Comfortably making return on the money market via interest? A thing of the past. Interest rates will remain low in the foreseeable future. Are there any alternatives? Companies that regularly pay out some of their profits as dividends to their shareholders are a substitute for interest income, which currently does not exist. If you also attach importance to principles of sustainability, you can sort of reap “two dividends” with the ERSTE RESPONSIBLE STOCK DIVIDEND fund.

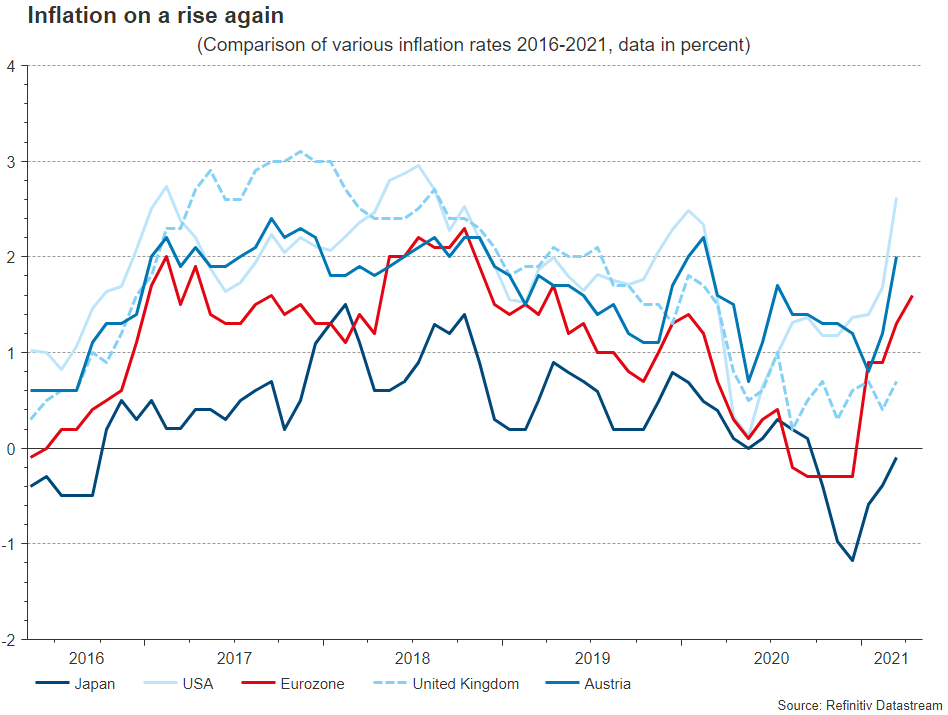

The phase of low interest rates that has been going on for years on the financial markets seems to continue, as has been supported by the most recent statements from the important central banks, i.e. the US Fed and the European Central Bank (ECB). Even though inflation expectations have increased on the back of the re-opening after the pandemic, necessary measures will continue to be taken across the globe to ensure that the economy comes off the ground again. This means that nobody really needs high interest rates at this point – countries with high levels of debt (not only due to corona) the least. However, if the central banks are firing on all cylinders, the risk of an overheating economy increases. It remains to be seen how well the banks straddle the necessary stimuli and the return to normalcy in the coming years.

Source: Datastream

Despite these adverse conditions for investors looking for yield, the savings ratio in Austria remains enormously high. Those who leave their money in a savings account cannot offset rising inflation, not by a long shot. Instead, if your money is in a savings account, you are likely to lose purchase power in the foreseeable future. – Unless you find an alternative, like dividends: by buying the shares of a company, you become a co-owner and benefit from profits, but may incur losses in less profitable times. This means that when buying dividend shares, one has to take into account the share price risk.

In a long-term analysis, equities perform very well. However, investors have to be aware of the volatility that is a characteristic feature of stock exchanges; share prices can fluctuate both ways. If you invest some of your money in shares, you should have a long investment horizon in order to be able to recover possible losses. That being said, losses offer a good opportunity to buy at lower prices.

The number of shareholders is on the rise

We are happy to see that the number of shareholders and fund investors has increased significantly. 57% of adults up to the age of 29 are well-disposed towards investments, which is significantly above the 42% across all age groups. This is based on a change of heart among Austrians: five years ago, the percentage was drastically lower at 29% of people taking a positive view on financial investments, as a study by the Association of Austrian Investment Companies within the context of the World Fund Day 2021 (only in German) shows (see the German blog post: Investigation of fund associations as part of World Fund Day 2021). More and more investors are interested in the risks and benefits of funds and have had a positive experience in recent years; especially as they are turning the risks of price fluctuations into an advantage by investing in fund savings plans (s Fonds Plan).

