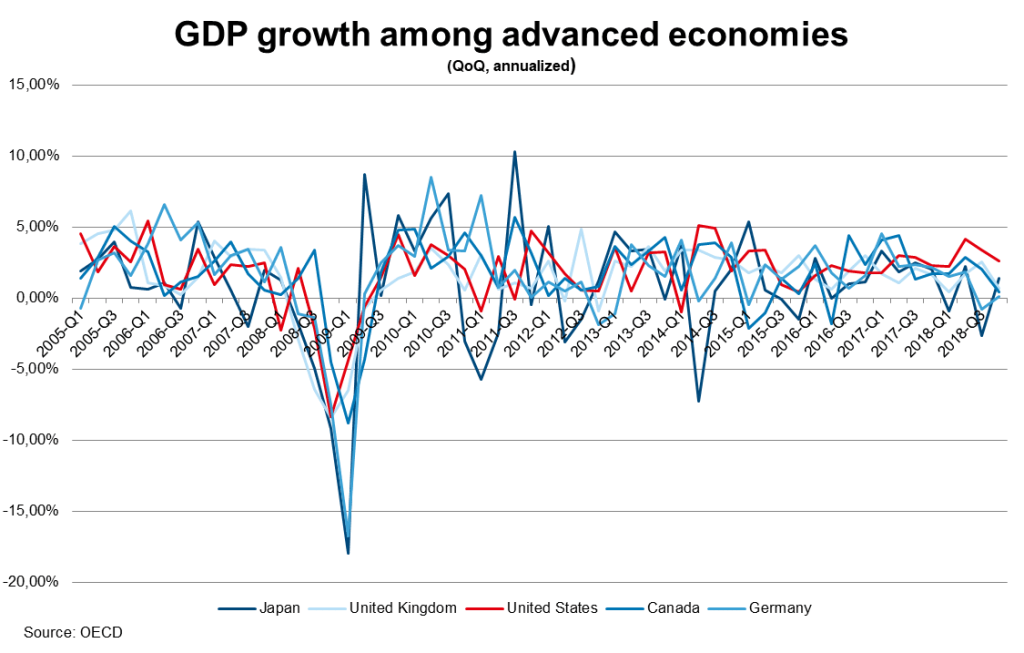

The economic development in the United States has been based on a firm footing since the financial crisis. Especially over the last couple of years, the U.S. outpaced most other advanced economies in terms of GDP growth and the current expansion could soon become the longest in U.S. history.

