Central banks and markets are in a calibration phase. The question is how many key rate hikes are needed to confidently expect inflation to fall toward 2%.

Good economic news

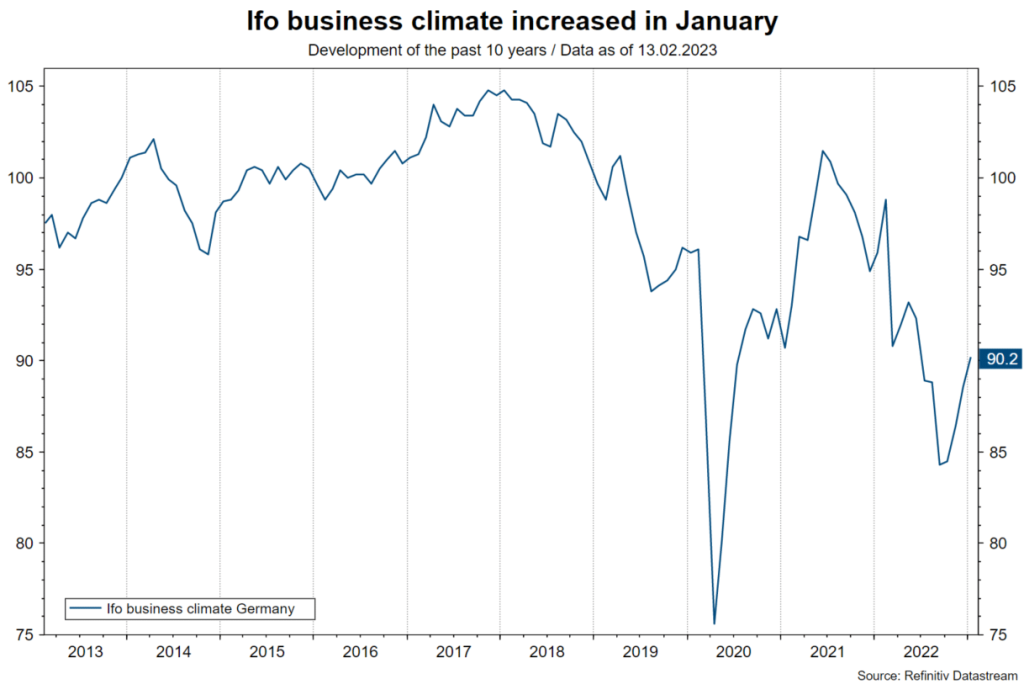

A large number of indicators of economic activity have improved in recent weeks. In the euro zone, the rise in survey-based indicators (Ifo index, purchasing managers’ indices, European Commission consumer sentiment) for the manufacturing, services and consumption sectors points to a moderate increase in real economic growth in Q1, after the economy already showed slight growth in Q4. At the same time, some segments were weak. For example, retail sales contracted 2.8% y/y in December. However, the technical recession that was widely expected until recently is not taking place. The main driving factor behind this is the sharp drop in the wholesale price of natural gas, which has now fallen below early 2022 levels.

Note: Past performance is not a reliable indicator for future performance.

In China, more and more indicators confirm the expectation for a V-shaped recovery of economic growth. Last week, the total credit figure for the month of January was above expectations.

