In less than two weeks, Donald Trump will be sworn in as the 45th President of the United States of America for the second time since 2016. Trump’s return to the White House and his possible plans are already causing a stir. This week, for example, the US president-elect made some seemingly abstruse demands, such as that Denmark should sell Greenland to the US and that Canada should be incorporated into the United States as the 51st federal state.

While Trump’s foreign policy ideas are already causing international unrest, the markets are eagerly awaiting the economic policy decisions with which he will start his second term in office. The main focus here is on the Republican’s planned tariffs. Market players fear that the tariffs could lead to new trade wars, but also to a rise in inflation. What else can be expected from Trump’s policies?

Higher tariffs to reduce the trade deficit

Trump had already announced extensive tariffs during the election campaign. He argues that US companies would then produce more in the US again and thus create jobs. Right at the start of his term of office, Trump wants to impose high import tariffs on all goods from Mexico and Canada, as well as additional tariffs on goods from China. According to a report by CNN on Wednesday, Trump could declare a national economic emergency in order to create a basis for the declaration of new tariffs.

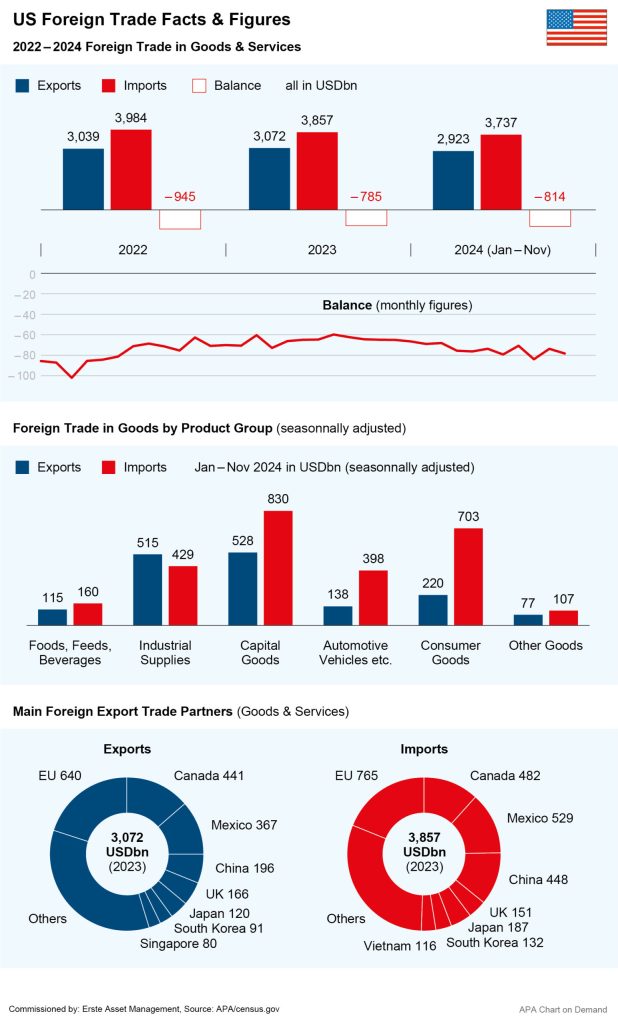

Trump wants to use the tariffs to combat the chronically high trade deficit of the USA. It is a thorn in the side of the president-elect that the USA imports more than it exports in its trade with many trading partners. The US trade deficit has continued to grow recently. According to the US Department of Commerce, in December the value of imports exceeded that of exports by 78.2 billion dollars. Trump had already imposed punitive tariffs on many countries during his first term in office, but this did nothing to change the high trade deficit.

But Europe is also affected by the tariffs. Trump threatened the EU with tariffs if it did not import more oil and gas from the US. But Europe would already be affected by the tariffs on Mexico, Canada and China, and here in particular the German automotive industry. Many manufacturers and suppliers use Mexico as a low-cost production location and also serve the US market from there.

Both the European and US automotive industries would be affected by Trump’s tariff plans. Image source: unsplash

But the US manufacturers themselves could be hit even harder than the German automotive industry, as they source supplier parts from Mexico. According to Trump’s announcement, car parts will also be subject to the new tariffs. According to industry sources, German carmakers are therefore hoping to join forces with their US competitors to dissuade Trump from his tariff plans.

Trump’s plans could provoke a trade war

Experts also fear that the high tariffs could provoke retaliatory measures by the affected countries and thus trigger trade wars. China, in particular, could strike back, especially since Trump has promised tariffs of up to 60 percent on Chinese imports. Beijing is already preparing for a tough confrontation with Washington and has already made it clear that it is capable of striking back.