Debt level on the rise

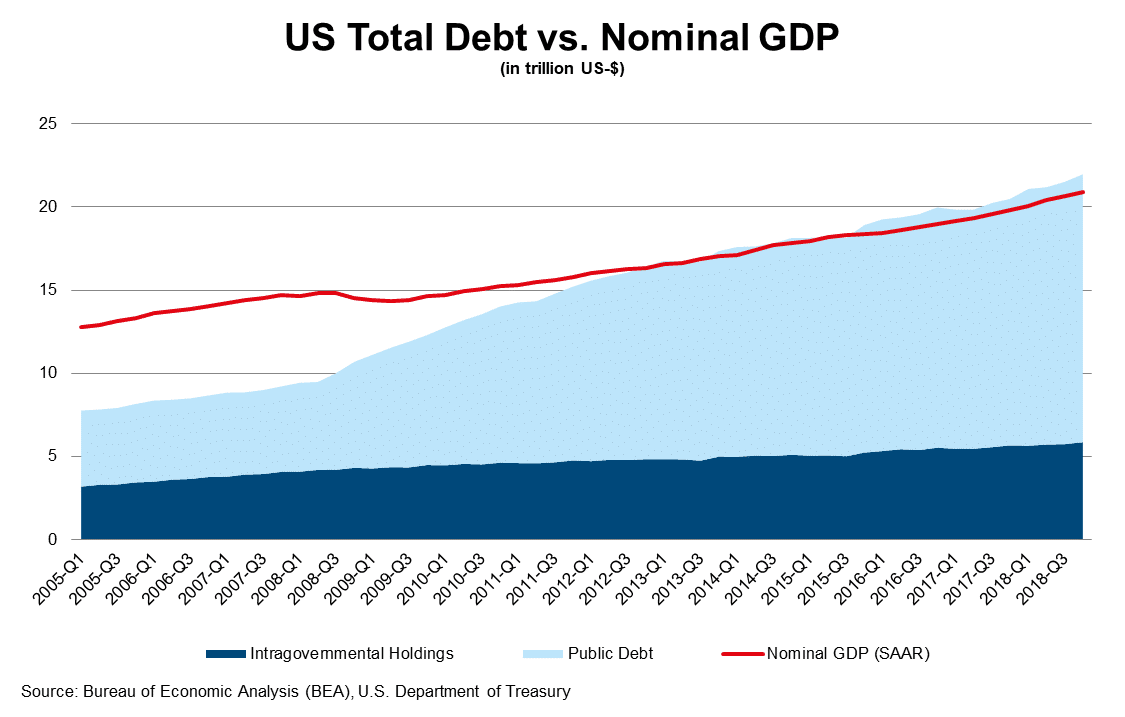

The amount of total debt increased substantially in the past, especially since the financial crisis. Budget deficit figures are still at an elevated level and there is no sign of a reversal of the trend in the upcoming years.

Fiscal stimulus major part of Trump’s policy

While the Federal Reserve has decided to reduce the level of accommodative monetary policy in December 2015 and since then raised the federal funds rate nine times to the current boundaries of between 2.25% to 2.50%, fiscal stimulus as part of Donald J. Trump’s campaign pledges was increased in the last couple of years. The policy measures were implemented at a point in time, where the Congressional Budget Office (CBO) estimated output gap was already close to zero or even positive. Inflationary pressures however still remain at the lower bound of the FED’s symmetrical 2% target.

Fiscal policy legislation, such as the “Tax Cuts and Jobs Act of 2017” helped to enhance the economic development by reducing the tax burden on corporations and individuals (under current law tax cuts for individuals will fade out until 2027). Although consumer spending contributed substantially to GDP growth, repatriation flows of corporate profits held overseas stayed somewhat muted and where mainly used to finance stock buybacks. Federal spending is likely to rise over the next decade as a result of the aging population and rising costs of health care.

The average yield on total interest-bearing debt has risen to 2.58% on Feb. 28th, 2019, from 2.35% a year ago. As real GDP growth is likely to slow in the near future (CBO estimate for 2019 is 2.3% vs. 3.1 % in 2018), the budget deficit forecast for the current fiscal year is estimated at around 900 billion US-$ and increasing to over 1 trillion beginning in 2022 or between 4.1% and 4.7% of GDP, if current legislation stays in place. Although this is not a sustainable path in the very long run, it should not be an immediate reason of concern either. However, currently there is no common position on a solution as the political parties persist in their viewpoints.

Trade talks continue between USA and China and the European Union

In the upcoming months we will see how trade talks with China and the European Union evolve and to what degree the slowing global economy will affect the United States. Policy measures on infrastructure investments remain currently on a partisan level and it is too early to estimate whether a bipartisan solution on this topic can be agreed on before the presidential election in 2020. This will be an ongoing source for volatility, as these developments will be key for the global growth outlook and risky assets.

Current view on interest rates and the US-Dollar

After the Fed hiked rates during the last years to 2.25% (lower bound) and 2.5% (upper bound), we have a more conservative rates outlook going forward for the Fed. The weakening global outlook already pushed the Fed to delay further tightening steps and recent news flow also indicated a potential further reduction of the central bank balance sheet could be delayed into the future.

Concerning the US-Dollar president Trump is pushing for a weaker US-Dollar. But in times of a weakening global growth outlook and relative to Europe and Japan attractive yield levels, US-Dollar has potential to attract further inflows.

Investments in US-treasuries

An investor that is looking for an efficient way to invest into US-treasuries might find the ESPA BOND DOLLAR compelling. The ESPA BOND DOLLAR is a fund that has a 30 year track record in investing in US Treasuries since 13th March 1989, celebrating its 30th anniversary 2019.

Clients investing in the fund buy a US Treasury enhanced strategy with active management of US-DOLLAR Duration and US-DOLLAR exposure. Additionally the fund has the possibility to add investment grade sovereigns, quasi-sovereign and supranational exposure up to a maximum of 25% of the fund. This enhancement should create an interesting pick-up, but keeping a high level of solvency within the portfolio. The client’s exposure is US-DOLLAR – the US-DOLLAR-exposure is not hedged to EUR.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.