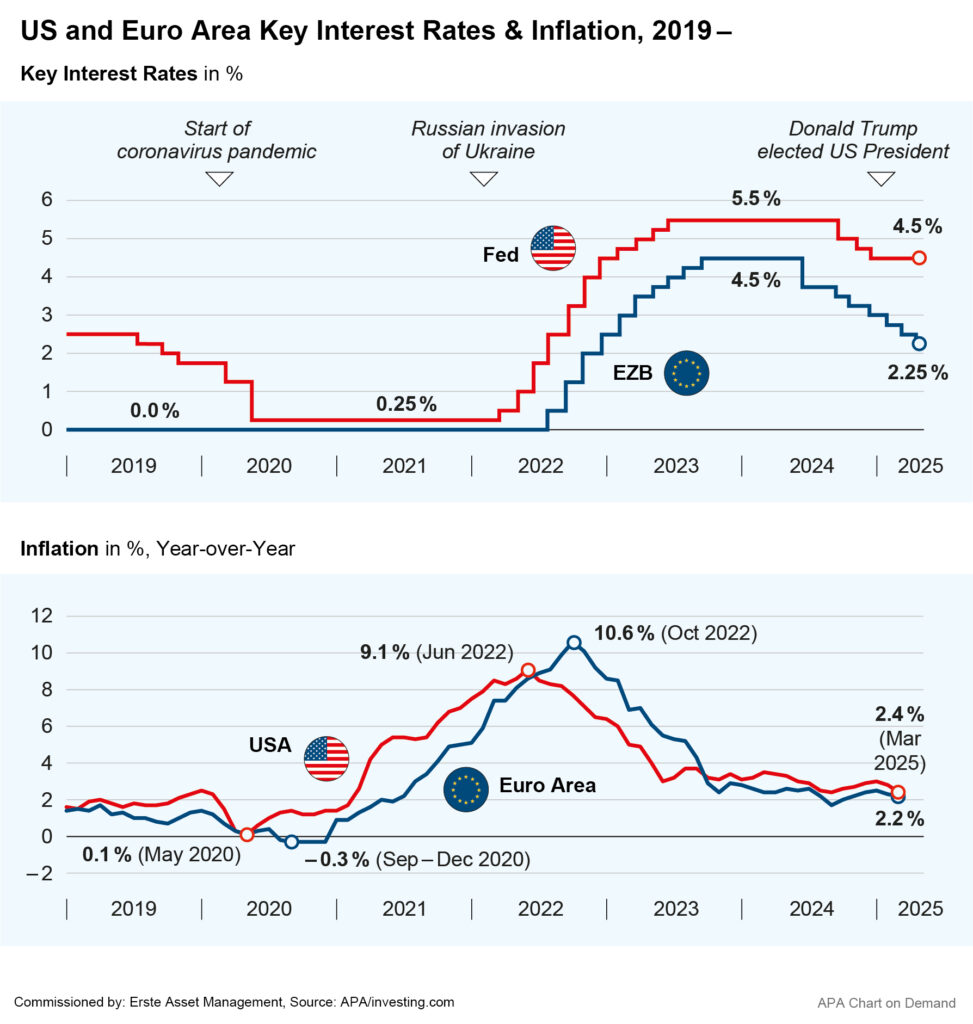

The US Federal Reserve and the European Central Bank are likely to adjust their monetary policy to the recently escalated trade conflict. Prominent representatives of both central banks have already verbally warned of the consequences of a trade war, and these dangers are now likely to be reflected in an adjustment of interest rate paths.

However, while the ECB could react to the expected negative effects on economic growth primarily by cutting interest rates , the Fed is likely to keep its interest rates stable for longer than expected in order to react to an expected rise in inflation as a result of the trade conflict. Although the inflation rate in the US has recently fallen further, the US central bankers fear at least a temporary surge in inflation as a result of the trade war. The latest tariff increases make many products imported into the USA significantly more expensive.

However, US President Donald Trump is not very fond of this course. He recently stepped up his criticism of the Fed and in particular the chairman of the central bank, Jerome Powell. He even threatened to sack Powell, causing renewed uncertainty on the markets.

Note: Past performance is not a reliable indicator of future performance. Data as of 23 April 2025

US central bankers warn of rising inflation

Powell had recently warned several times about the consequences of Trump’s tariff policy. The higher tariffs and the resulting counter-tariffs provoked by other countries could be reflected in higher inflation and slower economic growth in the US. ‘The tariff increases announced so far are significantly larger than expected, and the same is likely to be true of the economic impact, which will include higher inflation and slower growth,’ said the Fed Chairman at an appearance in Chicago in April. The tariffs would most likely lead to at least a temporary rise in inflation. However, the inflation-driving effects could also be more persistent, Powell said.

Fed on a confrontational course with Trump

This puts the central bankers on a confrontational course with US President Trump. He has repeatedly urged the Fed to cut interest rates to stimulate the economy, but this has so far fallen on deaf ears among Fed members. In view of the inflation risks, they do not want to raise interest rates for the time being. As a result, Trump has recently increased the pressure on Fed Chairman Powell significantly and even called for his dismissal.

‘Powell’s resignation can’t come fast enough,’ Trump wrote on his Truth Social platform last week. A few days later, Trump escalated his wording further and called the Fed Chairman a ‘loser’. According to one of Trump’s economic advisors, a review of Powell’s dismissal was indeed planned. Powell himself declared that his dismissal was not legally permissible in light of the Fed’s independence. However, Donald Trump has since rowed back. ‘I have no intention of firing him,’ Trump said of Powell on Tuesday.

