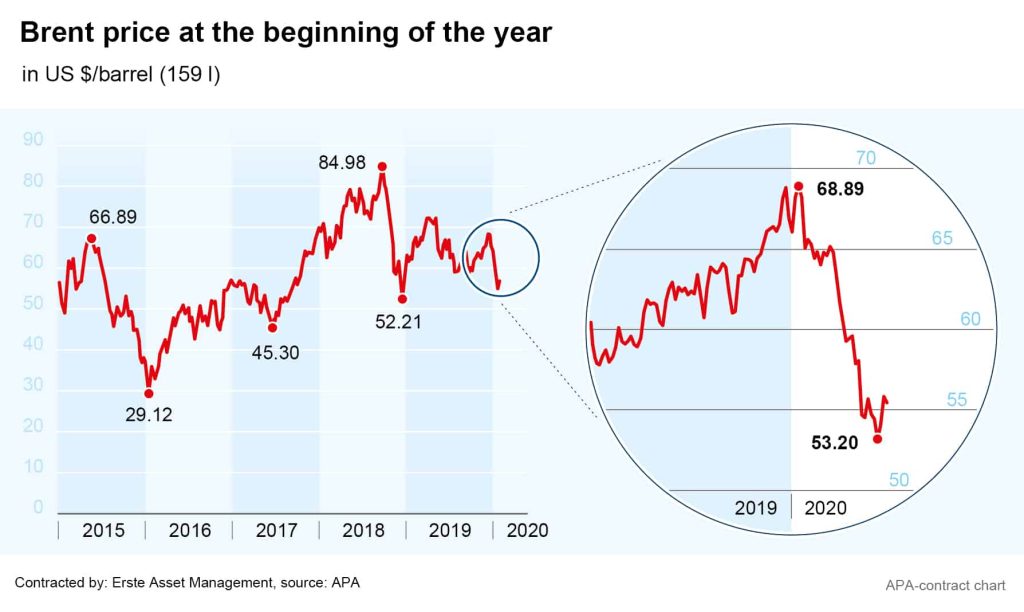

Oil prices came under significant pressure at the outset of the year. Last week, the price for a barrel of North Sea Brent crude dropped to as low as USD 54 after peaking at nearly USD 70 in early January. The main reason cited by the markets for the price drop was concern about the coronavirus’s impact in China. Fears are rising that the lung disease will affect the Chinese economy, lowering the demand for oil noticeably. An example of this was plants remaining closed even after the Chinese New Year celebrations in order to combat the spread of the virus. However, the situation in China is only one aspect of the current weak prices on the oil market.

Coronavirus is not the only challenging factor

In its latest monthly report, the US energy agency EIA significantly lowered its forecasts for oil demand. For Q1 2020, the EIA has reduced its expectations for daily demand by 900,000 barrels compared to its January estimate. It is interesting to note that only 320,000 barrels of this number is attributed to declining demand in China. This could indicate that a possible economic slump in the OECD countries (which are responsible for 500,000 barrels by which the forecast was lowered) is expected to be larger by comparison. The Organization of Petroleum Exporting Countries (OPEC) has also significantly lowered its forecast for global crude oil demand. In their view, demand in Q1 should average out to of 440,000 barrels per day less than previously forecast, according to OPEC’s monthly report.

Will the oil price support hold?

Against this background, an OPEC committee has recommended to its members and other OPEC+ cooperating countries to cut the agreed production volumes by an additional 500,000 barrels per day until the end of June. The additional reduction is to be decided at a meeting in Vienna in early March. However, there are early signs of increased resistance to the price stabilisation measures: Russia initially blocked the expansion of production cuts and announced that it would “scrutinise” the OPEC Committee’s proposal closely.

US oil reserves already grown significantly

It was only in December that important oil producing countries agreed to a stronger cutback of half a million barrels per day. It is questionable whether a new agreement can be reached in March, particularly as the US, gaining more and more significance as an oil producer outside OPEC+, continues to communicate no-holds-barred production. The responsible US authority has reduced its forecast for growth in global demand for oil this year by 300,000 to one million barrels per day. However, this is likely to lead primarily to increased build-up of reserves and thus to greater pressure on prices – which is also suggested by the official US crude oil inventories, which surprisingly grew twice as much as expected last week.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.