Central banks have recently indicated a tendency to cut key-lending rates, with some survey-based indicators suggesting continued good real economic growth at a global level. There are also signs of an improvement in previously poorly performing areas at sectoral (manufacturing) and regional (Eurozone) level.

Please note: Prognoses are not a reliable indicator of future performance.

Tending towards rate cuts

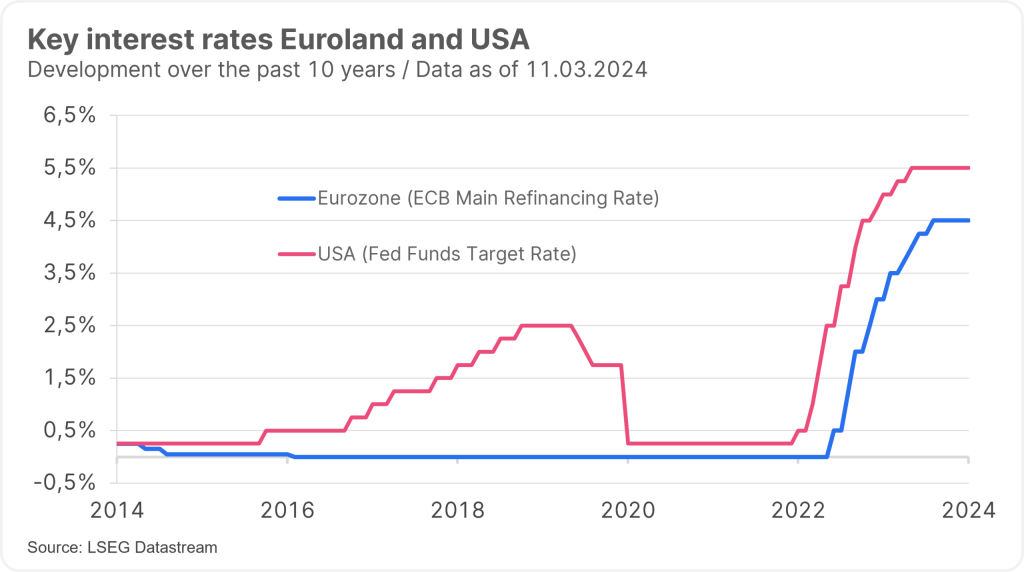

The USA and the Eurozone have moved closer to lowering key-lending rates – or so numerous speeches by leading central bankers from the Fed and the European Central Bank would at least suggest. In the USA, Fed Chairman Jerome Powell gave his semi-annual speech to the US Congress. On a general level, he reiterated the two risks to the interest rate policy: cutting rates too early or too much could trigger a second wave of inflation and further rate hikes; cutting interest rates too late or too little could weaken economic activity excessively, i.e. trigger a recession.

Powell hinting at less restrictive monetary policy

However, the key messages were not so much about fighting inflation as they were displaying a tendency towards a rate cut. Firstly, Powell did not sound particularly concerned in the speech about the acceleration in month-on-month inflation for January (personal consumption expenditure deflator, core rate: 0.4% p.m.). Rather, he spoke of a broadly-based decline in inflation for both goods and services.

Secondly, Powell pointed out that it was probably appropriate to reduce the restrictive policy at some point this year if Fed members were to gain confidence in a sustained decline in inflation.

Thirdly, this would not require an improvement in data, just a confirmation of recent developments. And lastly, he was even more specific about the timing, claiming that the Fed was not far away from that point in time.

Not enough confidence in the ECB yet

The latest meeting of the European Central Bank took place in the Eurozone last Thursday. The ECB President, Christine Lagarde, said that the ECB’s Governing Council had not started to discuss a reduction in the key-lending rate, but had begun to entertain the idea of loosening the restrictive monetary policy stance. Inflation had made good progress towards the inflation target (of 2%), even if the target had not yet been reached (flash estimate for consumer prices in February: 2.6% p.a.).

Lagarde also explained that while only little more information would be available in April, much more would be accessible in June. This has opened the door for a key-lending rate cut in June as a possibility. According to Lagarde, the ECB is focussing on the development of wages (“strong”; wage growth per employee in the fourth quarter of 2023: +4.6%) and profits (unit profits: +2.8% p.a.). According to Lagarde, this was due to there still being concerns about domestic inflation (“too high”), which was largely driven by the services sector (consumer prices in February: +3.9% p.a.). This is understandable, as wage growth per employee of 3% would only be compatible with the inflation target of 2% if productivity growth were to rise to 1% (fourth quarter: minus 1.1% p.a.).

No rate cut cycle

However, a key-lending rate cut does not yet mean a cycle of interest rate cuts. After all, there is still uncertainty about how restrictive, i.e. growth- and inflation-dampening, the current interest rate level actually is. As long as the economies in the USA and the Eurozone are able to avoid a recession, there will probably be no rapid cuts of key-lending rates. Instead, the central banks will proceed with caution.

The market is now expecting a key-lending rate of 3.75% in the USA by the end of 2025 (or in the US case, the so-called Fed funds rate), while the corresponding figure for the Eurozone is 2.25%. The arguments suggesting that we will not return to the pre-pandemic environment have become louder. Zero and negative interest rate policies are in all likelihood truly a thing of the past. If we take nominal economic growth as a rough benchmark for the long-term key-lending rate, we arrive at a value of 4% for the USA (2% real growth plus 2% inflation) and 3% for the Eurozone (1% growth plus 2% inflation).

Rising growth indicator

In terms of economic activity, the further rise in the Purchasing Managers’ Index (PMI) for the month of February is noteworthy. At 52.1, the overall figure points to a trend growth in the global economy of around 2.5% (on a quarterly and annualised basis). Last year, however, the composition of growth was extremely varied.

In this context, we should mention the robustness in the USA in particular, whereas other regions and countries (Europe) in the developed economies experienced stagnation. Growth was also driven by the service sector, with manufacturing flatlining. The purchasing managers’ report now indicates a possible reduction in regional and sectoral disparities.

Possible reduction in inequality

Although the Purchasing Managers’ Index in the Eurozone is still at a tepid 49.2, it is now well off its previous low (October 2023: 46.5). The rising trend provides an indication that the stagnation phase that has persisted since the fourth quarter of 2022 could be overcome. Exceeding the 50 mark, which (theoretically) signifies economic growth, would be an important signal.

In terms of sectors, it is worth noting that the Purchasing Managers’ Index for the manufacturing sector (50.3 / +0.3 points) has risen more strongly than that for the service sector (52.4 / +0.1 points). However, the signal for a breakout from the sideways movement in the manufacturing sector (which has been in place in the OECD area since the end of 2021) remains weak.

Favourable environment vs. warnings signals

The current environment is favourable for risky asset classes such as equities:

- Good global growth

- Falling inflation

- Signals suggesting a cut in key-lending rates

- Possible improvement in growth in the Eurozone and the manufacturing sector

If this sounds too good to be true, it is mainly because the various valuation ratios (price/earnings ratio, credit risk spreads) are already expensive. This means that the market prices already reflect a favourable scenario. The risks outlined by Powell (interest rate cuts too early vs. too late) could certainly be extended. This is due to the fact that cutting rates too early and too sharply could not only trigger a second wave of inflation, but also cause asset prices to rise too sharply.

Please note: Investing in securities involves risks as well as opportunities. Forecasts are no reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.