According to the latest data, the economic environment in the US remains favourable in spite of the interest rate hike. The economy seems to continue growing strongly, while inflation is increasingly falling towards the central bank’s target of 2%. The only question is how long this scenario can be maintained and, above all, how the Federal Reserve will react today at its first of a total of eight FOMC meetings this year.

Please note: Prognoses are no reliable indicator of future performance. An investment in securities contains risks in addition to opportunities.

👉 What will you read in this article?

What impact do the higher key-lending rates have?

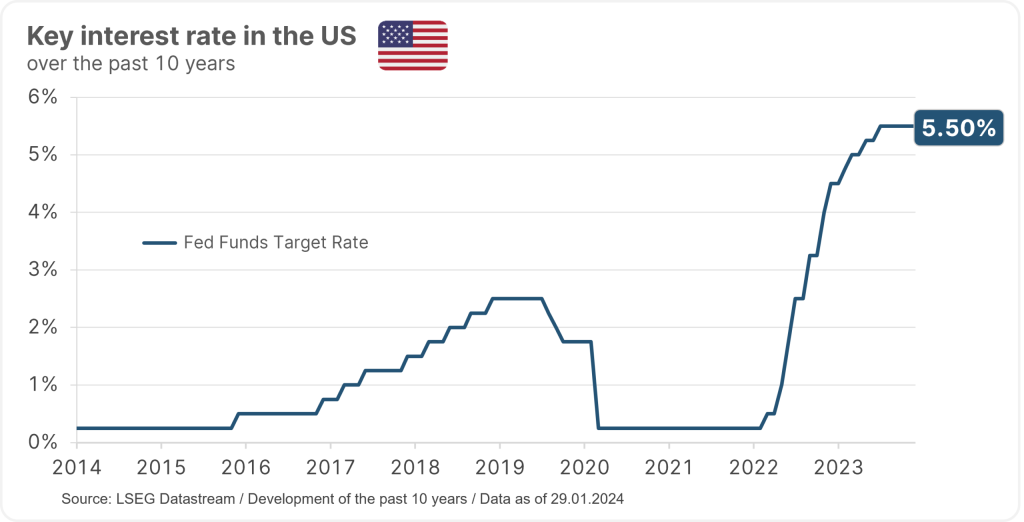

Just a year ago, many analysts feared a recession. In the past, such rapid and significant key interest rate hikes like we have seen in the recent two years in the US had already caused an economic downturn. However, with the economy remaining robust and therefore increasingly arguing against a recession, the scenario of a “soft landing” became more and more likely. In this scenario, inflation falls towards the central bank’s target of 2% without the economy slipping into recession.