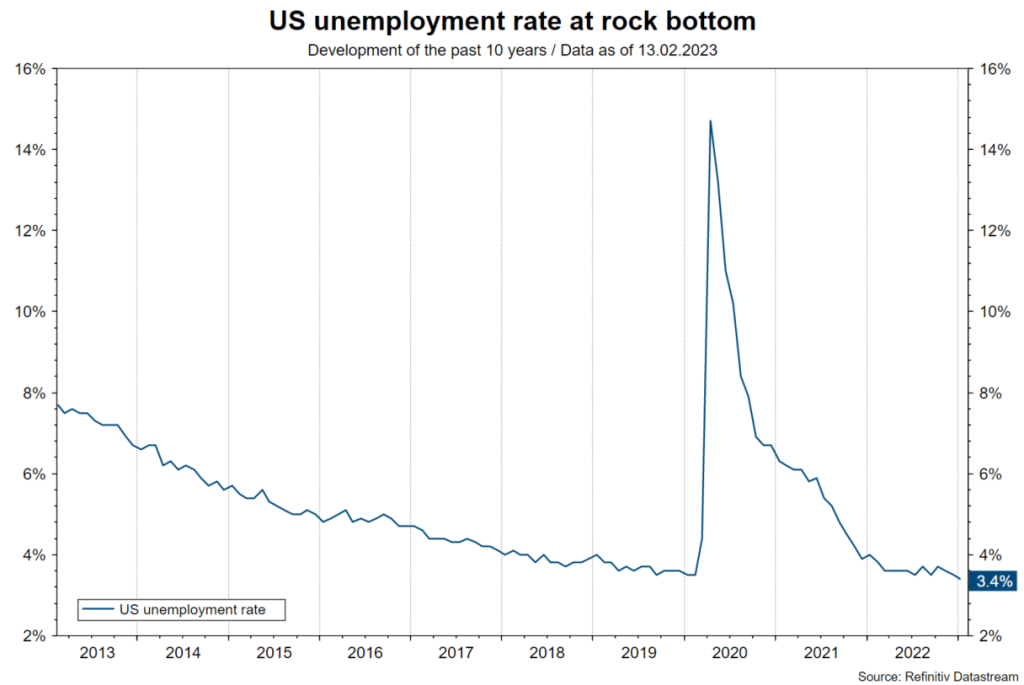

In the US, the labor market report showed an exceptionally strong increase in employment (in the non-agricultural sector). In addition, two important growth indicators due for release this week (retail sales and industrial production) are expected to grow, after contracting in the months before.

Note: Past performance is not a reliable indicator for future performance.

Bad news for the market

In an inflationary environment, however, good economic news implies additional inflationary pressure. In particular, the aforementioned US labor market had a clear negative impact in early February. In response to the release, future inflation rates priced into the market (two-year breakeven inflation rate from 2.33% to 2.75%) as well as the Fed’s future policy rates (overnight rate for July 2023 from 4.84% to 5.19%) have risen so far. The optimism of market participants for a rapid decline in inflation has given way to a scenario that describes a slower decline in inflation.

End of rapid key rate hikes

Overall, this implies a more hawkish stance of central banks with regard to inflation. At the beginning of the year, markets reacted positively to signals from central banks indicating a reduction in the extent of key rate hikes per meeting in the first half of the year. In a generally optimistic frame of mind, this was interpreted as a move away (pivot) from the hawkish stance in favor of a milder (dovish) stance. Last year, however, the focus was on raising from very low to mildly restrictive interest rate levels as quickly as possible.

High uncertainty

Since this state has (probably) been reached, a transition to a calibration phase has begun. Here, central banks emphasize that it may take a long time before the full effect of tighter monetary policy on growth and inflation is apparent.

Recession reports

Economic pessimists point out that some indicators are already pointing to increased risks of recession. Last week in the US, a Fed report (Senior Loan Officer Opinion Survey) on lending standards and credit demand pointed to further tightening and a further decline, respectively.

Immaculate falling inflation

Inflation optimists, on the other hand, believe that inflation could fall quickly without the need for restrictive monetary policy and a significant increase in the unemployment rate. (Immaculate Disinflation). This scenario describes a so-called “no landing” scenario. In this case, economic growth does not weaken (because inflation falls quickly).

Persistently high inflation

However, central banks cannot afford the luxury of being optimistic about inflation developments. Cutting interest rates too early to possibly too low levels could create a stagflation scenario like in the 1970s. In this phase of reviewing the correctness of the monetary policy stance, central banks are taking a step back in statements for future monetary policy (forward guidance). They merely emphasize that some interest rate hikes are probably still needed. At the same time, they point out to act data-dependently, i.e. to focus on the publication of economic data (backward-looking action). If it turns out that inflation remains stuck at too high levels for an uncomfortably long time (sticky inflation), key rate hikes could increase even further. In this scenario, the risk of recession increases.

The difference between immaculate disinflation and high inflation persistence is, of course, huge. Optimism for the former has fallen somewhat. The next important data point is the publication of consumer price inflation in the US for the month of January, today afternoon.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.