In the square of inflation, economic growth, monetary policy and financial markets, inflation has been the underlying driving factor for some time. This impacts central bank policies (tightening) and economic growth (lower), and in turn, in the next round, central bank policies themselves impact both growth (lower) and inflation (lower). This environment can be described as stagflatonary. As such, it is negative for the prices of numerous asset classes. Meanwhile, the feedback from falling asset prices to growth (lower), inflation (lower) and central banks (less restrictive) is also gaining relevance.

Falling valuations

Rate hike expectations have increased sharply in the developed economies. In the meantime, a key interest rate of 2.75% is priced in for the Fed by the end of 2022 (currently: 1%). For the eurozone, an increase from -0.5% (discount rate) to 0.5% is priced in. The direct effect is a reduction in asset price valuations because higher interest rates mean a lower present value of future profits. The result is a deterioration in the financial environment (falling prices). This impact channel was the determining factor from January to April.

Higher interest burden

The indirect effect of interest rate rises is a dampening of demand, especially in the interest-sensitive segments of the economy. In the USA, the real estate market is already showing signs of weakness. In April, the NAHB sentiment index for the real estate sector fell sharply (69 after 77). However, the level still points to growth.

Reduction in purchasing power

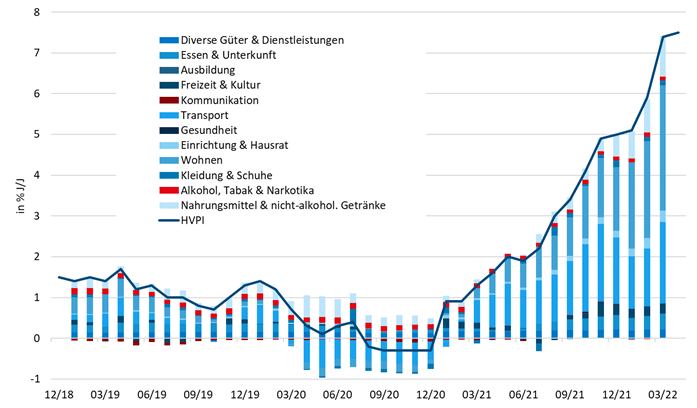

High inflation (OECD area in March: 8.8% pa) is reducing the purchasing power of companies and consumers. In line with this, consumer sentiment indicators have fallen. In April, consumer sentiment in the entire OECD area fell below the May 2020 level. Only during the Great Recession of 2008 / 2009 was sentiment worse.

Corporate reports point in the same direction. US retailers Target and Walmart have issued a gloomy outlook. Ongoing supply chain issues, as well as higher freight, fuel and labor costs, are squeezing profits at both companies. In addition, it was reported that consumers are shifting their spending away from brand-name items toward cheaper private-label items. On the positive side, US retail sales grew strongly in April (0.9% pm). What was particularly positive about the report was that previous months were revised upward.

Note: “Past performance is not a sufficient indicator of the future performance of the fund”.

Contraction in China

Both factors (higher interest rates, lower growth) have led to increasing growth and profit fears (falling valuations, higher interest burden, reduction in purchasing power). In addition, there has been a sharp contraction in economic activity in China caused by the zero tolerance policy towards new infections. In April, industrial production plunged by 7% and retail sales by 9.9% pm. The global economy is suffering because of the loss of demand from China on the one hand and the disruption of supply chains on the other. Some goods export data in Asia were already weak in April. For example, export orders in Taiwan fell -5.5% pa for the first time since February 2020.

Uncertainty Output Gap

Uncertainty abounds as to whether central banks will manage a soft landing for the economy or ultimately trigger a recession. On the one hand, the output gap is difficult to estimate. If the economy is already operating very far above potential, a restrictive interest rate policy is needed (triggering a recession). If the output level is only slightly above potential, a soft landing is possible. The risk here is that the central bank will not manage the fine-tuning (too strong key rate hikes).

Uncertainty about inflation drivers

On the other hand, there is considerable uncertainty about the explanatory factors for inflation. The triggers are the pandemic on the one hand and the war in Ukraine on the other. The past two years have seen strong and rapid downward and upward movements in demand, which supply has not been able to keep up with. In addition, the supply itself has also been affected (closure of ports). Due to the war in Ukraine, food and energy prices have risen again. The price shocks are external in nature. The key question is whether the higher price level lowers demand (economic growth) or sets off an inflationary spiral. Increased growth fears argue for the former.

Change of perspective

In hindsight, it is apparent that monetary policies have remained expansionary for too long. Last year, it became increasingly foreseeable that the pre-pandemic trend in GDP would soon be reached. Unemployment rates had also already reached low levels in the past year. The change in perspective by central banks from “too low inflation” to “too high inflation” has taken place too late. The prevailing mindset can be summarized as, “Because inflation is too low, the recovery phase can be supported for a long time.” Expansionary monetary policies have encouraged pass-through to other price components. The dangerous thing is an inflation spiral. In this environment, inflation rises in the next period because it has risen in the current period. The Fed and the other central banks in the developed economies are now showing a strong commitment to getting inflation under control. While they can do little to influence the high inflation this year, they are trying to damage economic growth enough to prevent an inflationary spiral.

At the beginning of the year, the baseline scenario was “recovery”. Not only the pre-pandemic level, but also the pre-pandemic trend should soon be reached in terms of GDP. Initially, the war in Ukraine had affected but not overturned this scenario. Meanwhile, the probability of a growth phase below potential growth had increased. In this environment, the recovery from the pandemic is halted (but not overturned), inflationary pressures are falling, expectations for key rate hikes are at least not rising further, and government bond yields are supported.

PS: home office music – beautiful solo piano: Encore From Tokyo (Keith Jarrett, album: Sun Bear Concerts)

For a glossary of technical terms, please visit this link: Fonds-ABC | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.