The basic formula of “high inflation plus restrictive monetary policies plus deterioration in the financial environment plus uncertainty about further liquidity crises such as in the UK equals global recession risks” still applies. In addition, the so-called exchange rate regime trilemma is receiving increasing attention due to the strong US dollar.

High inflation

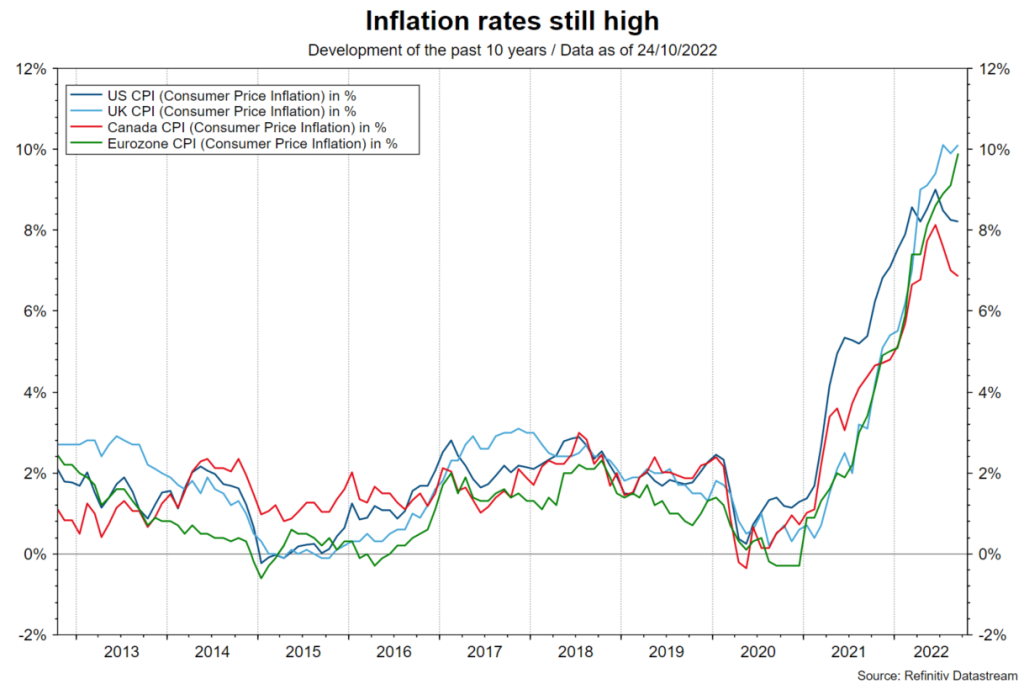

The inflation rates published for September are still high or higher than expected. This is true for the US (Sep, 0.4% m/m / 8.2% y/y), the UK (0.5% m/m / 10.1% y/y), Canada (0.1% m/m / 6.9% y/y) and the Eurozone (1.2% m/m / 9.9% y/y). Although there is evidence of easing inflationary pressures – falling energy prices, falling goods price inflation, falling delivery times, little evidence of a wage-price spiral – the risk of inflation persistence anchoring at a high level remains high. Central banks argue that the costs of persistently high inflation are greater than the costs of recession. They show a strong commitment to maintain the basic monetary policy stance hawkish (rapid and synchronous policy rate hikes) and restrictive (dampening the economy) until inflation rates have convincingly embarked on a downward trend.

Note: Past performance is not a reliable indicator for future performance.

Key interest rate hikes

This week, the central bank in Canada (BoC) is expected to raise its key interest rate by 0.5 percentage points to 3.75% and the central bank in the euro zone (ECB) is expected to raise all three key interest rates by 0.75 percentage points each (deposit facility: from 0.75% to 1.5%). In the following week, key interest rate hikes are also expected for the US central bank (Fed – upper band: from 3.25% to 4%) as well as for the central bank in the UK (BoE: from 2.25% to 3%).

Tightening of the financial environment

Tight monetary policies are creating a tightening financial environment. Last week, yields on credit-sensitive government bonds rose further. This reduces the present value of future cash flows, and the prices of numerous asset classes are under pressure. In other words, the cost of capital is rising. In addition, uncertainty remains as to whether a liquidity crisis could break out elsewhere as in the UK.

