Author's Contributions

Investment Update: First steps to interest rate hikes and volatility in the stock markets

Stocks posted significant gains on Wednesday after U.S. Federal Reserve Chairman Jerome Powell signaled that the central bank would begin raising interest rates this month. Stock markets interpreted this as a positive signal in the sense that the threat to growth posed by the war in Ukraine did not justify a change of course in monetary policy at the moment.

Ukraine conflict: sanctions against Russia

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

Military conflict Russia-Ukraine

Russia launched a military invasion of Ukraine on Thursday. The financial markets are reacting with price declines, a rise in the price of crude oil, a fall in the Russian ruble and price rises in credit-sensitive government bonds. We provide an assessment of the current market situation.

Escalation of the conflict between Russia and Ukraine: are the markets at risk?

The Russia/Ukraine conflict is keeping the markets in suspense. Everything is possible – from continued diplomacy in order to contain the escalation to harder sanctions in case of a more comprehensive invasion. The volatility on the financial markets will remain high.

Erste Asset Management achieves record result in 2021

Erste Asset Management was yet again ranked first among the Austrian investment companies last year. Assets under management in Austria had increased by 16.6% y/y to EUR 47.7bn as of 31 December 2021.

European Forum Alpbach: Overcoming the Crisis with Energy Transition, Capital Markets Union and Digitalisation

“The Great Transformation”: This was this year’s Forum Alpbach’s overarching motto for the talks and panel discussions among the assembled top politicians, economic leaders and scientists from around the world. Partly on-site and partly online, between 18 August and 3 September a total of 4,134 participants from 62 countries discussed possible ways out of the corona pandemic crisis and global future scenarios.

Erste Asset Management financial markets outlook for the second half of 2021

Since the beginning of the year, the rapid recovery of the economy has mainly supported securities such as equities. But what happens next? Erste AM Managing Director Heinz Bednar and Head of Multi Asset Alexander Lechner explain how the second half of 2021 and especially our focus on sustainability will continue to develop in our outlook for the next six months.

Erste Asset Management pulls the plug on coal on 1 July

We are pulling the plug on coal, abstaining from investments in companies that operate in the fields of coal mining or the production of electricity or fuel from coal from 1 July 2021 onwards.

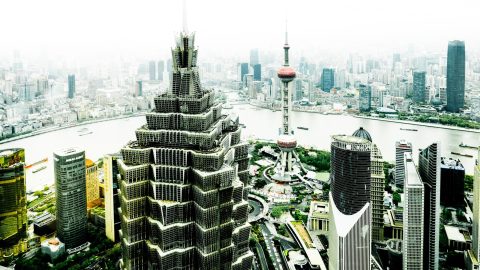

China bonds in demand for mixed funds

China as a third pole. The reasons why fund managers expect China government bonds in mixed funds to generate more return and at the same time provide better diversification.

Erste Group is first financial institution to commit to the European Commission’s Green Consumption Pledge

As the first financial institution in Europe, Erste Group has joined the European Commission’s Green Consumption Pledge initiative to accelerate its contribution to a sustainable economic recovery. The Green Consumption Pledge is the first initiative delivered under the New Consumer Agenda and part of the European Climate Pact.

How are stock markets currently reacting to increases in yields?

Central bank targets for inflation may be met earlier than expected in some countries. This environment has led to an increase in government bond yields. We explain how it came about.

Erste Asset Management regards economic recovery as driver of the capital markets in 2021

We are looking back on a turbulent investment year. After the slump in February and March, we saw a strong recovery on the markets almost across all asset classes. CEO Heinz Bednar and CIO Gerold Permoser give an outlook for the capital markets in 2021.

Trade conflict between China and the USA – Update from the Investment Division

The trade conflict between China and the USA is gaining further momentum. In our opinion, this should also be seen against the background of the approaching presidential election campaign.

Continuation of an economic recovery – Update from the Investment Division

The majority of economic indicators point to a continuation of an economic recovery. This is indicated by data on industrial production, survey-based indicators and rising producer prices.