Signs of interest rate cuts in Europe

Unlike the Fed, the ECB does not currently have to react to inflation. The eurozone’s inflation rate fell further to 2.2 per cent in March . The central bankers also do not expect any strong price-driving effects from the trade conflict. In the tariff conflict, the euro has recently appreciated strongly against the dollar, making imports to Europe cheaper and tending to dampen inflation.

The dwindling inflationary pressure clears the way for possible interest rate cuts in the eurozone. This allows the ECB to focus its monetary policy entirely on cushioning the expected negative effects of the trade conflicts on economic growth. In the previous week, the central bank had already lowered its deposit rate, which is important for banks and savers, by 0.25 percentage points to 2.25 per cent. As usual, ECB head Christine Lagarde avoided giving any indication of the future interest rate course, but she did warn of the possible consequences of the trade conflict with the USA.

In view of the ‘extraordinary uncertainty’, no direction can be given, only the goal of price stability can be kept firmly in mind. Future monetary policy decisions are more data-dependent than ever. The outlook for the eurozone economy has ‘clouded over due to increasing trade tensions’, explained the ECB. ‘The increased uncertainty is likely to reduce the confidence of private households and companies’, the ECB said. The head of the central bank, Lagarde, spoke of ‘exceptionally high uncertainty’.

Interview with CIO Gerold Permoser

Following US President Donald Trump’s customs plans, the next source of uncertainty for the markets is just around the corner: Trump wants to force the US Federal Reserve to cut interest rates and is openly threatening to dismiss Fed Chairman Jerome Powell. Can Trump actually do that – and what consequences would such a serious move have? CIO Gerold Permoser assesses the situation 👉

Why is an independent central bank important?

The independence of the central bank is a key principle of modern monetary policy. It enables the central bank to make decisions free from short-term political pressure and the election cycle.

This insight has become widely accepted worldwide since the inflationary period of the 1970s and has been considered best practice for well-organized monetary policy for the past 40 years or so. This was partly due to the experiences of the 1970s, when countries with highly independent central banks, such as Germany with the Bundesbank, reported lower inflation rates, and partly due to a growing number of academic papers pointing to the advantages of an independent central bank.

Empirical studies show that countries with independent central banks have lower inflation rates without this being accompanied by higher unemployment. Independence is therefore a prerequisite for credibility, financial market confidence, and long-term price stability. Accordingly, restricting the independence of the central bank, especially the US Federal Reserve, i.e., the world’s most important central bank, would be a step that would be perceived negatively by the markets.

Can Donald Trump bring the Fed under his control?

A US president cannot directly take control of the Fed. The Federal Reserve is independent by law and its leadership can only be dismissed “for cause.” Trump tried to put pressure on Jerome Powell during his first term, but legal experts warned that dismissal would violate the law. In practice, however, a president could gain influence in the medium to long term by strategically filling vacant positions, but this requires time and Senate approval.

Theoretically, the US Congress could change the legal basis of the US central bank in such a way that the Fed’s independence would be abolished. However, given the Republicans’ wafer-thin majorities in both chambers and the obviously serious adverse effects of such a move on the US economy, this seems extremely unlikely at present.

Who decides on US interest rate policy?

Interest rate policy is decided by the Federal Open Market Committee (FOMC). It consists of 12 voting members: the seven members of the Board of Governors (including the Fed chair) and five of the twelve presidents of the regional Federal Reserve Banks. The presidents of the regional central banks rotate annually on the basis of a fixed rotation schedule: New York always has a vote, while the other eleven central banks rotate in groups. This structure ensures that regional perspectives are incorporated into national monetary policy. Changes to these rules require a legal amendment.

What role does Fed Chair Jerome Powell play?

The chair of the Federal Reserve, currently Jerome Powell, plays a central role in the central bank’s communication, strategy, and decision-making. He chairs the FOMC (Federal Open Market Committee), which decides on monetary policy, in particular key interest rates. However, the chair has only one vote among several and cannot make decisions alone. Replacing Powell alone (which is highly unlikely) would therefore not be enough to fundamentally change US monetary policy.

What happens if Trump fires Powell anyway?

Such a move would be highly controversial. The legal basis allows the Fed chair to be dismissed only for cause. A politically motivated attempt would most likely be challenged in court. Such a move could severely shake market confidence in the Fed’s independence and have serious economic consequences. Bond and currency markets would likely react immediately with volatility, as studies of Trump’s previous attacks show.

What would be the impact on financial markets?

The dismissal of a Fed chair for political reasons would have significant consequences. In the short term, investor confidence in the institutional stability of US monetary policy would be shaken. Yields on US government bonds would probably rise – and with them the yields on many other financial instruments priced on the basis of US Treasury yields, such as mortgage bonds and government bonds from emerging markets issued in US dollars.

Equities would be under pressure, the dollar would lose value, and gold and commodity prices would tend to rise – reflecting a flight to safe havens. In the long term, inflation expectations would rise (which in turn could lead to higher inflation), investment would decline and economic growth would be hampered.

Are there any historical comparisons?

There is no precedent in the US for the dismissal of a Fed chair. Even Richard Nixon, who was not known for restraint, only pressured Arthur Burns, the Fed chair at the time, to shape monetary policy in line with the government’s wishes in the 1970s, but did not dismiss him.

In contrast, countries such as Turkey show that political interference in central bank management can have dramatic consequences: high inflation, capital flight, currency devaluation. These examples underscore the relevance of institutional independence, especially in developed economies.

Is there any data on the relationship between Trump’s attacks on the Fed and market reactions?

Yes. Liu & Popova (2023) analyzed Trump’s tweets about the Fed and Jerome Powell and found that negatively rated tweets in particular led to increased volatility in the foreign exchange market, especially for the US dollar. These data show that political communication alone can trigger financial uncertainty, even without concrete measures. The markets perceive when the independence of the central bank is at risk.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.