The economic environment for the capital markets is subject to change as we speak. About one and a half years ago, the global economy shifted from recovery to boom, which was very advantageous for the markets. The features were strong, broadly based economic growth, low inflation, very supportive monetary policies, good earnings growth, and limited price fluctuations on the markets. We have now started leaving this best of all worlds (“Goldilocks scenario”) in more and more categories.

The falling prices on the equity markets at the beginning of February were largely due to the time-lagged reaction of inflation (rise), monetary policies (interest rate increases), and government bond yields (increase) to the significant economic growth. In order to be able to assess the market development, one has to answer three questions: is the currently strong economic growth likely to weaken in the foreseeable future; to what extent, at what speed, and how broadly are indicators changing (i.e. how many and in what countries); and, are there any additional positive or negative developments (protectionism, elections in Italy, stimulus in the USA)?

Growth: acceleration is over

The growth of the global economy is strong and broadly based. For 2018, we expect to see an inflation-adjusted growth rate of 3.5%. However, many leading indicators for economic activity are already at high levels. The start of their decline is therefore only a question of time. One example is the German business climate index (Ifo index). Having reached an all-time high in January, it dropped slightly in February. Something similar is also true for the purchasing managers’ indices for the manufacturing sector, which have fallen slightly in the Eurozone and Japan. The global economy will remain in the current boom phase (i.e. strong growth) for a few more quarters, and the transition to the decline phase is not yet foreseeable. However, the acceleration phase (increasing growth rates) is over.

Low unemployment rate

After the Great Depression in 2009, capacity utilisation was low, i.e. unemployment rates were high. The recovery and boom phase each came with a significant decline in the unemployment rate. In the meantime, the unemployment rate for the OECD region is down to 5.2%, i.e. the lowest value in decades. According to estimates by the OECD and the IMF, the developed economies will soon be producing at levels above potential (i.e. the output gap will turn positive).

Rising inflation pressure

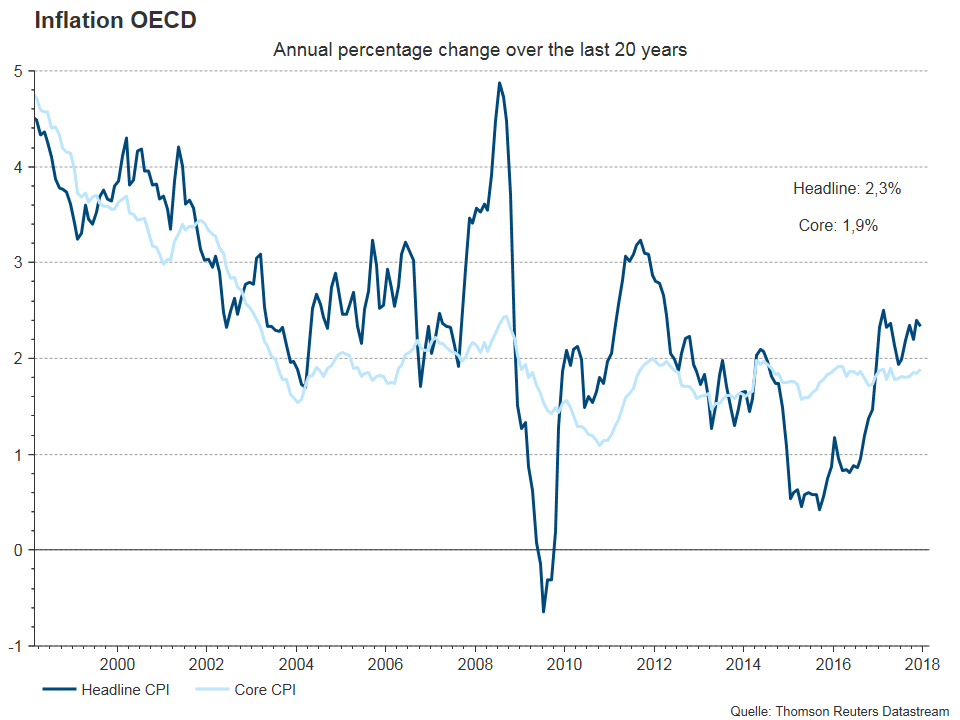

The rate of inflation is below the central bank target in many important countries. The time series illustrates the end of the falling trend as early as in 2015 (0% in September 2015 for the G-7). Since then, inflation has been on a slight increase (1.9% p.a. in December 2017 for the G-7). The low unemployment rates in conjunction with strong economic growth suggest a further rise. Indeed, the leading indicators for inflation are up. In the USA, the growth of average hourly wages increased in January. In Germany, the wage agreements in the metal sector suggest an increase in overall wages. In February, the price sub-component of the aggregated purchasing managers’ index for the USA, the Eurozone, and Japan reached its highest value since 2009, according to an initial estimate. The market prices reflect this development. The inflation priced into the bond yields for the coming ten years has increased in the USA from 1.20% in February 2016 to currently 2.12%.

