Asia’s cities are growing and growing, presenting the urban infrastructure with great challenges. Thanks to technical progress, the relevance of environmentally friendly transport solutions is on the rise. Investors can benefit from this trend, as Gabriela Tinti points out in an op-ed article for the magazine “Global Investor”.

The population of Asia has been experiencing rapid growth, especially in urban areas. The rising degree of urbanisation presents urban and infrastructure planners with new challenges on a global scale. In 2015, about 53% of the world’s population was living in cities. In other words, every other person lives in a city. At 46%, Asia’s degree of urbanisation is below average – despite its high number of mega-cities with high population density. China’s metropolitan areas record an influx of about 13mn people from rural regions every year.

Ten times more cars in China by 2035

More people by default mean bigger challenges to infrastructure. The strong growth of mobility leads to an increasing over-use of traffic infrastructure with dramatic consequences for the environment. The International Energy Agency (IEA) expects about 1.7bn passenger vehicles globally for 2035 (IEA, 2013). The density of passenger cars in India should triple, while it should quadruple in Indonesia and rise by the factor of 10x in China.

The expansion of infrastructure in public metropolitan and long-distance transportation is therefore the focus of Asian governments. In addition to environmental aspects, there is also economic interest: the idea is to cut the dependence on crude oil imports by installing environmentally friendly means of transport.

E-buses and e-taxis becoming more important

The relevance of electromobility is rising on the basis of these concepts, as it is being employed in metropolitan transportation. Especially in China, e-buses are being tested and used across numerous cities. According to estimates by IEA, about 36,500 e-buses were operational in China at the end of 2014. But not only China is well-disposed towards environmentally friendly metropolitan transportation. E-buses are in use across numerous Asian regions, among others in Bangalore (India), Bonifacio (Philippines), and in Kuala Lumpur (Malaysia), where the first Asian “Bus Rapid Transit Programme” has been launched. Electric taxi fleets, tested for the first time in Shanghai, are also already in use in various cities.

Multi-storey car parks serving as e-car rental stations

The city of Hangzhou with about 8.8mn inhabitants is located about 200km to the south-west of Shanghai. Headed by the Chinese car manufacturer Kandi (ISIN US4837091010), the project “Self-driving Electric Vehicle Rental for Public Transportation in Hangzhou“, aimed at the introduction of electric metropolitan cars, was launched in 2012. The project stands for the combination of sustainability with electric motors, efficient usage on the basis of car-sharing, and space saved by mechanical parking facilities. The rental stations are what makes this project special. In mechanised multi-storey car parks, e-cars are stacked on top of each other on racks that look like car hoists while at the same time being charged. In the meantime, this concept has been expanded to Shanghai, Nanjing, Chengdu, and other cities in China as joint venture.

Fully automated driverless e-cars tested in Singapore

Almost nowhere in the world is the population density as high as in Singapore, with its 4.6mn inhabitants. Due to its limited surface area of 650 square kilometres and its highly developed infrastructure, Singapore is regarded as ideal laboratory to test electromobility. The National University of Singapore has been testing a fully automated, driverless e-car for use on urban streets. According to calculations by the university of Singapore, a fleet of 300,000 driverless taxis would suffice to guarantee that nobody had to wait more than 15 minutes for a car even during rush hour.

Super trains reaching speeds of up to 350 km/h

We seem to see the dawn of a new age not only in individual transport. In public long-distance traffic in Asia, massive investments have been made in the expansion of high-speed train routes in the past years in order to better link the rapidly growing cities via shorter travelling times. With a total of 22,000 kilometres, China has the world’s longest high-speed train network. All other countries combined do not even get close to that number. China also tops the list of the fastest scheduled trains at up to 350km/h. Thanks to technology transfers, China itself now holds enough know-how to construct its high-speed trains “in-house”. CRRC Corp Ltd (ISIN CNE100000BG0) has turned into a respectable competitor for established train manufacturers. China and CRRC will build the first high-speed route together with Russia for freight trains from Moscow to Kazan. The line is to become operational in 2019. Project costs are budgeted at USD 16.9bn.

