This year’s World Environment Day focuses on active measures to protect the environment under the motto “Our Power, Our Planet” – for example through education, stakeholder advocacy, or responsible investing.

In line with this, we at Erste Asset Management have recently published our latest Engagement & Voting Report. In it, we report annually on our voting behaviour at Annual General Meetings (AGMs) and the dialogues we held with companies in the previous year to encourage them to adopt more sustainable and environmentally friendly business practices. Our message is clear: sustainable investing is not a trend, but an obligation – and active ownership is a key tool for us to bring about change in companies through dialogue, the exercise of voting rights, and clear expectations.

What companies did we engage with last year and what successes did we achieve? And what does it actually mean to practise active ownership as an investor? We address these questions in today’s blog post on the occasion of World Environment Day.

What do we mean by active ownership?

The term active ownership means much more than simply exerting influence – it describes a strategic and structured dialogue with companies, combined with the targeted exercise of voting rights. This also provides the Management Boards of the various companies in which we invest with information about the progress investors are seeking, which in turn has a medium and long-term impact. This approach is an integral part of our investment strategy.

In 2024, we carried out:

- 159 Engagements

- 17 thereof new ones

- 15 company dialogues successfully completed

Among other things, these discussions resulted in progress on measuring climate risks, formulating environmental targets, and disclosing political activities. The focus was particularly on companies in carbon-intensive industries, with clear expectations regarding their remuneration policies in order to incentivise climate-friendly behaviour internally as well.

Focus ond biodiversity

A key focus in 2024 was biodiversity – a topic that combines ecological and economic relevance. According to the World Economic Forum, more than half of global GDP depends directly or indirectly on the state of nature – that is around USD 44 trillion! The ongoing loss of biological diversity therefore poses a risk not only to people and the environment, but also to entire economic and financial systems.

To counteract this and to contribute as an active investor, we adopted a Biodiversity Policy back in 2023 and expanded our engagement strategy accordingly. The aim is to support companies in improving nature-related governance structures, disclosures, and strategic measures – and thus put them on a biodiversity-friendly course.

Our 2024 engagements covered a wide range of topics

In addition to biodiversity, our company dialogues focused on the following topics:

- Deforestation: identification of risks in supply chains

- Human rights: ensuring of decent working conditions

- Good corporate governance: separation of positions of power in management bodies

- Climate reporting and political influence

As in previous years, we focused our engagement on dialogues with Austrian and Central and Eastern European (CEE) companies, as we see particularly high potential for impact as a major institutional investor in Austria and CEE. We also held talks with numerous companies from other countries, including Volkswagen, TotalEnergies, Bayer, thyssenkrupp, Deutsche Bahn, and Lufthansa. We were active in cross-sector alliances such as Climate Action 100+ and Nature Action 100. In addition, social and governance-related issues were addressed through joint engagement activities with PRI (Principles for Responsible Investment) and Morningstar Sustainalytics.

Note: The companies listed here have been selected as examples and do not constitute investment recommendations. Where fund portfolio positions are disclosed in this document, these are based on market developments at the time of going to press. As part of active management, the portfolio positions mentioned may change at any time.

Governance case study: TotalEnergies

The case of TotalEnergies is an example of consistent active ownership. In June 2024, we joined 19 other investors in submitting a shareholder motion calling for the separation of the roles of CEO and Chairman of the company’s Management Board – a key governance issue. Although company management failed to put the resolution on the agenda of the AGM, we remained in dialogue with TotalEnergies. In a conference call in June, the company argued in favour of retaining the dual role.

We, on the other hand, believe it is very important to talk to oil and gas companies not only about environmental but also about governance issues. After all, good governance plays a crucial role in facilitating the energy transition in these sectors. The message: sustainability dialogues include not only environmental issues, but also governance and transparency issues – especially in transition industries such as the oil and gas industry.

