As we are passing through the second month of the new year, the markets are dealing with negative events: the spreading of the coronavirus in China and the measures taken to prevent said spreading. The markets reacted with falling prices in equities, energy, and industrial metals and rising prices of credit-safe bonds.

Mild recovery of the global economy

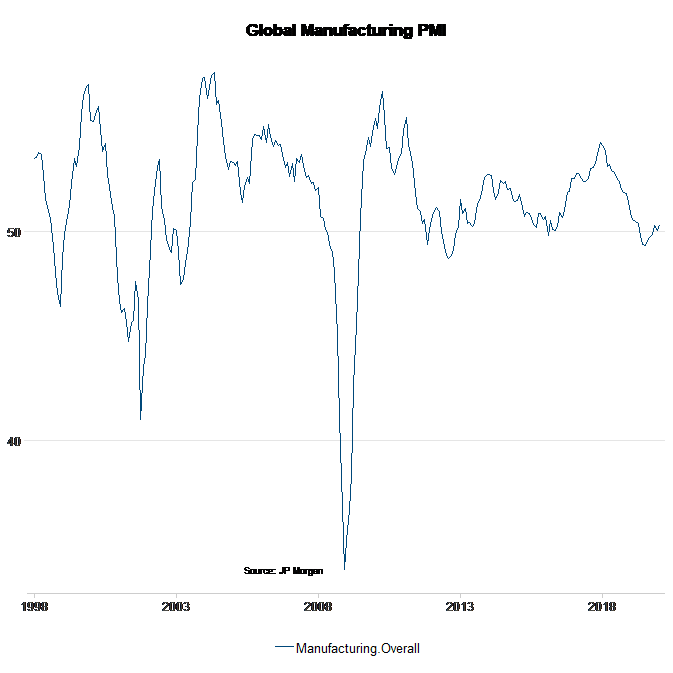

Real global economic growth has been weakening for about two years. At about +2% q/q (annualised), global economic growth was particularly weak in Q4 2019. In recent weeks, signs of the economy bottoming out have increased. The leading indicators have improved especially in the weak manufacturing sector. Notably, the Purchasing Managers Index for the manufacturing sector has been on a slight rise since August 2019.

Chart: Slight recovery in the manufacturing sector

Source: JP Morgan

Good market performance

This positive development was reflected in the market prices at the beginning of the year. The prices of risky assets had been on the rise since September 2019 (positive momentum). The market participants were largely bullish (overweighting in equity positions). Valuation metrics were above average. In such an environment, markets are susceptible to corrections.

Coronavirus triggering correction

The exponential rise in infection rates and the extremely stringent measures taken in China to contain the virus have pushed up the risk aversion of investors. After the previous, strong increases, it could have been any serious event, really. The escalation between Iran and the USA was not strong enough – the epidemic in China is.

Reason for downturn?

The degree of uncertainty has increased: will the negative effects on economic growth be strong enough to throttle the likely, mild recovery of global economic growth? The extent (large / small), duration (one quarter or longer), and the spread (China, Asia, global) of the effects are unclear. On the upside, the growth rate of new infections is on the decline: it was 19% from 3 to 4 February, after 35% the week before. This falling tendency is the main reason why the base case scenario of “mild recovery of the global economy” remains unchanged.

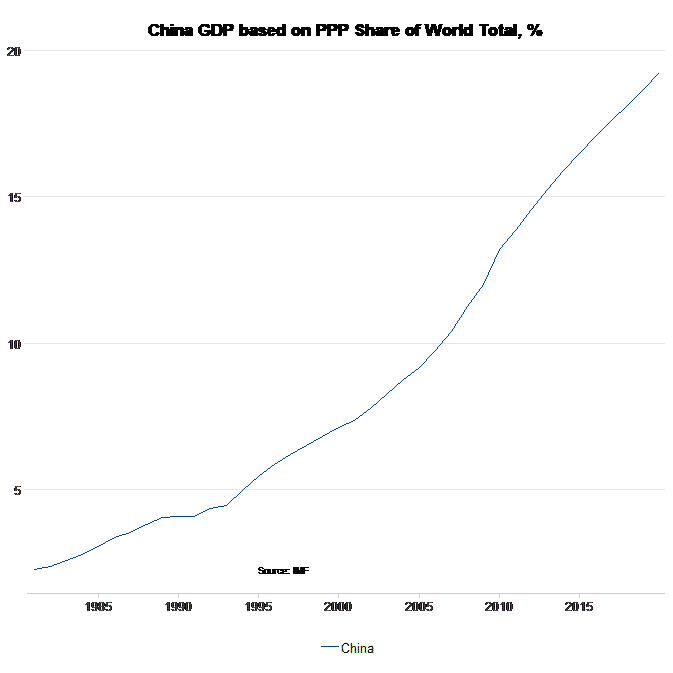

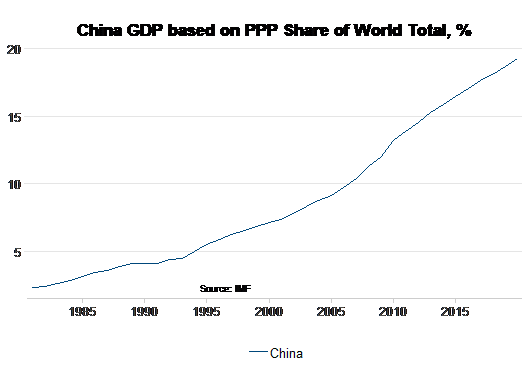

China is important

In China, factories have beee closed, travel has been restricted, cities have been sealed off, and quarantine regimes have been set up. Public life has ground to a halt in some cities. The comparison with earlier cases (SARS in 2003) is flawed: the importance of China has increased. The share of China in the global GDP has increased from about 9% then to almost 20% in 2019. Also, the global value chain is integrated. A disruption of one crucial element affects the entire system.

Chart: Increasing share of China in terms of global GDP

Source: IMF

Central banks as stabilisers

The central bank of China (People’s Bank of China) reacted by stepping up liquidity in an effort to stabilise the markets. The expectations of future key-lending rates priced into the market switched within a short period of time to further rate cuts. Here, the market participants relied on the established interconnectedness of increasing growth uncertainty, a tighter financial environment, and the loosening of the monetary stance.

These are the conclusions of Erste AM

We maintain our base case scenario of “mild recovery of global economic growth”. However, said recovery should now only launch in Q2 2020 (as opposed to Q1, as previously assumed). The general improvement of some important economic indicators will probably be suspended in Q1.

- The downside risk (i.e. tail risk) has increased as well.

- Beyond the short-term horizon, risky asset classes such as equities remain more attractive than bonds with low yields such as Eurozone government and corporate bonds.

Our dossier on coronavirus with analyses: https://blog.en.erste-am.com/dossier/coronavirus/

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.