Strong US dollar

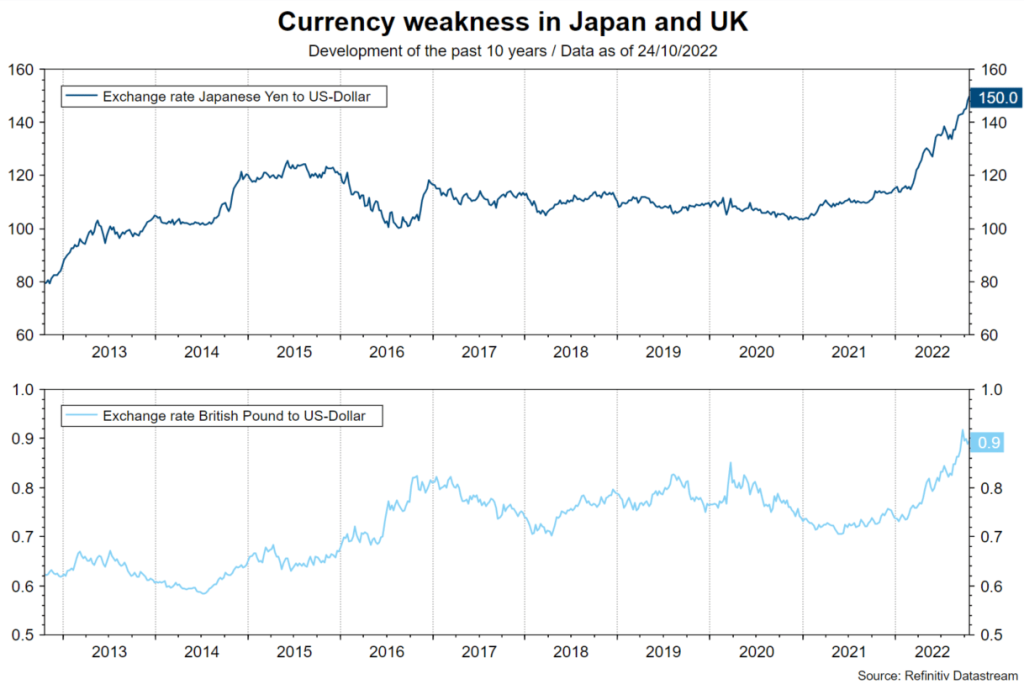

In addition, the strong US dollar causes problems. It makes it difficult to service debt in dollars, increases inflation in countries with a weak currency (higher energy prices), reduces the attractiveness of countries for capital investment (a problem for countries with a high current account deficit) and is generally detrimental to planning (similar to high inflation).

Yen Intervention

In the developed economies, the problem of currency weakness is virulent in two countries in particular. In the United Kingdom, with an estimated current account deficit of just under 5% of nominal GDP, the British pound is under pressure. In Japan, the Japanese yen has weakened sharply because, unlike the other central banks, the Bank of Japan is sticking to its ultra-loose monetary policy. After the yen climbed to over 150 per US dollar last Friday, the second currency intervention in a month took place, according to media reports.

Note: Past performance is not a reliable indicator for future performance.

Trilemma of the Exchange Rate Regime

As a result of the high inflation rates, the famous trilemma of the exchange rate regime has also come to the fore. The three exchange rate policy objectives of exchange rate stability, monetary policy autonomy and free capital movements cannot be achieved simultaneously. Only two of the three objectives at a time. Because exchange rate stability is no longer a given for an increasing number of countries, they are faced with the choice of either raising key interest rates significantly or intervening in the currency market. Unilateral currency interventions aimed at preventing currency weakness are often unsustainable from a historical perspective. One possibility is concerted currency intervention to the detriment of the US dollar. However, this is not particularly likely.

The “only” thing left to do is to address the underlying problem. In the case of the UK, this involves putting fiscal policy on a credible footing. For Japan, the probability of abandoning ultra-loose monetary policy has increased significantly. Among other things, this means that the Bank of Japan could take the upper band (currently: 0.25%) for the ten-year government bond yield upward. The Bank of Japan’s meeting next Friday will thus be followed with greater interest than usual.

Inflation trend is decisive

Inflation remains the most important factor influencing the markets. Only increasing signs of easing inflationary pressure would enable central banks (the Fed) to reduce the pace of interest rate hikes or even pause. This would be positive for numerous asset classes and negative for the US dollar.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.