The financial environment has become slightly more relaxed since the beginning of November. This fact is manifesting itself on the market in the form of falling yields and rising share prices. From August to October, financial conditions were tightening continuously. This week, two indicators relating to the US economy in particular could provide clues as to the sustainability of this trend since the beginning of the month: retail sales and consumer prices.

Soft landing

The technically positive correlation between government bond yields and share prices is currently an important interplay. The rapid exit from the central banks’ zero interest rate policy represents an interest rate shock that has put pressure on the valuation of future company profits (i.e. share prices) and dampened economic growth.

In this context, indications of a so-called “soft” landing of the economy would constitute a positive environment for the financial markets. This scenario would come with a rapid decline in inflation, an only moderate rise in the unemployment rate, and a foreseeable cut in key-lending rates (i.e. in the first half of 2024).

Strong growth

As of the end of October, the initial estimate of real economic growth in the US for the third quarter was at 4.9% on an annualised quarterly basis (Source: Bureau of Economic Analysis, bea.gov). This is a very high number.

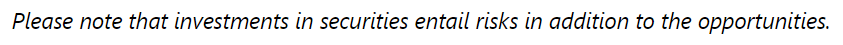

At the same time, the data on the still very tight labour market indicate only a slight easing. The unemployment rate has risen from its low in January (3.4%) to 3.9% in October.

Source: LSEG Datastream; please note: past performance is no reliable indicator of future value development.

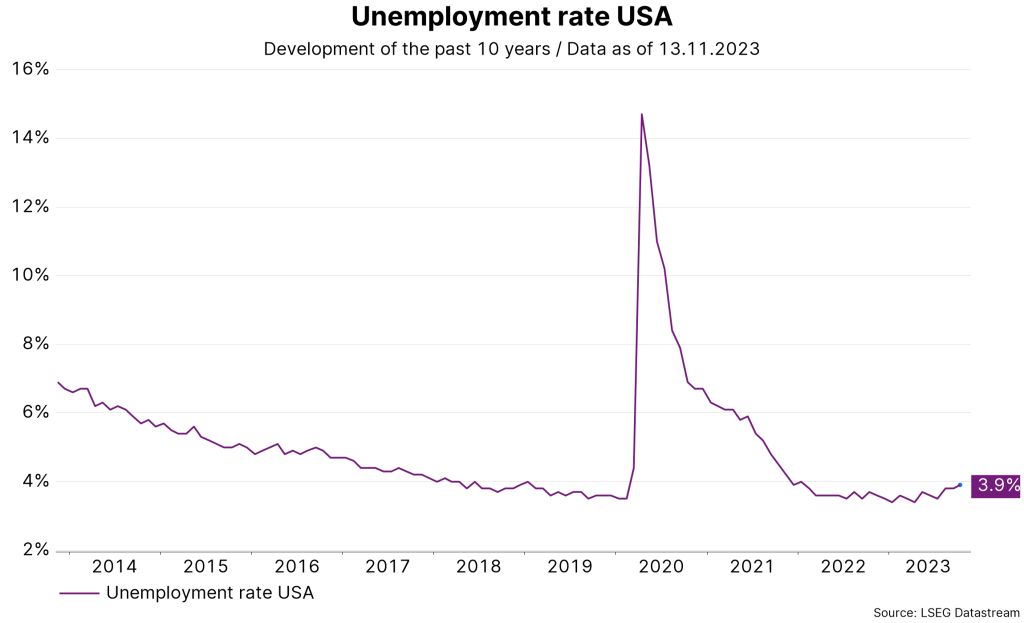

Consumer price inflation decreased to 3.7% in September, having peaked at 8.9% in June 2022. This means that inflation remains considerably above the central bank target of 2%. There are also signs of a certain degree of inflation persistence. The preliminary November report on consumer sentiment from the University of Michigan indicated an increase in long-term inflation expectations to 3.2%, i.e. the highest level since the rise in inflation during the pandemic. This highlights the risk that the anchoring of long-term low inflation expectations could be loosened. In this case, an even more restrictive monetary policy would be required to achieve the inflation target.

Source: LSEG Datastream; please note: past performance is no reliable indicator of future value development.

Finetuning

Despite strong growth, a tight labour market, and indications of inflation persistence, the bandwidth for the key-lending rate was left at 5.25% – 5.5% at the central bank meeting on 1 November, as expected. The statements made by Fed Chairman Powell were also interpreted as dovish (i.e. business-friendly) as opposed to hawkish (i.e. inflation-fighting).

As a matter of fact, market expectations for interest rate cuts in June 2024 rose in the days that followed. In a speech a few days ago, Jerome Powell tried to set the market interpretation straight by emphasising the central bank’s inclination to raise rates: “The Federal Open Market Committee (FOMC) is committed to keeping monetary policy tight enough to bring inflation down to 2% over time; we are not confident that we have achieved this. […] Should it be appropriate to tighten policy further, we will not hesitate to do so.”

Conclusion: focus on inflation and consumption

Yields on government bonds will only fall sustainably if and when the indicators point to a significant slowdown in economic growth, a rise in the unemployment rate, and a further decline in inflation. Given that economic growth is largely driven by private consumption, the publication of retail sales for the month of October next Wednesday will provide an important insight into economic momentum.

Also, consumer price inflation for the month of October will provide an update on inflation momentum next Tuesday. In the base-case scenario, it is too early to bet on further signals of a soft landing of the economy. This is mainly the case because the risks associated with inflation are pointing upwards.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.