Voting season highlights interesting trends

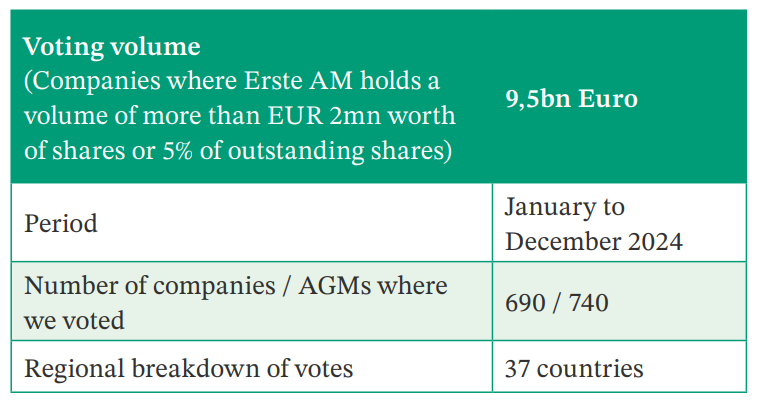

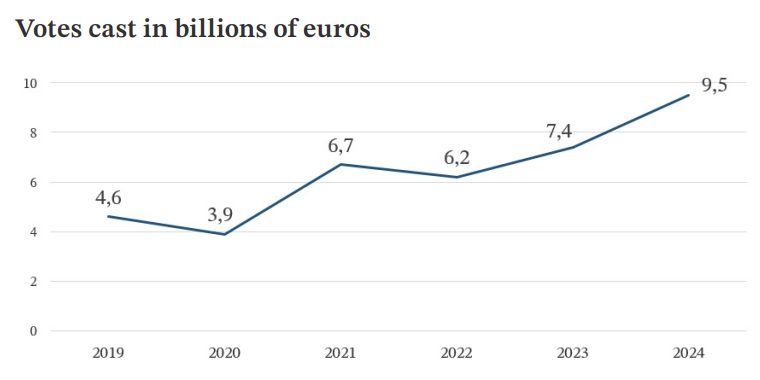

In addition to company dialogue, actively exercising voting rights is an equally important component of active ownership. Last year, we exercised our voting rights for EUR 9.5bn worth of the share capital we were holding and voted at more than 700 AGMs in 37 different countries. Our voting volume had continued to rise significantly compared to previous years. We report on our voting behaviour on an ongoing and transparent basis in the voting section of our website.

The motions submitted by shareholders during the past voting season revealed an interesting trend: approval rates for motions on environmental and social issues varied on both sides of the Atlantic. According to an analysis by ShareAction, the support rate for such issues in the USA was still around 40% in 2021. By 2024, the rate had fallen to just 19%. The picture in Europe is completely different: from 2021 to 2024 shareholder approval for social and environmental issues rose from 68% to 82%.

Challenges for 2025: strengthen ESG & credibility

In the context of increasing political polarisation and ESG-critical voices in some countries, one thing is clear: it is not enough to simply call for sustainability – it must be implemented credibly and consistently. This year, we will once again be focusing on a number of key areas in our active ownership activities:

- Remuneration policy: precisely because companies are prematurely withdrawing their climate targets, it is essential to align incentives for key decision-makers with the goals of climate-positive transformation in order to ensure credible and sustainable corporate management.

- Political engagement of companies: companies should be transparent about how they influence regulatory developments.

- Enhanced dialogue: there will be a targeted approach for companies that have not been willing to engage in dialogue to date.

- Assessment of companies’ net-zero strategies: in addition to ambitious targets, the key factors here are feasibility, financial viability, the timeframe and the progress achieved.

Conclusion: positive impact through active investment

The Engagement & Voting Report 2024 shows that as an active investor, we are in a position to drive real change – through structured engagement, systematic voting, and clear sustainability goals.

In times of increasing uncertainty, active ownership can provide a stable foundation to encourage companies to act responsibly and with a view to the future – in the interests of investors, society, and the environment.

📘 More information

Please visit this link for the complete Engagement & Voting Report 2024 👉 Publications & guidelines of Erste AM

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.