Let’s start with a trip down memory lane:

Do you remember the scenery 30 years ago – on the financial markets, and in our personal lives?

The 1980s – many of the older generation are still thinking back to the “good old times”. There were no smartphones and no data kraken. Instead, we had shoulder pads in our jackets and wore peg-top jeans. No.1 in the German charts was an actor known from Knight Rider and Baywatch called David Hasselhoff with his song “I’ve been looking for freedom”.

This was eerily in tune with the most important geopolitical event of that era, i.e. the fall of the Berlin Wall and the opening of the Eastern Bloc. On the financial markets, this set off a period of sharply falling yields on government bonds.

A chart is worth a thousand words

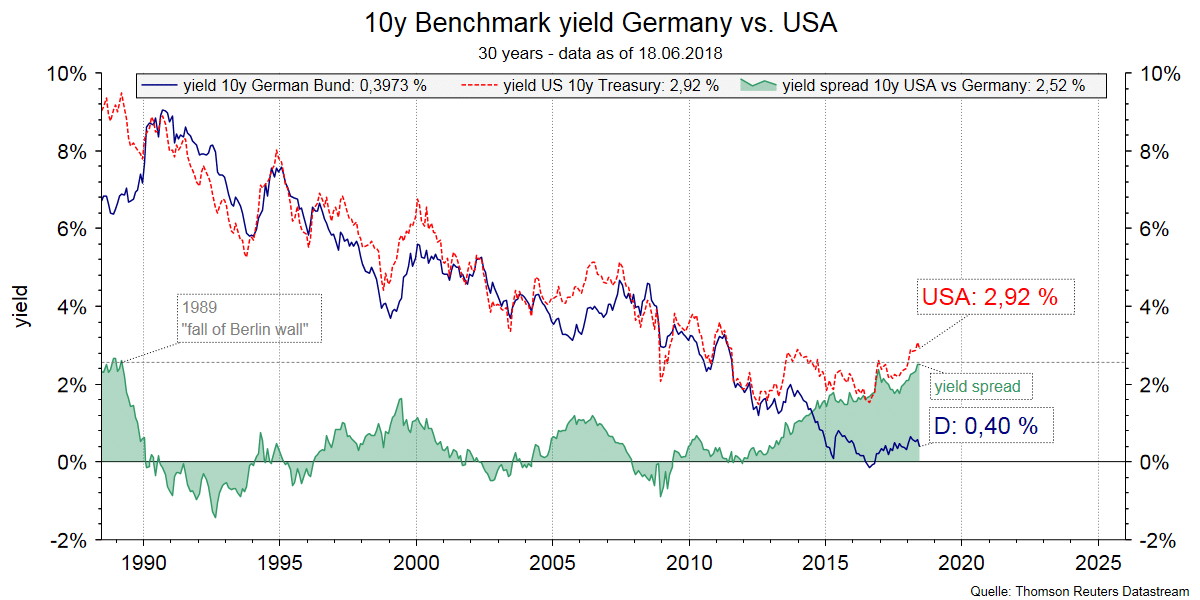

The following chart shows the long-term development of 10Y (remaining time to maturity) German and US government bond yields over the past 30 years. Let us discuss a number of remarkable findings and look at possible future scenarios.

Long-term development of 10Y German (blue) and US (red) government bond yields and interest rate differential (green)

Source: Datastream, 30 years as of 22 May 2018

Note: past performance is not indicative of the future development of an investment.

The chart depicts the yield of German government bonds in blue and that of US government bonds (i.e. treasury bonds) in red. The green area illustrates the yield differential. The long-term chart highlights several developments:

- Both US and German yields have fallen drastically

- The decline has occurred in waves

- For most of the time the US yield would exceed the German yield

- The yield differential (i.e. spread) between the two countries has fluctuated over time

- The German government bond yield turned negative at its low

What does this development mean for investors?

The bond yield reflects the inverted performance of the bond price. This means that German and US government bond prices have increased over the observation period, albeit with significant setbacks interspersed. Investors have thus not only received the ongoing coupon payments, but also benefited from rising bond prices. The optimum strategy has been to remain invested and ignore setbacks.

While future developments are unpredictable, this relationship holds: when yields are rising, the prices of existing bonds are falling. At the end of the 1980s, yields were above 8%. The falling interest rates made it easier to compensate for price fluctuations than today, with US yields of 3% vs. German yields of 0.5%.

The interest rate differential is currently as high as 30 years ago

German and US government bonds command high ratings. Defaults are unlikely. The spread (i.e. the green area in the chart above) can be explained by the underlying currency and the investment region. It constitutes an important criterion for the assessment by investors and at 2.5% in favour of the USA is currently as high as previously in 1989!

Rational investors will assess whether the volume of the spread can offset a possible depreciation in the underlying currency.

At a spread of 2.5% (per year) this means a surplus interest income of 25% over ten years for US bonds. Or in other words: if the US dollar were to depreciate by 25% in the coming ten years, euro investors would still earn the same return as they would on German government bonds.

The historically high spread is clearly making a case for US bonds at this point. Also, the US central bank (Fed) stopped its bond purchases back in 2014, whereas the ECB continues to buy aggressively and is expected to abandon its purchase regime only in autumn of 2018. This means that the Fed is about four years ahead of the ECB and has also communicated further interest rate hikes for 2018 and 2019 to the market. The ECB has not issued any statements about its possible future interest rate policy, except that rates will remain very low in the foreseeable future.

The last time the spread was of similar proportions (in favour of the USA) to today’s scenario, the year was 1989. David Hasselhoff (known for his starring roles in Baywatch and Knight Rider) was topping the German charts with “I’ve been looking for freedom” at the time. By the way: Knight Rider has recently been rebooted, and Baywatch has been turned into a movie with a new cast. Is history repeating itself?

How to invest, and what asset allocation to maintain

As we pointed out above, the optimum strategy has been to remain invested. Investors will rightly ask how they can remain invested when the bond expires after ten years.

The solution: an investment fund will always remain invested. It automatically buys new bonds and thus provides investors with the chance to remain invested in the chosen markets without expiry date.

Conclusion: This is what we can learn from the long-term chart: in the past 30 years it has made sense to invest and remain invested in government bonds due to continuously falling yields. As far as the future is concerned, the experts of Erste Asset Management do not expect yields to continue falling for the coming 30 years. Investors should diversify their portfolios beyond credit-safe government bonds.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.