Despite making up over 90% of the atoms in the universe, hydrogen was only “officially” discovered in 1766. And despite hydrogen production through steam reforming taking place for almost 100 years in Europe, many investors have only gotten aware of the industry very recently, with some of the stocks reaching stratospheric heights before coming back to earth.

The last years have indeed brought many new entrants into an industry that seems to be ever-changing. While at first the area of focus was light commercial vehicles (think hydrogen cars), it is now shifting towards bigger mobility applications (busses, ships, aircrafts). Hydrogen will also play a big role in longer-term energy storage and in decarbonizing heavy industries like Steel production or Refining.

For this article we want to focus on the production of green hydrogen, where recent technological advantages and reductions in cost have changed the landscape dramatically. The total addressable market for green hydrogen is estimated at >€ 150 billion and might be the missing link in making the energy transition possible.

This time is different

The hydrogen sector has been prone to hype in the past, but 2022 brought numerous developments on the political front that make us think that his time might be different! The EU has in March announced RePower EU, identifying hydrogen as a key pillar to decarbonize industry and wean Europe off of its Russian gas dependence. To be more precise, Europe plans for 10 million tons (!) of green hydrogen production and 10 million tons of green hydrogen imports by 2030. It also launched a “Hydrogen Bank” to, in the words of European Commission president Ursula von der Leyen “create a market maker for hydrogen, in order to bridge the investment gap and connect future supply and demand.”

Not to be outdone by Europe, the US has this summer announced its Inflation Reduction Act, granting tax credits of up to 3$/kg of green hydrogen production – making it almost “free” for some production sites. Different to Europe’s plan, which is mostly announcements on paper, the US has a clearer path for green hydrogen producers on how to access subsidies. This has led to a “green rush” with a lot of companies setting up operations in the US and intensifying their sales ambitions there.

The flurry of announcements and governmental support for hydrogen would be enough to fill its own blog post. In any case, these are developments that could be very positive for the entire hydrogen industry.

Fusion Fuel – first mover in green hydrogen

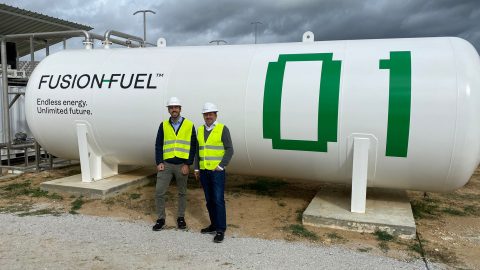

One company profiting from recent developments on the political front is Fusion Fuel. The Portuguese company is an innovator and at the forefront of green hydrogen production in Europe. We have recently visited the company’s production facilities near Lisbon as well as its first solar-to-green hydrogen facility in Evora (Portugal), which is one of the first operational green hydrogen facilities in Europe.

Fusion Fuel’s main product is the HEVO-Solar: a device that captures 100% of the energy of the sun to create on-site green hydrogen from solar power. This is done by combining very efficient solar panels, concentrating solar energy at over 40% efficiency as compared to common solar panels at ~20%. Electricity and heat captured is used for electrolysis – and each HEVO-Solar unit can produce 1 ton of green hydrogen per year. Fusion Fuels H2Evora facility boasts 15 HEVO-Solar units, with a nameplate capacity of 15 tons of green hydrogen per year. An advantage of Fusion Fuels technology is, that it produces hydrogen on-site, reducing transportation cost, making it particularly attractive for smaller industrial clients and hydrogen fueling stations.

On the business side Fusion Fuel has two angles: Sale of its patented technology to business partners on the one hand and developing projects on the other. The H2Evora facility acts as a demonstration plant for potential business partners and, in our case, fund managers. Sadly, the sun wasn’t shining when we visited, so we couldn’t see the HEVO-Solar in motion – but seeing the operations in the field (literally) was very interesting nonetheless.

Fusion Fuels future

The hydrogen industry has long been caught in the famous chicken- and egg problem. Big industry cites limitations on the production capacity for electrolyzers, while electrolyzer manufacturers wait for the big-ticket orders to justify those capacity expansions.

Fusion Fuel is currently in the process of ramping up its production as well, and we had the opportunity to visit two production facilities in Benavente and Sabugo, near Lisbon. We came away impressed by the size and sophistication of its operations, in particular its plant in Benavente which will be fully automatized and act as a blueprint for future production sites globally.

Benavente production facility. There is enough room to scale capacity at Benavente quickly once projects are signed and money starts flowing. Sales activity so far has been mostly in Europe and especially Iberia, which makes sense as it is their home-market and also very well suited for green hydrogen production. However, with the changing landscape and attractive incentives in the US, Fusion Fuel has been increasing its activity there and recently announced a project in California worth up to € 175 million. Fusion Fuel has also broadened its product offering to include stand-alone electrolyzers, where it managed to decrease costs by over 50% while increasing the efficiency.

Our visit gave us a good overview of the operations and made us very confident that Fusion Fuel will be able to thrive in this ever-changing hydrogen market. We are looking forward to a bright future for the company!

This article is part of the ESGenius Letter on the topic of the Energy of the Future. The other articles with information and insights on sustainable energy use can be found here.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.