Last Thursday, the European Central Bank raised key interest rates probably for the last time in this interest rate cycle. But the oil price poses a risk that the ECB has only taken a pause.

ECB raises key interest rates

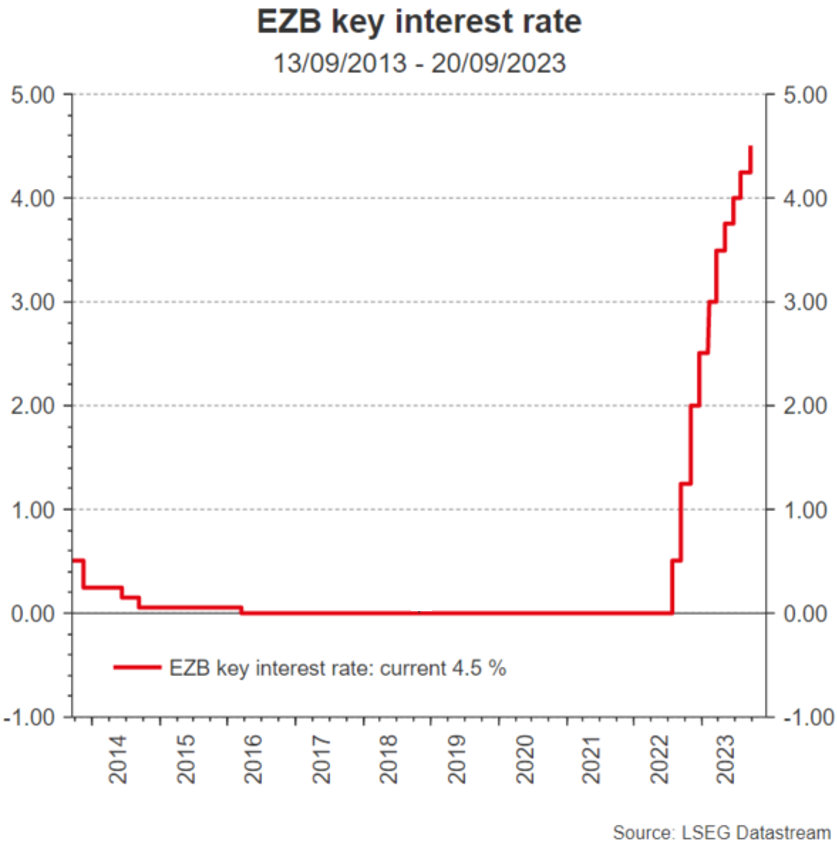

The European Central Bank raised key interest rates by 0.25 percentage points on Thursday, September 14, 2023. The interest rate for the deposit facility is now 4%, and that for the main refinancing rate is 4.5%. Market participants were divided on whether a key interest rate hike would take place in September. Prior to the central bank meeting, market prices reflected a rate hike with a probability of around 65%. The reason given for the interest rate hike was that inflation, while declining, will remain too high for too long.

Falling inflation

The scope for key rate hikes has diminished significantly in the euro zone. Gross domestic product is growing at a very low rate and inflation is falling, albeit more slowly than hoped. The central bank’s growth estimate is now 0.7% for 2023 and 1.0% for 2024 and 1.5% for 2025. With regard to inflation, it is estimated to fall from 5.6% for 2023 to 3.2% for 2024 and 2.1% for 2025. Excluding the price components of food and energy – which is the traditional core rate – inflation is expected to fall to 2.9% for 2024 and 2.2% for 2025. The forecast thus still does not reach the inflation target.

Growth risks

In the coming week, the flash estimates of purchasing managers’ indices and consumer sentiment for the month of September, as well as the report on consumer price inflation in August, will provide new information on growth and inflation dynamics. To an increasing extent, economic activity indicators signal the risk of GDP contraction.

Monetary policy takes effect

In the design for monetary policy, the ECB applies three criteria:

- Inflation dynamics (disappointingly slow decline)

- Inflation forecasts (are above the 2% target)

- Impact of monetary policy.

From the ECB’s perspective, the rate hikes so far are having a strong impact because financing conditions have tightened and are dampening demand. The press release on the monetary policy decisions includes a key sentence: “Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

Restrictive level

At a level of around 4%, key interest rates have thus probably already reached a restrictive, i.e. growth-dampening, range. By comparison, estimates for the interest rate that does not have a dampening or supporting effect on growth range between 1.5% and 2.5%. This range is admittedly very wide, but the point is that the current level is above it. The important underlying assumption of the central bank here is that weak growth reduces inflation with an uncertain time lag.

However, the time-lagged effect of monetary tightening on economic growth and inflation is not satisfactorily well established in terms of both duration and magnitude. In other words, forecasts do not work well, which is why the central bank looks to published economic data. Indications that the key rate hike has already dampened growth are provided by both stagnating credit volumes and falling survey-based growth indicators (European Commission economic confidence, purchasing managers’ indices).

Rate hike cycle comes to an end

The key rate hike in the current weak growth environment was an opportunity to underline the commitment to achieving the inflation target. The ECB has now clearly signaled a conditional pause in the rate hike cycle. Of course, the central bank will maintain its inflation-fighting tone. Key rate cuts are therefore not to be thought of any time soon. If the economic data develop as projected, however, the key ECB interest rates will not be changed for some time. In the most likely scenario, the rate hike cycle will even come to an end.

Rising oil price

However, one should not rely too much on forecasts and certainly not on assumptions. Sometimes the models are wrong – a pandemic was not foreseen – or the assumptions for important parameters – such as a stable oil price – do not hold. In fact, the price of oil (Brent) has risen sharply in recent months. The most recent low was reached at $71 per barrel in early May. In the meantime, the oil price has risen to just under 94 U.S. dollars. Behind this is the OPEC+ policy of keeping oil production low. The immediate effects are easy to see: Higher production and transportation costs, lower purchasing power, higher energy prices and higher short-term inflation expectations. In the current environment of excessively high inflation, however, one key question stands out. Will we see pass-through effects like we saw in the 1970s and early 2020s (for the past two years)?

Conclusio

The central bankers hope that consumer prices excluding energy will not be persistently affected. However, if pass-through effects are indeed detectable, the ECB (after a pause) could see the conditions for further interest rate hikes met in a risk scenario.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.