Markets recover after US Congressional election results ease tension

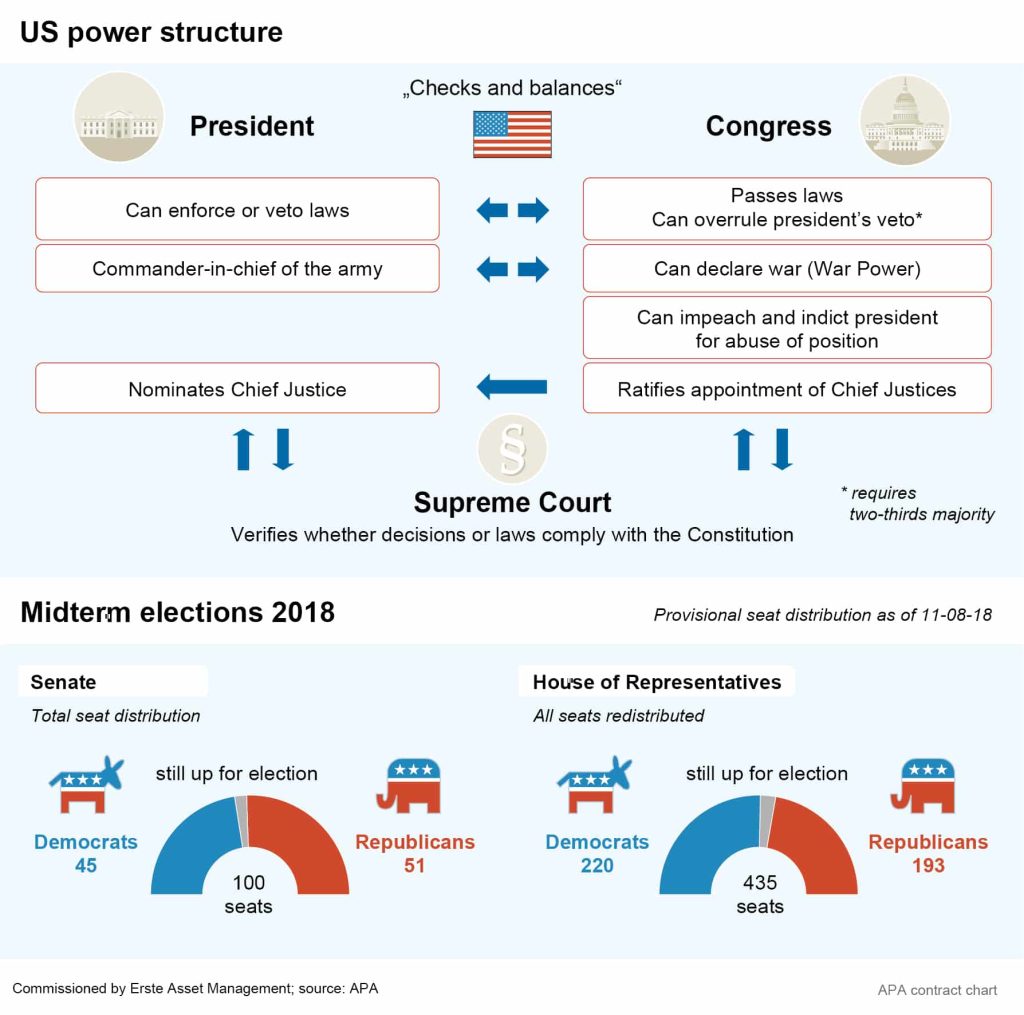

The outcome of the US Congressional election on Tuesday has caused some relief in the international financial markets. In the election, the Democrats won back the majority in the House of Representatives, the lower chamber in the US Congress, while the Senate remains in Republican hands.

Congress is the supreme legislative body of the United States and consists of two chambers, the House of Representatives and the Senate. Parliamentary work takes place through the interaction of the House of Representatives and the Senate, with the entire Congress being the government’s opponent in accordance with the Constitution.

The results of the US Congressional election were as expected. According to analysts, this takes a lot of uncertainty out of the markets, which investors accordingly acknowledged with new entries, causing a 2 per cent rise in the leading US indices on Wednesday. Prices also recovered in Asian and European stock markets following the election. The US dollar, on the other hand, lost some ground against the euro, which temporarily climbed to just under 1.15 dollars on Wednesday.

US bond markets did not show much movement on Wednesday, although yields for medium and longer maturities pulled back a little. This is due to US President Donald Trump’s now somewhat less solid position in Congress. As the House is now dominated by the Democrats, the market expects a tighter rein on budgetary and fiscal policy. This could conceivably slow or halt new fiscal impulses, which in turn could not only slow economic growth in the country, but also the speed of the Fed’s interest rate hikes in the medium term. This outlook puts pressure on US bonds, reducing yields.

No trend reversal expected in US economic and interest rate policy

However, even though Trump’s policy is coming under stronger democratic control, analysts do not believe that there will be a major turnaround in US economic and foreign policy. With regard to the US’s international trade conflicts, Trump is likely to continue as before. According to experts, he won’t have to face much resistance, as there are supporters of his protectionist tendencies in the democratic camp – especially in the conflict with China.

The US Federal Reserve policy is not expected to change much after the election either: according to experts, the Fed’s course will probably remain unaltered. At the interest rate meeting on Thursday evening the Fed left the key interest rate unchanged, as expected, but signaled a further hike for December. The last increase took place in September, with the interest rate range was raised to 2.00–2.25 per cent.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.