US President Donald Trump has escalated his fight against the Chinese-owned social media services TikTok and WeChat, and in the process also caused new tensions in the trade dispute with China.

THIS AUTHOR'S POSTS

Race for Corona vaccine: 25 vaccine candidates in clinical trials

The pharmaceutical companies and universities racing to develop a corona vaccine are making strides: according to the World Health Organisation (WHO), 25 candidates are currently undergoing clinical trials.

Corona crisis continues to weigh heavily on the aviation industry

Despite the recent border openings, the corona pandemic continues to impact the aviation industry.

Travel industry hoping for rapid recovery after border opening

With the opening of many European countries’ borders, the travel industry, which has been severely affected by the response measures to the coronavirus pandemic, is also hoping for a revival of travel and tourism, which has virtually come to a standstill.

German government approves EUR 130bn stimulus package to “emerge from the crisis with a bang”

Germany’s government wants to cushion the consequences of the Corona crisis with a massive economic stimulus package. This show of strength is intended to revive the economy and consumption of citizens and avert a severe recession.

Car industry suffers from corona pandemic

The Corona crisis has also caused the automotive industry to suffer a sharp drop in sales. The sharpest drop in new registrations was recorded in Italy and Spain. China provides a glimmer of hope.

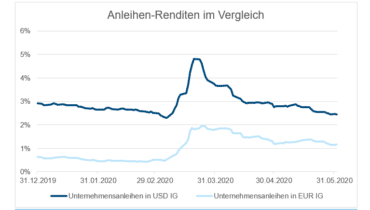

ECB to buy bonds despite ruling of the German Constitutional Court

The European Central Bank (ECB) wants to stick to its bond purchases despite the recent ruling by the German constitutional court. “We will continue to do whatever is necessary to fulfill this mandate,” said ECB chief Christine Lagarde.

Corona crisis dampens expectations for business figures

The first reporting season of 2020 in the USA is dominated by the corona crisis. What trends can be seen from the Q1 figures for the rest of the year?

Dow Jones: A brief history of the crisis

As the world’s best-known stock index, the Dow Jones Industrial index provides an overview of the most serious crises from the perspective of the financial markets. History shows that a deep fall does not necessarily mean a long dry spell.

What is helicopter money?

While traditional monetary policy measures are also employed, the focus has recently shifted to a concept that has always been the subject of debate: helicopter money.