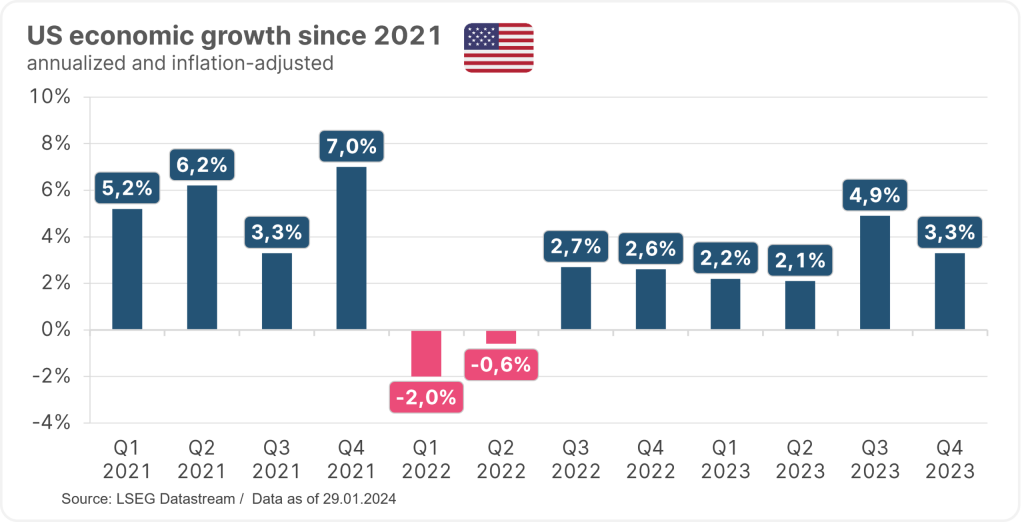

That being said, the US economic data from the past two quarters would be more in line with a “no landing” scenario, i.e. falling inflation, while economic growth remains robust despite the interest rate hikes. At the end of 2023, the US economy grew by a surprisingly considerable 0.8% net of inflation, i.e. by 3.3% on an annualised basis. Adjusted and annualised gross domestic product (GDP) growth had already been at a strong 4.9% in Q3. At the same time, core inflation, based on the respective previous quarter and annualised, was at 2% for the second quarter in a row.

Please note: Past performance is no reliable indicator of future developments.

A closer look at the labour market shows the first signs of weakening demand though, including a decline in job vacancies in the USA. Interest rate hikes usually come with a delayed – and also not always identical – effect on the economy. It is therefore quite possible that the more restrictive monetary policy will ultimately subdue economic growth. We are therefore probably in a transition phase from high to low growth.

What is the US central bank doing today?

This brings us to the question of how the US Federal Reserve is reacting to the current environment. Today, Wednesday, the world’s most important central bank is due to make the first of a total of eight interest rate decisions in 2024. Even though the market is expecting a number of interest rate cuts this year, the Fed funds rate is very likely to remain unchanged at today’s meeting. Please note: past performance is no reliable indicator of future value developments.

Please note: Past performance is no reliable indicator of future developments.

The upper end of the range for the Fed funds rate is currently 5.5%. The fall in inflation in recent months has also changed the prevailing market theme. Whereas previously there was discussion about the level to which rates should be raised, the focus is now on when they will be cut again.

Fed funds rate: a tightrope walk

In his speech after the FOMC meeting, Federal Reserve Chairman Jerome Powell will most likely attempt to argue against early and sharp interest rate cuts. The general rule is that cutting interest rates too early increases the risk of a second wave of inflation, while cutting interest rates too late harbours the risk of a recession.

When interest rates will be cut again depends not only on inflation, but also on the expected impact of interest rate hikes on economic growth. As economic growth and the labour market remain robust, the central bankers’ confidence of inflation remaining at 2% is on the lower side. The central bank will therefore proceed cautiously with interest rate cuts and keep its monetary policy restrictive for the time being.

Favourable environment on the equity market

Meanwhile, the equity market has reached new highs in the past two weeks, tying the previous highs from the end of 2021. Remarkably, the driving factor was not the hope of interest rate cuts by the Fed. In fact, the key interest rates priced into the market have actually risen recently. Rather, the good economic data from the USA has also boosted the sentiment on the equity market.

Whether the first interest rate cut in the US will come at the end of the first quarter, in the second quarter or in the third quarter no longer seems overly relevant. Inflation-fighting, i.e. hawkish, statements by Federal Reserve Chairman Powell should therefore have no lasting negative impact on the equity market. At the same time, there are also current risks: last week, oil prices rose sharply following a missile attack on an oil tanker in the Gulf of Aden. The increased risk of escalation in the Middle East could also affect the positive market sentiment.

Please note: an investment in securities contains risks in addition to opportunities.

Conclusion

Even though the market is expecting the US Federal Reserve to cut key interest rates this year, everything is likely to remain the same for the time being, at least at today’s FOMC meeting. Federal Reserve Chairman Jerome Powell is likely to be rather cautious with regard to initial interest rate cuts. At the same time, this should not weigh too heavily on the equity market, given that the robust US economic data in particular has recently supported the markets. Despite the positive market sentiment, however, the geopolitical risk associated with the conflict in the Middle East remains a factor.

More articles on this topic 👇

No Posts Found

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.