Financial markets outlook: equities and high-yield bonds remain first choice

On top of the corona situation, two additional developments have been crucial for the development of the financial markets. The central banks have been pursuing a very expansive regime on a global scale, and at the same massive stimulus packages have been passed in an effort to get the economy up to speed again

Corporate earnings provide tailwind – Update from the Investment Division

The surprisingly good corporate earnings provided a tailwind & the price of gold continued to rise. Update from the Investment Division.

Shares in positive territory – Update from the Investment Division

The US stock market was lifted by technology stocks such as Apple and Microsoft & earnings growth so far is -10.5%. Update from the Investment Division.

TikTok ban in the USA – Update from the Investment Division

TikTok is the focus of the dispute between the US and China & corporate bonds posted their best month in June. Update from the Investment Division.

FOMC Meeting – Update from the Investment Division

Yesterday, the Fed was the focus of attention & the increase in Covid 19 infections could put further pressure on the economy. Update from the Investment Division.

„I just can’t get enough“– Update from the Investment Division

In one hit the Black Eyed Peas sang “I just can’t get enough”. Even governments and central banks seem to have fallen in love with economic stimulus packages. Update from the Investment Division.

Losses for risk investments – Update from the Investment DivisionOutlook.

The markets for risky assets ended last week with losses. The main reason was the escalating tensions between China and the US. Update from the Investment Division.

EU summit: Agreement on billion-euro aid package – Update from the Investment Division

The EU heads of state and government have agreed on a billion euro aid package. It is the largest in the history of the EU. Update from the Investment Division.

Marathon talks on EU Corona aid packages – Update from the Investment Division

The weekend was marked by marathon talks between EU leaders. So far, no agreement has been reached. Update from the Investment Division.

Canada’s central bank – Update from the Investment Division

Canada’s central bank has left the key interest rate unchanged and no change in monetary policy stance is expected at today’s meeting of the Governing Council.

Stock markets in the corona crisis – Update from the Investment Division

The stock markets continue to be caught between the economic recovery on the one hand and the rising number of new infections in the USA on the other. Update from the Investment Division.

Increasing new infections – Update from the Investment Division

After the easing measures new global infections continue to rise. The stock markets remain unimpressed by this. Update from the Investment Division.

Trading session in Asia – Update from the Investment Division

Asian stock exchanges traded significantly higher & new infections with the Covid-19 virus reach new record levels. Update from the Investment Division.

US Consumer Confidence – Update from the Investment Division

Consumer confidence is rising in the USA. An index that measures consumer confidence is the largest growth and has clearly exceeded expectations for the index. Update from the Investment Division

„I‘ m easy like a sunday morning“ – Update from the Investment Division

The Commodores around Lionel Richie landed a hit with their song “Easy” in 1977. The monetary policy of the central banks remains just as “easy”. Update from the Investment Division

Markets are gaining again – Update from the Investment Division

“Markets recovery”: High yields, EU peripheral government bonds and emerging market bonds posted gains. Update from the Investment Division.

Rollercoaster ride for markets – Update from the Investment Division

“Rollercoaster ride continues”: Most stock exchanges were clearly in the red & the markets ignore the new infections in China. Update from the Investment Division

“Now it starts again”: – Update from the Investment Division

New wave of Covid-19 cases from Beijing market spreads to Liaoning and on Friday there was a countermovement on the stock markets. Update from the Investment Division.

Stock market rally – Update from the Investment Division

Yesterday it seemed as if the stock markets needed to catch their breath after the rally of the last few weeks. It was the seventh day that the S&P 500 suffered a daily loss. Update from the Investment Division.

Decoupling the real economy – Update from the Investment Division

Stock market prices have risen sharply despite the crisis, but the gap between the financial and the real economy continues to widen. Update from the Investment Division.