Note: Past performance is not indicative of future development.

Central banks: conflict of goals

Given that economic growth has become increasingly self-supporting, the unemployment rates have fallen, and projections suggest an increase in inflation at ever-growing rates of confidence, more and more central banks have reined in their very expansive monetary stance. Key-lending rates have been increased, and central bank liquidity has been reduced, with the US Fed leading the way; it has raised the Fed funds rate to 1.25%-1.50% and cut central bank balance sheets.

Similar in relevance to the increase of key-lending rates, central banks now are confronted with two conflicts of goals that were of little importance until not long ago: inflation and full employment or financial markets stability; when markets become more fragile but inflation and employment rise, the central banks cannot suspend interest rate hikes tat easily anymore; and, inflation vs. government debt / financial repression; if key-lending rates / yields were to clearly rise above nominal economic growth, countries with high government debt ratios could come under pressure.

Credit environment and fiscal policies: supportive

Credit growth has stopped falling globally except in China. As for fiscal policies, the budget deficits are not being cut any more. Thus, two important stumbling blocks for economic growth are gone. In the USA, not only are taxes being cut, but a significant increase in government spending is also in the pipeline, which is new. The budget deficit could rise above 5% in terms of GDP next year.

External environment: twin deficit in the USA

The recovery from the Great Depression was accompanied by a reduction of external imbalances. Important current account deficits have fallen (USA from almost 6% in terms of GDP in 2006 to 2.4% in 2017; Spain from almost 10% to a surplus of 1.9%). The question at the moment is how significantly the fiscal stimulus in the USA is expanding the current account deficit via an increase of import demand. The USA is facing a twin deficit (high budget and current account deficit). Generally, as long as economic growth remains strong and key-lending rates are not raised substantially, the risk for countries with elevated twin deficits remains comparatively low (Brazil, India, South Africa, Turkey).

Politics: protectionism

In the political arena, the protectionist tendencies are becoming more abundant. The increase of import duties on washing machines and solar panels could herald a new trade conflict – a trend strengthened by the recent announcement of possible import duties on aluminium and steel.

New environment for the financial market

- Economic indicators suggest sustainably strong, broadly based growth. As a result, the estimates of high earnings growth and low default rates remain intact. The next economic phase after the current boom, however, will be the decline. A recession, with the traditional valuation ratios (PE ratio) of equities falling sustainably (i.e. sustainable price declines), is not foreseeable at this point.

- Key-lending rates (higher), central bank liquidity (lower), and yields (higher) have a lagged response to the strong economic growth – although only in a few (albeit important) countries / regions (USA, Eurozone, UK, Canada) and at a low pace. Yields will be fluctuating around an increasing yield trend, which means they may also be temporarily falling. At the moment, the positioning of investors (strongly short, i.e. expecting yield increases) suggests a countermovement (i.e. falling yields).

- Surplus liquidity has been an over-arching topic since the 2000s. It was partially responsible for the decline in the price of money (i.e. interest rates). The increase of the budget deficit in the USA, the reduction of central bank liquidity, and the significant improvement of capex suggest a decrease in surplus liquidity. However, we are not yet at the point where the private sector is competing with the public sector for the scarce good of capital.

- The uncertainties about whether the rise in inflation ends at the respective central bank target and above what level of interest rates and yields economic growth will be dampened have increased. This suggests a slightly higher risk premium for risky asset classes.

- The conflicting goals of the central banks between inflation, financial markets stability, and the momentum of government debt push up uncertainty (i.e. higher risk premium).

- Transitional phases such as the current one from Goldilocks to normalisation are usually accompanied by elevated volatility. It is important to keep one’s nerves here.

- Risk management concepts are endogenous. Falling prices cause an increase in volatility. But elevated volatility also causes falling prices.

- The falling share prices might therefore be due to increased yields (i.e. future earnings are discounted at a higher rate), the higher rate of uncertainty (i.e. future earnings are discounted at a higher risk premium), and elevated volatility (which exacerbates falling prices). If the rising trend for yields ends or is interrupted, risky asset classes such as equities may find support.

- The link between government bonds and equities has changed. When government bond yields increase and share prices are falling as a result, the bonds fail to offer the function of safe haven. Asset allocation becomes more challenging.

- Generally, we can see a changing investment scheme. More specifically, investors are shifting from carry to valuation (N.B. this refers to the four ways of earning money: 1) search for yield (carry); 2) momentum; 3) speculation; and 4) valuation (return-to-mean).

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.