Given its success, abundant domestic experience, and progressive technologies, CRRC and CRC have now started to look for more opportunities in the overseas markets, among them India, Malaysia, Singapore, Indonesia (Jakarta-Bandung high-speed railway, China-Laos railway), and many other countries. India is planning to build high-speed lines, and at 2,200km, the proposed Chennai-New Delhi route could become the second-longest behind Beijing-Guangzhou (2,300km).

Railless train

The development of a railless train, i.e. the ART, (Autonomous Rail Rapid Transit), by Zhuzhou CRRC Times Electric Co (ISIN CNE1000004X4), which has already launched operations in the province of Hunan on 2 June 2017, illustrates the innovativeness of Chinese companies. The 30m long e-train moves on rubber tyres instead of rails, can transport up to 500 passengers, and can reach a top speed of 70km/h. It selects routes on “virtual rails” with the help of built-in sensors.

Attractive stock exchange valuations

The infrastructure spending in Asia continues to grow at a faster pace than in the rest of the world. In the coming ten years, China wants to invest more than USD 18bn in infrastructure. A third thereof is earmarked for the transport sector*. Thus, China will account for 60% of worldwide infrastructure expenditure by 2027. India’s share will also increase during that period from 15% to 26%. Traffic/transport will account for the main part. Given the goal of expanding the rail network by 2,830 kilometres by 2018, this sector continues to offer good investment opportunities. The companies in the rail sector (H-shares) are currently traded at a P/E of 8.2x (2017e) and 7.1x (2018e), respectively. At 1x (2017e) and 0.9x (2018e), respectively, P/BV is also more attractive than for the MSCI China. From a longer-term perspective, a portfolio strategy that focuses on companies that benefit from infrastructure investments in Asia could pay off, provided a certain degree of risk appetite.

*) Source: Chinese government

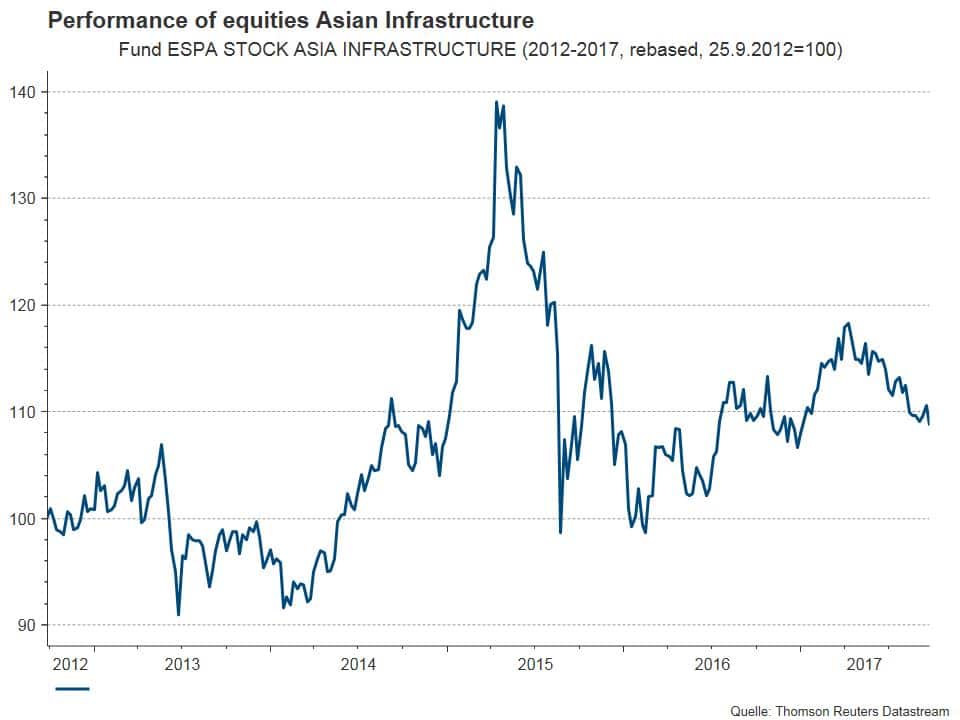

Calculated according to the OeKB method. The performance data take into account the management fee, but do not take into account the one-off load of up to 4.00% due at the time of issue nor other costs that diminish performance such as account and depositary fees. Past performance is not indicative of the future development of the fund.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.