For six years now, Erste Asset Management has used World Water Day as an opportunity to draw attention to global water risks. This is the seventh year that we have published the water footprint of our sustainable equity funds. Since 2021, this disclosure has been complemented by the publication of the data for our sustainable bond funds.

A lot has happened since 2017: back then, not even half of the companies in our sustainable funds published their water consumption; today, almost three quarters disclose this information. Nevertheless, there needs to be an even greater awareness of the urgency of global water risks. After all, they also come with economic risks attached to them, as the droughts and water shortages in Europe last year mercilessly demonstrated.

Water shortage is increasingly becoming an issue in Europe

Problems that a few years ago we only knew from reports about distant countries have now arrived here, right in the middle of Europe. We can also increasingly feel the impact of the water shortage and the progressive lowering of the groundwater level. In rural regions, for example, domestic wells that have existed for generations are increasingly drying up. This is just one example of the consequences of the climate crisis, which are being brought home to us ever more drastically.

Yet water is much more than “just” a vital good. The valuable resource is also of enormous importance from an economic point of view. The far-reaching effects of the water shortage became clear once again last year. If the rivers in Europe do not carry enough water, cargo ships get stuck. Even nuclear reactors cannot continue to operate because they cannot be cooled sufficiently.

Water risks are also economic risks

For companies, a water shortage can have a wide variety of consequences, such as stricter regulation of water consumption, massive price increases or delays in the production process. This highlights the fact that water risks are also economic risks. It is therefore all the more important for companies to use our water resources responsibly and manage water risks sustainably.

It is important to understand that not only the actual consumption in absolute terms plays a role in possible water risks. Unlike the carbon footprint, the regional component is crucial. Water consumption in regions with high water resources, such as in the area of the Alps, is to be classified differently than water consumption and related management practices in water-scarce regions, such as in Cape Town in South Africa.

We follow the risk classification of the World Resources Institute and distinguish between low (e.g. Austria in the Alps), medium (e.g. Germany) and high (e.g. Spain) stress regions. At the country level, Austria – an alpine country – is fortunate enough to be classified as a low stress region. Large parts of Germany, on the other hand, are already classified as medium and high stress regions. Italy, Spain and Greece are largely classified as high to very high stress regions. In the past, these countries in particular have often struggled with extreme droughts, water shortages and forest fires.

How do we take into account water risks?

In the course of the sustainability analysis, Erste AM first records whether a company is located in a low-water risk region and whether it is dependent on high water withdrawals there. In addition, our sustainability experts assess what measures companies take to improve water consumption. These aspects are accounted for in the calculation of the ESG rating of the companies, which among other things is decisive for whether a company is included in the fund or not.

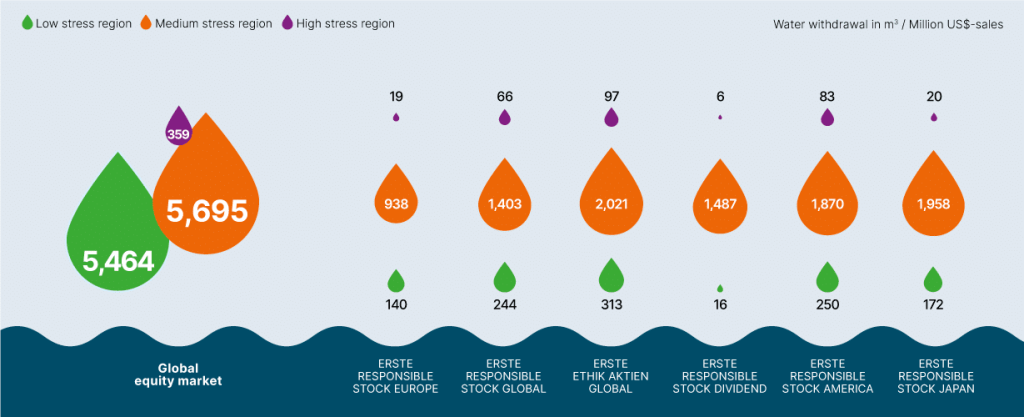

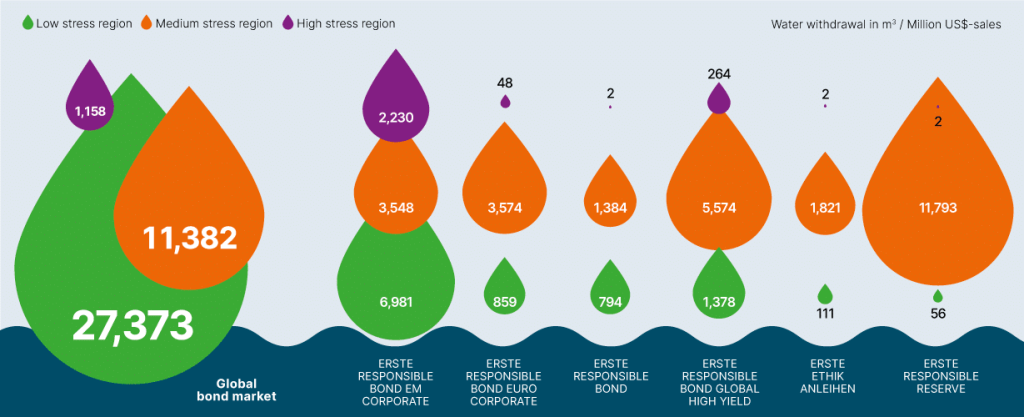

The consideration of water risks in the selection of assets is proving successful, as the evaluation of the water footprint in our sustainable funds illustrates. This year, Erste AM’s sustainable funds have again significantly outperformed the global equity and bond market in terms of water footprint.

