In the past few years, it was not only the assessments of inflation trends that were wrong. Instead of a brief sharp rise in inflation, there was a prolonged period of higher inflation rates. There were also positive surprises with regard to the development of economic growth. The recession expected by many analysts has not materialized (to date).

Note: Please note that forecasts are not a reliable indicator of future developments and that investing in securities involves risks as well as opportunities.

Good growth indicators

On the contrary, economic indicators point to good global growth, which could also be increasingly broad-based. Last year, growth was primarily driven by the normalization of supply chains, the catch-up process in the services sector, the expansionary US fiscal policy and the improvement on the US supply side.

The global Purchasing Managers’ Index (PMI) for March now points to continued good growth (even slightly above potential), although the growth drivers could become more broad-based and sustainable.

End of the stagnation phase in manufacturing

This is because the sub-components indicate that the individual sectors and regions are growing in unison. Firstly, the Purchasing Managers’ Index for the manufacturing sector has risen further. With a value of 50.6, the indicator is now above the 50 mark, which theoretically means growth in the sector, for the second time in a row.

In fact, manufacturing in the OECD region has been stagnating since the end of 2021. Even in the booming USA, manufacturing has moved sideways. In line with this, industrial metals have also been trending upwards since April. Manufacturing could therefore show growth in the coming months.

Return to growth in the eurozone

Secondly, a rising PMI trend can also be observed in the eurozone. In addition, the latest ECB survey on bank lending shows that lending guidelines have not been tightened any further. This means that the stagnation phases in both lending volume and real gross domestic product (since the fourth quarter of 2022) could be over.

Rising growth indicators in China

Thirdly, the purchasing managers’ indices in China have also risen. Although China still faces structural problems (negative GDP deflator, real estate sector, geopolitical tensions), achieving the growth target of 5% for this year now seems more realistic.

Tight labor market

The labor market remains tight. In the eurozone, the unemployment rate was a low 6.5% in February despite economic stagnation. In the USA, employment growth continues to surprise with strong increases. Employment in the non-farm payrolls sector increased by 303,000 jobs in March. At the same time, the unemployment rate has fallen (3.8%), although the labor force participation rate has risen slightly (62.7%).

Pause in the disinflation process

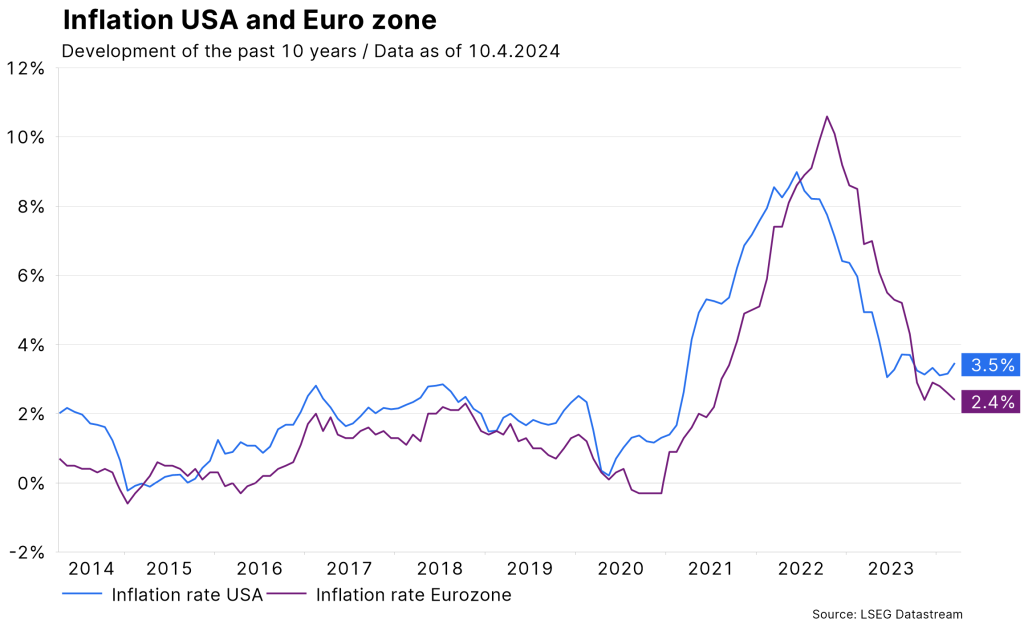

On the inflation side, there are signs of a pause in the falling inflation trend. In the eurozone, the flash estimate of consumer price inflation for March showed a further decline in the annual change in both the overall figure (2.4%) and the core rate (2.9%). While goods prices remained unchanged month-on-month, the price increase in the services sector was high in both the monthly (0.4%) and annual change (4%).

Inflation rates in the USA are showing an accelerated rise at the start of the year. There was a strong focus on the publication of consumer price inflation for the month of March yesterday, Wednesday. Even before that, estimates were already pointing against a resumption of the falling inflation trend. This proved to be the case, as the core inflation rate remained at 3.8% compared to the previous month. This was even slightly above expectations of 3.7%. Overall inflation in March was 3.5%, 0.3% higher than in February.

The purchasing managers’ indices also point to a sustained increase in price pressure. In addition, the oil price jumped significantly in April. The Brent oil price is currently at USD 91 per barrel. The risk lies in a further sharp rise in oil prices and / or in the fact that price increases can be more easily passed on to other prices.

Falling expectations for key interest rate cuts

In line with the positive development at growth and employment level and the pause in disinflation, the expectations for key interest rate cuts priced into the market are falling. At the beginning of the year, the US central bank was still pricing in 1.68 percentage points of interest rate cuts by the end of the year. Currently, the figure is only 0.63 percentage points, i.e. less than three interest rate cuts.

For the European Central Bank, the figure has shrunk from 1.6 to 0.84 percentage points. This has led to price losses for credit-safe government bonds. At the same time, share prices have risen significantly (and the yield premiums for credit risk have fallen considerably) because the prospects for continued good earnings and economic growth have improved.

From hawks to doves

The Fed and the ECB can now be described as more dovish (growth-friendly) than hawkish (inflation-fighting), as both central banks are hinting at key interest rate cuts this year. In the US in particular, above-potential growth and higher inflation argue against key interest rate cuts. For the ECB, the question has arisen as to why numerous central bankers have already set a date for the first rate cut (June), even though inflation in the service sector and wage growth are high while productivity is stagnating.

Without a decline in wage growth or a significant increase in productivity, it will be difficult to argue for a key interest rate cut in June. The next meeting of the European Central Bank takes place today, Thursday. The focus will be on whether ECB President Lagarde will sound the same or slightly less optimistic about the expectation of a further fall in inflation. Data dependency will probably be particularly emphasized. After all, the ECB’s next inflation forecasts will be published in June.

Conclusion: constructive environment

Overall, the economic indicators support the scenario of a soft landing for the economy. Inflation will remain slightly above the central bank’s inflation target for the time being. The central banks seem to accept this, at least in the short term. This is because they do not want to start cutting key interest rates too early or too late. The former increases the risk of a second wave of inflation, the latter the risk of a recession.

Because they are currently arguing in favor of key interest rate cuts, the macroeconomic environment remains supportive overall for risky asset classes such as equities. But even if key interest rates are not cut this year, the environment could remain constructive, at least as long as growth and inflation indicators point to good earnings growth. However, headwinds could come from increasing geopolitical tensions (keyword: oil price).

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.