The automotive industry currently finds itself in a challenging climate. The import tariffs imposed by US President Donald Trump are making exports to the USA more expensive, while many car manufacturers are also finding it increasingly difficult to compete against growing local competition in the key sales market of China. Despite some difficulties, the trend towards electric vehicles (EVs) continues, and some car manufacturers are also increasingly focussing making autonomous driving a mainstream feature.

The difficult market conditions have already made themselves felt in the earnings reports of leading groups in Q1. Volkswagen holding company Porsche SE posted a loss for the group of EUR 1.08bn for its core shareholdings. The core brand Volkswagen’s earnings before interest and taxes fell by 85 per cent to EUR 112m. Provisions due to stricter CO2 targets in Europe and write-downs on export vehicles to the USA cost Volkswagen almost its entire profit at the start of the year. However, sales increased by 10.2 per cent to EUR 21.2bn due to rising demand for the ID.4 and ID.7 electric cars and several combustion engine models.

French car manufacturer Stellantis suffered a significant drop in sales in Q1. In the three months of the year, the number of vehicles delivered fell by 9 per cent to 1.2 million compared to the same period last year. The second most important market, North America, fared particularly badly with a 20-per-cent drop in sales. Japanese car manufacturers are also suffering from the difficult environment. Toyota is expecting nearly one-fifth less profit for its financial year ending March 2026. The industry leader cited the stronger yen, higher material prices and the impact of US tariffs as reasons for the expected decline in profits.

Note: The companies listed here have been selected as examples and do not constitute an investment reommendation.

Data as of June 26 2025

Japan’s Car Industry Hit Hard by US Tariffs

The heavily export-dependent Japanese automotive industry is suffering particularly badly from the US tariffs. US President Donald Trump has imposed a 25-per-cent surcharge on imported cars and car parts and recently announced potential further tariff increases. There is some relief for car parts for manufacturers who finalise their vehicles in the USA. They can have part of the customs duties refunded.

Japanese car exports to the USA plunged in May due to the import tariffs imposed by Trump. The value of cars and car parts delivered to the USA was 24.7 per cent lower year-over-year, according to Japan’s Ministry of Finance. However, the volume of exports fell by only 3.4 per cent, explained Taro Saito, chief economist at the NLI Research Institute. Some manufacturers are likely to have cut prices in order not to scare off their buyers in the USA despite the US tariffs. Meanwhile, Toyota is trying to negotiate down the US tariffs. In return, the company agrees to sell the models of its US competitors via its sales network in Japan.

Other companies are focussing on investments in the US. Volkswagen is negotiating with the US Department of Commerce to settle the tariff dispute, offering further investments in the USA in return. “I was in Washington myself and we have been in regular contact ever since,” Group CEO Oliver Blume told the German newspaper “Süddeutsche Zeitung”.