Note: Depending on the performance of the investment fund, the performance of an s Fonds Plan will differ from that of a single investment (higher or lower). A loss of capital is possible in both cases.

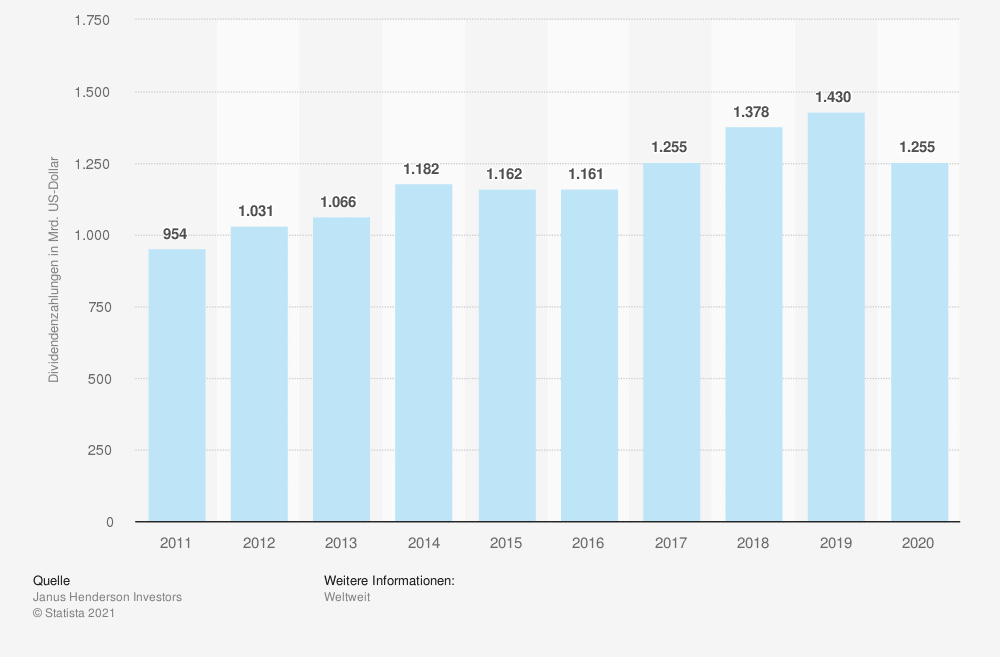

Dividend shares can help investors compensate for the lack of interest income in their portfolios. They are also a good way to diversify the risk of equities. Companies that pay out regular dividends are financially sound and generate stable sales, often over many years. Within their sectors, they often hold a strong market position – after all, they have to be able to afford a dividend payout. The following chart illustrates how important dividends have become to the generation of income and thus wealth: the total amount of dividends paid out globally has increased by more than a third since 2011.

Total amount of dividends paid out worldwide from 2011 to 2020 (in billions of USD)

Sources: Statista / Janus Henderson Investors

Due to the pandemic, many companies had to suspend their dividend payments last year. This year, the outlook is more positive: there is a certain need to recover previously unpaid dividends. The increasing re-opening of the economy comes with a healthy dose of optimism. The company results for Q1 2021 were largely above expectations, and the outlook for the coming quarters is positive. However, the conditions differ significantly between sectors. For example, the banking authority is keeping a tight rein on the banks, and some sectors still suffer from the effects of the pandemic, e.g. tourism and aviation.

Attractive dividend yield with ERSTE RESPONSIBLE STOCK DIVIDEND

It all depends on what kind of dividend shares the investor has in their portfolio. If you have neither the will nor the time to scrutinise dozens or hundreds of companies, you should leave the selection of suitable dividend shares to the experts of investment companies.

The ERSTE RESPONSIBLE STOCK DIVIDEND is a good choice in this segment. The dividend yield (i.e. expected dividend divided by current share price) of the currently 49 invested companies is 3.9%. The majority of the dividend income goes to the fund shareholder. The next dividend payout is scheduled for 1 June. The fund aims at a payout yield of 3%. The fund focuses on companies with attractive dividend payouts and with a pioneering role in the ESG arena. We take into account ethical aspects in the selection process of the shares.

Conclusion

Interest rates will not be attractive for a while. Investors wanting to outsmart inflation should think about dividends and dividend shares. The combination of dividend shares with a selection process that takes into account ESG criteria constitutes an interesting investment alternative. So there is a kind of “two dividends”.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.