Once a month the Investment Committee of Erste Asset Management convenes in order to discuss the medium-term market outlook. We are going to start a new blog, where we will report on what drives our investment professionals and what risks they see.

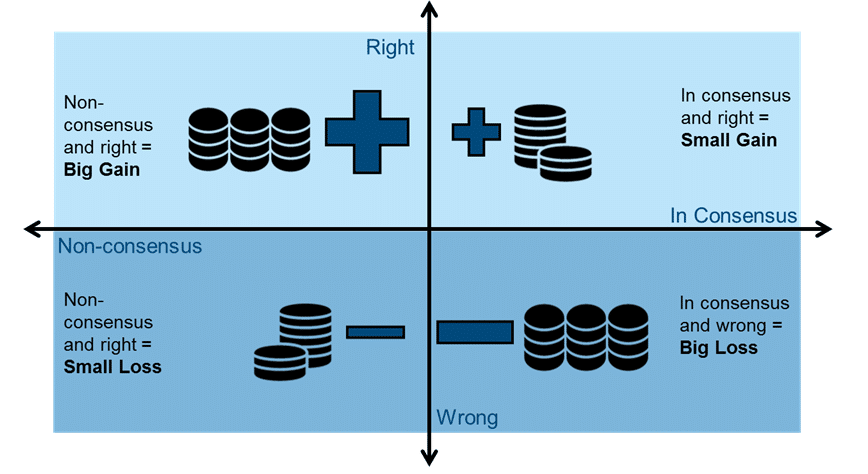

A quick word on the structure of the Investment Committee. Our idea is based on the so-called market consensus, i.e. the expectation(s) of the market. Opportunities and risks of an investment ultimately hinge on market expectations and the opinion of the fund manager with regard to those expectations. The following chart summarises the various scenarios: if the market expects something to happen (N.B. in fund management jargon, an event is “priced in”) and the fund manager does so, too, the return potential of an investment that bets on this event is limited. However, if the fund manager holds a different opinion and is right, the return potential is high.

The current market expectation – positive for risky assets

At the moment, the market has a very positive environment for risky assets such as equities and high-yield bonds price in.

- The global economy is growing. All countries covered by the OECD (i.e. the industrialised world plus emerging markets) are showing positive growth rates. This generally supports equities.

- Inflation is very low, and no significant acceleration of inflation is expected for 2018, either. This gives the central banks room for manoeuvre to carefully raise interest rates, it caps potential yield increases, and also does not burden equity markets.

- The only fly in the ointment of this positive picture is the interest rate cycle in the USA and the developed world, which very recently has turned from extremely expansive to restrictive. The US central bank, i.e. the central bank of the world, is currently in a cycle of raising interest rates and is about to start reducing its balance sheet total. The European Central Bank (ECB) will soon announce the reduction of its bond purchase programme. In a phase of interest rate increases[1], equities on average yield lower returns than in a phase of rate cuts. But at the moment, the monetary policy is not yet restrictive and is not yet burdening the performance of equities. Also, the central banks are aware of the risk associated with interest rate increases and therefore act very carefully by communicating every step in advance in order to rule out (unpleasant) surprises.

We share the constructive assessment by the market

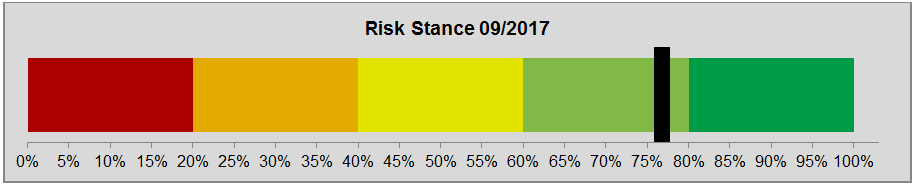

We basically share the positive assessment of the market and are positioned accordingly across our portfolios. For example, the average risk stance of our Investment Committee (consisting of 13 individuals) is easily established. It is clearly positive.

Why are we not more upbeat despite the aforementioned, positive picture? There are a few reasons:

- We are aware that our assessment is very close to the market consensus. Risky assets hold upward potential. However, the relative return potential is asymmetric and therefore indicates extreme return values as unlikely.

- Many economic indicators are elevated and have more downside than upside potential. A lower IFO or ISM index would not be a disaster at this point though.

- In the Eurozone, economic growth is currently high and broadly based; all countries, including France and the peripheral economies, are growing. The appreciation of the euro on a real effective basis, i.e. adjusted for inflation differentials as measured by a basket of currencies, of 7% since February should at least dampen the growth story in the Eurozone.

- Lastly, we can see more risks than opportunities for our outlook despite, or maybe because of, the positive picture. Among the risks that we have addressed are possibly negative effects caused by the tapering of the central bank balance sheets (quantitative tightening), an unexpected increase in inflation (the US central bank envisages higher growth for 2017, but expects the unemployment rate to remain roughly the same), and a more mechanistic Fed that operates less on the market in the wake of the newly to be appointed four (of a total of seven) Fed governors. The main upward potential that we have discussed hinges on the possible success of the Trump administration in implementing its comprehensive tax reform as planned.

Overall the Investment Committee continues to rate risky assets as positive despite the aforementioned risks.

[1] A phase of interest rate increases is defined as lasting from the first interest rate increase to the first interest rate cut.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.