform standards. This makes it easier to compare many products and is intended to give investors a basis for comparison that is as transparent and well-founded as possible, which they can use as a guide. At the same time, it is important to note that not all labels are the same. As already mentioned, there are different procedures and approaches.

What labels are there for investment funds?

Not only are sustainable funds becoming increasingly popular, the number of labels and certifications for financial products has also increased in recent years. As an investor, it can be easy to lose track.

In this article, we focus on two of the most important and best-known sustainability labels for funds in German-speaking countries: the Austrian Ecolabel and the FNG label.

Austrian Ecolabel

The Austrian Ecolabel for sustainable financial products is a state-run, independent label of quality and is awarded by the Federal Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology. It was and is one of the first international labels for sustainable funds and was launched in 2004.

The Association for Consumer Information (VKI) is responsible for drawing up and revising the Ecolabel guidelines and for the administration of interested parties and Ecolabel companies. Whether a financial product meets the requirements for the Ecolabel must be confirmed by a qualified testing body. This is selected from a pool of testers managed and provided by the VKI.

The products are checked according to ecological and ethical-social criteria. Exclusion criteria regulate which investments may not be made. These include, for example, fossil fuels, nuclear power, genetic engineering and armaments. On the other hand, there must be selection processes to identify companies, countries or projects that actually deliver positive environmental and social benefits. In addition, investors must be informed transparently about the socio-ecological concept of the sustainable financial product.

Read more about the criteria and the bearers of the Ecolabel here. Further information on the function of the Austrian Ecolabel can be found in this guest article.

FNG label

The FNG label has been awarded by the Forum Nachhaltige Geldanlage (engl.: Forum for Sustainable Investments; FNG) since 2015. The methodology of the label was developed in a three-year stakeholder process, in which Erste AM was also actively involved. The label is based on a minimum standard, which includes certain transparency criteria and the consideration of labor and human rights as well as environmental protection. The companies in which the respective fund invests must be explicitly analyzed for sustainability criteria. There are strict restrictions on investments in nuclear power, coal mining, weapons and armaments.

The sustainability investment style, the investment process and the sustainability criteria are analyzed and evaluated on the basis of over 100 criteria. If additional requirements defined in a tiered model (institutional credibility, dialog with companies in the form of engagement and voting, etc.) are also met, up to three stars can be added to the label. The review process must be repeated every year.

Overall responsibility for coordinating, awarding and marketing the label lies with the Qualitätssicherungsgesellschaft Nachhaltiger Geldanlagen mbH (QNG). The funds are analyzed and tested by the scientific association F.I.R.S.T. in conjunction with Advanced Impact Research GmbH (AIR) as a university spin-off. The review process is also monitored by an independent advisory committee. Its members include experts from the Austrian Society for Environment and Technology, the Impact Network GIIN and WWF Germany.

All further information on the label can be found on this guest blog post.

Tip: Which funds may bear the FNG label this year will be announced on November 23. From 3 p.m. you can find out here on our blog which Erste AM funds have been awarded the prestigious sustainability label.

Conclusion

Sustainability labels give investors the opportunity to compare financial products and their criteria and characteristics. On the one hand, this creates more transparency in the market for sustainable investments and, on the other hand, offers guidance for consumers.

The test criteria and standards according to which the respective labels are awarded are particularly decisive. As an investor, you should therefore find out exactly what the requirements of a label are before making an investment decision.

Sources:

Marktbericht Nachhaltige Geldanlagen 2023, Forum Nachhaltige Geldanlage

https://www.umweltzeichen.at/de/produkte/finanzprodukte

https://fng-siegel.org/

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.