A strong first half of the year is coming to an end on the stock markets. In addition to the already familiar factors of inflation and key interest rates, the trend topic of artificial intelligence (AI) came into focus. Especially the shares of some companies from the tech sector developed very positively.

In this interview, fund manager Tamás Menyhárt looks back on the past six months and tells us what has to happen for 2023 to end as happily as the first half of the year did.

With the banking crisis in the USA in March, some already saw a new global financial crisis approaching the market. Since then, however, the broad market has developed well. What do you see as the reasons for the current positive mood?

The most important factor in the market’s resilience was that both the Fed and the US Treasury responded very quickly to the unfolding crisis. The measures that were put in place have so far proven sufficient to stabilise confidence in the US banking system. While the troubled banks were by no means small, they were still regarded as regional players that clearly made mistakes in risk management.

There are several arguments for the generally positive sentiment this year. The most important reason is that inflation rates started to fall, which should eventually lead to an end of the monetary tightening cycle. The Fed recently paused after having raised interest rates ten times in a row, but still expects a few more this year. Other major central banks, such as the ECB and the Bank of England, are still in the process of raising rates

US inflation has peaked 12 months ago, and has been on a downward path ever since. Source: Refinitiv Datastream, Development of the past 10 years. Note: Past performance is not a reliable indicator for future performance.

Many investors are looking eagerly at the inflation trend. Have we already passed the high point of inflation?

We are not out of the woods yet, and there is a tail risk of a further uptick in inflation and hawkish central bank actions to continue for longer than expected. But overall, the most likely scenario is that inflation has peaked last year, and that we are approaching levels where central banks will not need to tighten further.

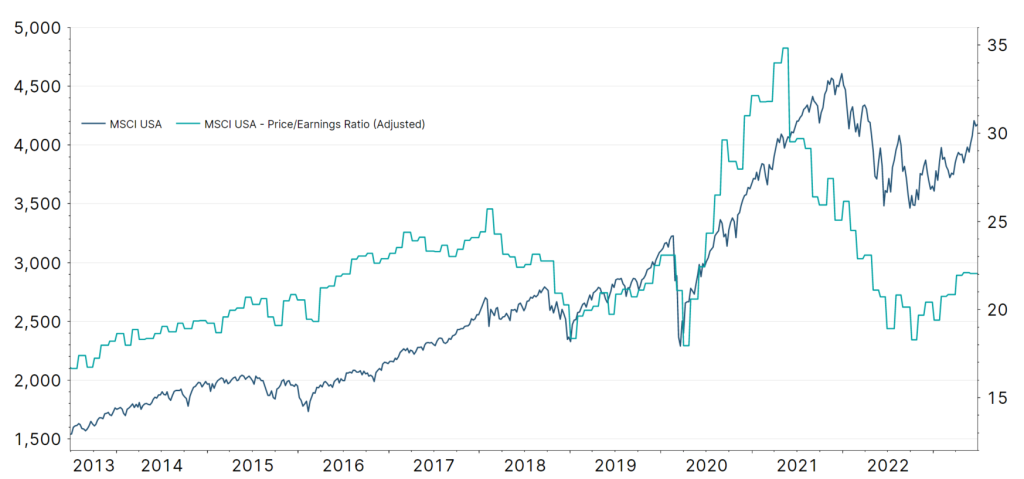

The level of interest rates set by central banks affects the level of risk-free government bond yields, which on the other hand correlate negatively with valuations of risky assets like equities. Simplified, this means: If interest rates rise, the valuation level on the stock market tends to decline – equities and their prices fall.

Why did the interest rate turnaround have such a negative impact on share prices in the previous year?

Last year`s negative stock market performance was almost entirely explainable by the compression in multiples like the P/E-ratio (=stock price divided by earnings per share).

Investors demanded a higher earnings yield in light of higher returns offered by safer bonds. This year, the inverse holds true. As market participants already price in lower interest rates in the future, stock valuations have expanded, even amid a mediocre earnings environment.

Important to mention is also the low level of stock market volatility. The VIX index, which measures the implied volatility of the S&P 500 index, has declined to its lowest level since the pandemic. Low volatility not only boosts confidence of stock market investors, but also leads to buying from systematic investors, thereby providing the market with additional demand.

Nevertheless, the risk of a possible recession continues to hover over the financial markets. In your opinion, is this risk adequately reflected in the current prices?