When the US government announced new chip sanctions against Chinese companies in the autumn, the Chinese reacted unusually harshly. Beijing not only launched an antitrust investigation into the US chipmaker Nvidia. The Chinese government also banned the export of essential minerals to the United States that are essential for chip production. According to insiders, China’s top politicians are now also considering depreciating the yuan in response to looming US tariffs.

The Chinese government is already planning measures to prepare for the impending US tariffs. Image source: Yue Yuewei Xinhua / Eyevine / picturedesk.com

Europe could also be affected by the trade conflict with China. According to experts, Beijing could try to sell more cheap Chinese products on the European market, thereby putting German industry under pressure. In addition to the already simmering dispute over Chinese e-cars, this could also lead to new conflicts between Brussels and Beijing.

Is there a risk of a comeback of inflation?

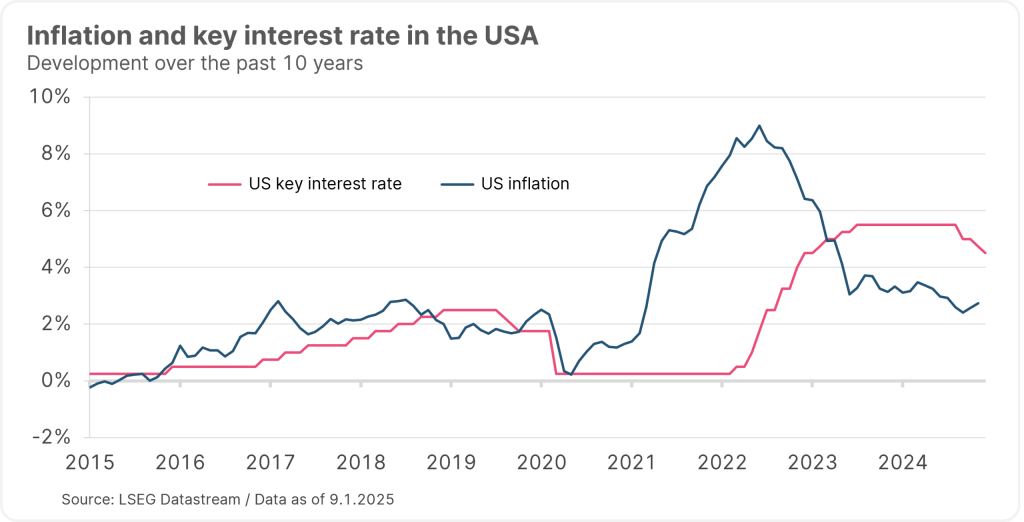

Economists also warn that high import tariffs could also drive up consumer prices in the US. US companies cannot replace products they source from Canada, Mexico or China with domestic production overnight. The higher costs incurred for the goods due to the import tariffs are likely to be passed on to consumers by companies, thus fuelling inflation again.

This would reduce the maneuvering room of the US Federal Reserve for the interest rate cuts hoped for by the stock markets. The central bank itself had recently signalled a slower rate of interest rate cuts. The Fed now expects to make only two interest rate cuts of one-quarter percentage point each between now and the end of 2025. This is half a percentage point less than it had expected as recently as September.

Current economic data is pointing upwards

In any case, current US economic data is pointing upwards, but this also makes interest rate cuts appear somewhat less likely. The upturn has recently been driven primarily by service providers, while industry has weakened. The ISM index for service providers reported on Tuesday was 54.1 points, above the 53.5 points expected by economists.

The economic barometer thus signalled a surprising brightening of sentiment in the services sector. In addition, the demand for personnel in the USA has risen unexpectedly. The number of vacancies rose more strongly than expected at the end of December to around 8.1 million, according to the US Department of Labor.

US economy continues to boom

The US gross domestic product rose by an annualised 3.1 per cent in the third quarter, as the US Department of Commerce announced in December. During the summer months, the economy was driven by private consumer spending, which increased by 3.7 per cent, somewhat more than initially calculated. The International Monetary Fund (IMF) has also raised its growth forecast for the USA recently and expects a plus of 2.8 per cent for the past year.

Winners and losers from an industry perspective

The US economy is starting the new year on a positive note. However, Trump’s first months in office could bring challenges not only for trade relations but also for individual industries. The pharmaceutical sector is likely to suffer not only from tariffs on imported components. Trump wants to tackle high drug prices and has also named the self-confessed anti-vaccination activist Robert F. Kennedy Jr. as his health secretary.

On the other hand, the oil industry can hope for support. Trump wants to increase US oil production and boost the industry. Armaments companies could benefit from Trump’s planned spending increases in this area. On the other hand, some economists are concerned about the potential national debt that Trump’s planned tax cuts and spending could entail.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.