„Ain’t no Mountain High Enough“ – Update from the Investment Division

“Ain’t no Mountain High Enough”: The mountains of debt that governments are accumulating know hardly any limits at present. Update from the Investment Division.

Security law for Hong Kong – Update from the Investment Division

What has occurred since yesterday? Politics 1 – Further tensions between the USA and China. As reported China is attempting to implement a national security law in Hong Kong. Since the UK handed over Hong Kong to China in 1997 the concept “One state, two systems” is in place. That granted Hong Kong a far-reaching autonomous […]

Positive start of the week – Update from the Investment Division

Our young swans are allowed to go back to school and Hong Kong stabilized despite tensions with China. Update from the Investment Division.

Hands remain shaky – Update from the Investment Division

The “Black Swan” is what stock market experts call an unexpected event and the daily news continues to influence events on the stock markets. Update from the Investment Division

Postitive end of the week – Update from the Investment Division

The end of the week on the stock markets was more positive than the beginning of last week. Update from the Investment Division.

Musk launches Tesla production – Update from the Investment Division

What has occurred since the yesterday ? Elon Musk has always been a colorful character. Until now, he could also adorn himself with the fact that his products help save the world. Especially the Tesla electric cars. Yesterday he added another chapter to his extraordinary story by announcing that he will resume production at the […]

Slow economic recovery – Update from the Investment Division

On Friday the markets for risky assets received a double boost. The reason for this is a rapid economic recovery after the sharp containment measures. Update from the Investment Division.

Trade deal between USA and China – Update from the Investment Division

What has occurred since yesterday ? The global equity markets closed yesterday in positive territory. The US markets could see gains of ca. 1%. In Europe the gains were ca. 1,5%. In the last days the trade conflict between the USA and China overshadowed the markets once again. However, from that corner came positive news […]

Fiscal- and monetary policies – Update from the Investment Division

What has occurred since yesterday ? Gus Backus celebrated in the 1960s some successes in the German Pop music charts. It is remarkable that in the 50s he also scored two top ten hits in the USA. In the chorus in one of his songs he sings: “Who should pay that, who ordered that, who […]

ECB bond purchases unconstitutional – Update from the Investment Division

What has occurred since yesterday ? Yesterday the German Constitutional Court has ruled that the Asset Purchase Program of the European Central Bank partly violates the German constitution. Via that program bonds of more than two trillion Euros were purchased since 2015 to bring liquidity to the markets and the economy. As the German constitutional […]

„Rough, nice and easy“ – Update from the Investment Division

What has occurred since the long weekend? The song „Proud Mary“was written by John Fogerty, the front man of the rock band Creedence Clearwater Revivial. There are many cover versions of this song. The best known is probably from Tina Turner. That version starts with the line “…we’re gonna take the beginning of this song […]

Losses at beginning of week – Update from the Investment Division

What has occurred since the long weekend? Last week began on a positive note in the markets for risk assets. The US leading index, S&P500, gained 3.6% from Monday to Wednesday. This was triggered by the following positive news: In a study, the drug Remdesivir showed success in treating COVID-19 patients. The US Federal Reserve’s […]

Argentina cries (again) – Update from the Investment Division

Argentina is crying (again): This time not for Eva Peron – but Argentina’s plans for debt restructuring are meeting with resistance. Update from the Investment Division.

Upward trend at the beginning of the week – Update from the Investment Division

At the beginning of the week stock markets continue the upward trend of the previous week and the WTI oil price falls in double digits to a multi-year low. What will we see this week?

Corona and the oil market

The oil market won’t escape the corona virus unscathed either. Within only two weeks, oil recorded its best and its worst day of the millennium so far.

Stock market rally– Update from the Investment Division

What has occurred since yesterday ? Markets Stock markets continued to rally yesterday. Europe was up slightly by 0.65%. USA clearly in positive territory at approx. 3%. Asia is slightly in negative territory as of this morning. The oil price fell back down to USD 20.30 (WTI). Gold remained strong at USD 1720 per ounce. […]