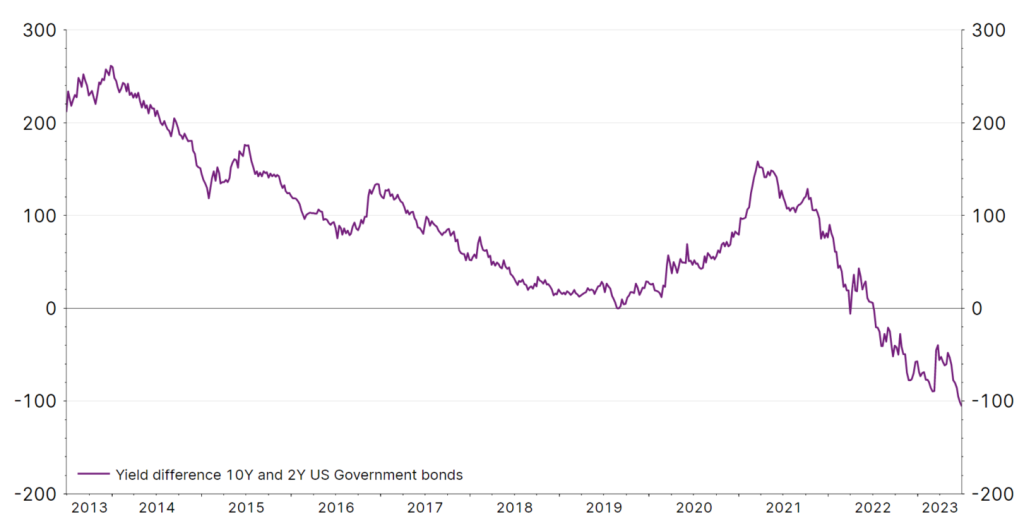

Since the start of the Russian aggression, which brought with it a spike in energy prices and exacerbated the already existing inflation-problem, recession fears have been a permanent feature of market activity. The yield curve in the US – an indicator which has predicted past recessions with high accuracy – has been highly inverted for a while now, highlighting the validity of recession concerns.

The difference between 2- and 10-year yields in the US has been negative over the last year. In the past, this usually pointed towards a coming recession. Source: Refinitiv Datastream, Development of the past 10 years. Note: Past performance is not a reliable indicator for future performance.

Despite some recession indicators flashing red, the US and Europe have so far been successful in avoiding a hard landing (= harsh recession). Also, while most economists agree on a high probability of a recession occurring, there is much debate around both the timing and the severity of a future economic contraction.

The significant reversal in oil and gas prices since last summer has increased the chances of a so-called soft landing, a scenario which ranges from a mild recession to a slowdown in GDP growth. As the expected start date of a recession gets pushed out continuously, investors regained some comfort and financial markets volatility declined.

Recession yes or no – what do market expectations currently say?

Currently, markets price in a combination of a soft landing and resultingly a less restrictive Fed going forward. In case of a significant economic contraction, central banks would turn outright dovish, but in such a case, the positive effects from multiple expansion would likely be outweighed by the negative effects of falling earning expectations.

Ironically, the biggest threat to current stock prices probably comes from an economy which surprises meaningfully to the upside. As of now, the S&P 500 is trading at around 20x forward earnings, which is above both its 5- and its 10-year average. At the same time, US real yields hover around their highest level since 2010. This combination is not sustainable, and in the end, one of the two will have to give. A too strong economy will force the Fed to keep raising rates, and current valuations are simply too high for that.

Both this and last year, price movements of major stock indices were largely driven by a contraction/ widening of the price-earnings ratio. Source: Refinitiv Datastream, Development of the past 10 years. Note: Past performance is not a reliable indicator for future performance.

In my view, the best market scenario would be if the economy ends up with a mild recession, which will for good put an end to speculation about further rate hikes. Then, the Fed can start easing policy in a coordinated manner, thereby providing support to equity prices. Under such an outcome, the positive valuation effect should outweigh a slight decline in earnings forecasts.

What is your general outlook for the second half of the year on the equity markets? Which topics could be important for the rest of the year?

Going forward, the most important driver will be the trajectory of inflation and as a byproduct, the level of interest rates set by major central banks. Risk assets will find support if the tendency of falling inflation and less aggressive monetary policy prevails, and if big economies manage to avoid a harsh recession.

Another thing to watch is whether the current hype around artificial intelligence proves to have further legs. Evidence of that has to come in form of an improved earnings outlook from companies exposed to this trend. As an example, Nvidia, one of the biggest semiconductor-producers, recently guided for group revenues to jump by more than 50% over the next quarter, a level far exceeding analyst estimates. Investors cheered the bullish outlook and drove the company`s market valuation to above USD 1trillion.

Nvdia is now the best performing stock year-to-date in the S&P 500 index, up almost 200% since the start of the year. Meta and Tesla rank 2nd and 3rd in terms of performance, both up more than 100%. As these stocks rank among the top 10 worldwide by market capitalization, their performance is of great importance to the stock market as a whole.

Stocks of Nvidia rallied, thanks to the company`s exposure to artificial intelligence. Source: Refinitiv Datastream, Development of the past 10 years. Note: Past performance is not a reliable indicator for future performance.

On the flip side however, market breadth has been fairly poor this year, as the rally was attributable to the incredible performance of a small number of large cap stocks. For a new bull market to be sustainable, we will need a higher number of stocks participating in the upwards trend. Over the last month, we have seen some positive developments on this front.

To sum up: Markets have gone a little ahead of themselves in terms of valuation. The biggest threat comes from a renewed uptick in inflation and yields. For this year`s good performance to continue, we need to see less restrictive central banks, positive earnings developments and higher market breadth. Then, the year 2023 might finish just as cheerful as the first half of it did.

Legal note:

Prognoses are no reliable indicator for future performance.

The companies listed here have been selected as examples and do not constitute an investment recommendation.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.