Inflation has surprisingly fallen in the USA. This has made the scenario of a “soft” landing for the US economy more likely. However, this business-friendly news is overshadowed by the assassination attempt on Donald Trump.

Assassination attempt

US presidential candidate Donald Trump was shot at during a campaign event in Pennsylvania on Saturday. High-ranking politicians around the world were horrified by the act. The assassination attempt could have at least two implications for the current election campaign. Firstly, the radicalization of the political camps could increase further. This, in turn, could lead to an increase in politically motivated violence. Secondly, the likelihood of Donald Trump winning the presidential election in November has probably (further) increased. The assassination attempt increases sympathy and further mobilizes Trump supporters, making the challenger even more attractive.

On the other side of the duel is President Joe Biden, whose mental competence is increasingly being called into question. It is not even clear whether he will actually stand for election. Meanwhile, Donald Trump is leading in the polls, even in states that switch between the two parties from time to time (so-called swing states).

MAGA

As a result, the thrust of nationalist populism (MAGA or “Make America Great Again”) has become more likely in the USA. Higher tariffs and lower immigration tend to increase prices and reduce potential growth (stagflationary impact). As in other countries, the fiscal leeway is low due to the high budget deficit (seven percent of gross domestic product). However, political polarization and the populist stance reduce the potential for savings.

There is a possibility that the Federal Reserve (Fed) could come under pressure – perhaps under a new central bank chief – to gear monetary policy to more than just the criteria of low inflation and full employment. High inflation (above the central bank target) is unpopular, but given the choice between government austerity or slightly higher inflation, the latter is likely to win. Admittedly, this statement applies to many parties in many countries. The issue of deregulation sounds good, but was not systematically evident in Trump’s first term.

The fight against climate change is likely to be significantly reduced. On a geopolitical level, the downgrading of the importance of international organizations (UN, NATO, WTO) could materialize. The conflict with China – irrespective of party – is likely to intensify further.

The impact of Trumpism and Trumponomics is rather negative for bonds because inflation is supported rather than dampened. Tax cuts are promised, but there is not much room left on the downside. Moreover, the lower taxes would probably be financed by higher tariffs. As long as the tariffs are not predominantly paid by the exporting countries – there is no clear evidence of this – the positive effect of a lower tax burden on share prices is manageable.

Falling inflation

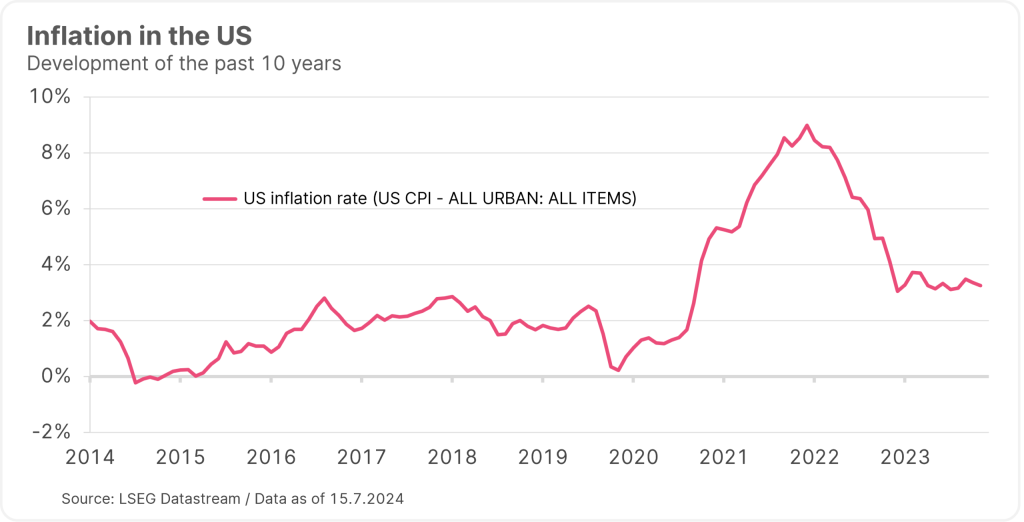

Apart from the theoretical considerations of what a Donald Trump presidency could mean, the focus is primarily on an economic report from the Bureau of Labor Statistics. Consumer prices in the US fell by 0.1 month-on-month in June, putting inflation at 3.0% compared to the same month last year. Excluding the traditionally volatile components of food and energy, the increase was only 0.1% (3.3% year-on-year).

The decline in price changes in the services sector, excluding the energy and real estate components, is particularly encouraging for the second month in a row (May: -0.04%, June: -0.05%, both month-on-month). Although this core rate for the services sector is still high on an annual basis, the downward trend in price changes on a monthly basis suggests a significant future decline in annual inflation.

Increasing confidence

Fed Chairman Powell made the following key statements in his semi-annual speech to two congressional committees. First: “In the labor market, a number of indicators suggest that conditions are roughly back to where they were on the eve of the pandemic.” Implication: The labor market, which was too firm until recently, is no longer an obstacle to interest rate cuts.

Caption: Fed Chairman Jerome Powell during his semi-annual speech to the Banking Committee in the US Congress. © CHRIS KLEPONIS / AFP / picturedesk.com

Second: “After no progress toward our 2% inflation target earlier this year, the latest monthly readings have shown further modest progress.” Third: “[…] further good data would strengthen our confidence that inflation is moving towards 2% on a sustained basis.” This is exactly what happened with the June inflation report. The first key interest rate cut for the month of September by 0.25 percentage points (upper band from 5.5% to 5.25%) and a total of just over 0.5 percentage points by the end of the year has now been fully priced into the markets.

Positive implications for growth

The inflation report has positive implications for economic growth. The growth indicators have been disappointing since the beginning of May. The rise in the unemployment rate from 3.4% in the first quarter of 2023 to 4.1% in June is particularly striking. Although the level is still low, the statistical nature of the unemployment rate points to the risk of further increases. A sharp rise in the unemployment rate would be tantamount to a recession. As the fall in inflation now allows for key interest rates to be cut soon, the probability of a “hard” landing (recession) has increased in favor of a “soft” landing (inflation towards the central bank target, growth slightly below average). The prospect of the “no landing” scenario (inflation and key interest rates remain high, but the economy is still doing well) no longer seems particularly plausible.

Conclusion

Overall, the inflation trend is positive for the markets: the main enemy of bonds – inflation – no longer looks so threatening, confidence in key interest rate cuts has increased, the positive growth implication supports the low premiums for credit risk and the equity market. The rotation from growth stocks to value stocks on the equity market is striking. Market prices reflect the increased confidence in a soft landing. However, the increased political uncertainty in the USA is a downside factor.

Note: Prognoses are not a reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.