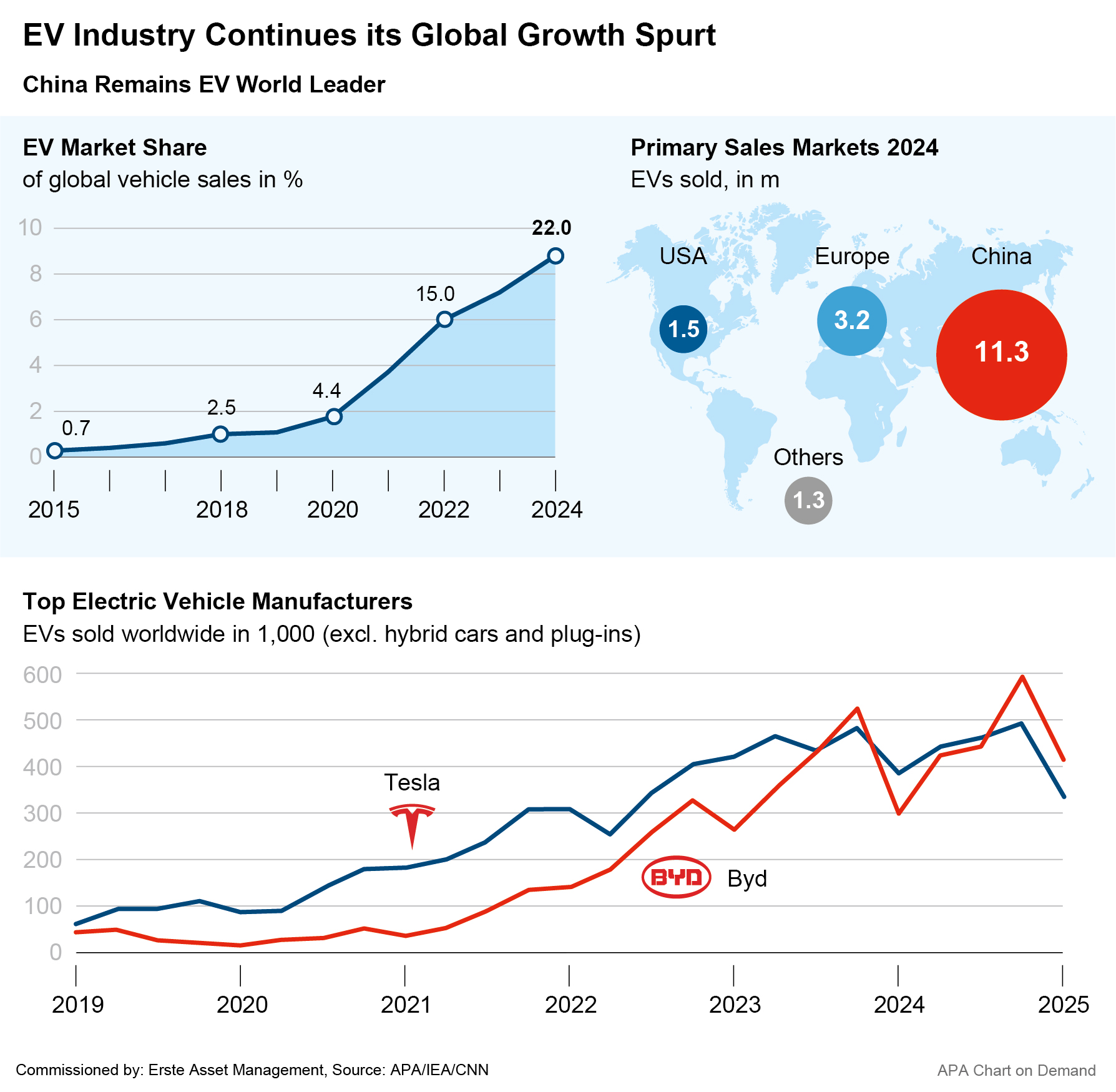

China Increases its EV Sales, BYD Widens Lead to Tesla

China has recently been able to further expand its leading position in the field of electric vehicles, both in terms of production and utilisation. Internal combustion vehicles are rapidly losing ground on China’s roads, with more than 50 per cent of new cars sold in China expected to be EVs for the first time this year, according to the Chinese Automotive Industry Association. The rise of e-mobility in the country is politically desired and state-subsidised. Electricity is also “very cheap” in China, while oil is more expensive, according to expert Cui Dongshu from the Auto Industry Association. Beijing has been subsidising the purchase of electric cars for over a decade.

This is also reflected in the success of Chinese EV manufacturers. China’s industry leader BYD has been in a neck-and-neck race with electric car manufacturer Tesla for some time now, with its global sales recently ahead of its US arch-rival. BYD is also outselling Tesla in Europe, while the US manufacturer is falling further behind. According to data from Jato Dynamics, the Chinese brand, which has only been active in Europe for a few years, registered 7,231 new cars in April, while Tesla registered 7,165. Billionaire Elon Musk’s US company is suffering from an outdated and small model range that has only just been revamped. In addition, Tesla is suffering from an image problem in Europe due to Musk’s political activities and position. Last year, BYD replaced its German competitor Volkswagen as the leading car manufacturer in China, the world’s largest car market.

The Chinese manufacturer of electric vehicles, BYD, is currently ahead of its rival Tesla in terms of global sales. (c) unsplash

The booming demand for electric cars goes hand in hand with an increasing demand for batteries, resulting in a correspondingly big success of the Chinese battery cell manufacturer CATL’s recent IPO. The company received a total of USD 4.6bn in fresh capital, making it the largest IPO of the year so far.

European Manufacturers Focussing on Autonomous Driving

Car manufacturers are also putting an emphasis on self-driving cars, as Europe in particular needs to catch up in that regard. In China and parts of the USA, self-driving minibuses and taxis have long been a familiar sight on the roads. But while pilot projects have been started in Europe, they are not yet as widespread. According to plans by leading industry representatives, this is to change soon.

In June, Volkswagen presented the series model of its self-driving electric van ID Buzz, due to enter regular operations in 2026, initially in Hamburg and Los Angeles, and later in other cities too. A letter of intent to this effect has already been signed with Berlin’s public transport operator (BVG). “Autonomous driving is a leap into the absolute future,” said Christian Senger, member of the Board of Directors of Volkswagen Commercial Vehicles and responsible for autonomous mobility, at the premiere.

Volkswagen’s self-driving ID Buzz is planned to start in Hamburg and Los Angeles in 2026. (c) scoolz-pixx / Action Press / picturedesk.com

Other companies are currently forging alliances in the field of autonomous driving, partially in order to be able to compete with US tech companies such as Alphabet in this area. At the 29th International Automotive Electronics Congress, 11 companies signed a declaration of intent to jointly develop and utilise open software for future generations of vehicles. The signatories include car manufacturers such as BMW and Porsche as well as leading suppliers such as Bosch, Continental and ZF Friedrichshafen. Meanwhile, Japan’s industry giant Toyota has held out the prospect of a co-operation with Alphabet. Toyota and Alphabet subsidiary Waymo has announced a potential collaboration in the development of autonomous driving technology. The companies want to combine their respective strengths to develop a platform for self-driving cars.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.