EVALUATION WATER FOOTPRINT

Global equity market vs. sustainable equity funds

EVALUATION WATER FOOTPRINT

Global bond market vs. sustainable bond funds

In determining the average water intensity of the companies held in the funds, we use the water withdrawal published by the companies as a key indicator. Water intensity measures water consumption in cubic metres per million US dollars of sales.

Risk notes

ERSTE RESPONSIBLE STOCK EUROPE

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in European stocks.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for an attractive increase in value.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE STOCK GLOBAL

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in equities in developed markets.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE ETHIK AKTIEN GLOBAL

For further information on the sustainable focus of ERSTE ETHIK AKTIEN GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE ETHIK AKTIEN GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE ETHIK AKTIEN GLOBAL as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in global companies that emphasise sustainability and ethical business practices.

- Opportunity to achieve substantial capital appreciation.

Risks to be considered

- The net asset value of the fund can fluctuate considerably (high volatility).

- Due to investments denominated in foreign currencies, the net asset value of the fund in euros can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE STOCK DIVIDEND

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK DIVIDEND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK DIVIDEND as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in equities in delevoped markets.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive current income or capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE STOCK AMERICA

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK AMERICA as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK AMERICA as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in North American stocks (US and Canada).

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE STOCK JAPAN

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK JAPAN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK JAPAN, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK JAPAN as described in the Fund Documents.

Advantages for the investor

- Broad diversification in selected Japanese companies with little capital investment.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate considerably (high volatility).

- Due to investments denominated in foreign currencies, especially in Japanese Yen, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE BOND EM CORPORATE

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EM CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EM CORPORATE as described in the Fund Documents.

Advantages for the investor

- Opportunities for additional earnings through interesting corporate bonds from emerging markets.

- Investments are made in companies that meet sustainability criteria.

- Foreign currencies are mostly hedged against the euro.

- Risk diversification through broad diversification in bonds from various issuers.

Risks to be considered

- Rising interest rates can lead to price losses.

- Deterioration in credit ratings can lead to price declines.

- Increased risk due to medium to low debtor credit rating of the participating companies.

- Foreign currency fluctuations can affect the fund price development.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE BOND EURO CORPORATE

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EURO CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EURO CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EURO CORPORATE as described in the Fund Documents.

Advantages for the investor

- Risk diversification through broad diversification in bonds from various issuers.

- Investments are made in bonds of ecologically, morally and socially operating companies.

- Price gains are possible when interest rates fall.

Risks to be considered

- Rising interest rates can lead to price declines.

- Deterioration in credit ratings can lead to price declines.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE BOND

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND as described in the Fund Documents.

Advantages for the investor

- Investment in selected bonds of sustainable (ethical) issuers.

- An ethics advisory board regularly reviews sustainability.

- Gains are possible when interest rates fall.

Risks to be considered

- Rising interest rates can lead to price declines.

- Deterioration in credit ratings can lead to price declines.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the Fund Documents.

Advantages for the investor

- Investments in selected bonds of sustainable (ethical) issuers.

- An ethics advisory board regularly reviews sustainability.

- Foreign currenciy risks are mostly hedged against the euro.

- Broad diversification in the area of global high-yield bonds.

Risks to be considered

- Deteriorations in credit ratings can lead to price declines.

- Increased risk due to average and below average credit rating of participating companies.

- The net asset value of the fund can be subject to considerable volatility.

- Fluctuations in foreign currencies may affect the net asset value.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE ETHIK ANLEIHEN

For further information on the sustainable focus of ERSTE ETHIK ANLEIHEN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE ETHIK ANLEIHEN, consideration should be given to any characteristics or objectives of the ERSTE ETHIK ANLEIHEN as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in global issuers that emphasise sustainability and ethical business practices.

- The fund invests mainly in government bonds, corporate bonds are added to the portfolio.

- Security due to issuers with higher credit ratings.

- Price gains on falling interest rates.

Risks to be considered

- Rising interest rates can lead to price declines.

- Deterioration in credit ratings can lead to price declines.

- Due to the investment in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE RESPONSIBLE RESERVE

For further information on the sustainable focus of ERSTE RESPONSIBLE RESERVE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE RESERVE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE RESERVE as described in the Fund Documents.

Advantages for the investor

- Investment in selected bonds from sustainable (ethical) issuers.

- Good security through issuers with very good to medium credit ratings.

- Small price fluctuations due to investments in bonds with variable interest rates or short remaining terms.

Risks to be considered

- Rising interest rates can lead to price declines.

- Deterioration in credit ratings can lead to price declines.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.