A few years ago, I read George Friedman’s The Next 100 Years while I was on holiday. My wife still remembers this time vividly because I kept complaining about the book and what it said. In his book, Friedman, one of the world’s best-known experts on geopolitics, tried to predict the global developments of the coming 100 years.

His message that the USA would remain the globally hegemonic superpower for the largest part of those 100 years – a message of relief for US citizens at the time of publication (2009). Around that time, China made a big leap forward in an attempt catch up with the USA. (Less of a relief for the USA: at the end of the 100-year horizon, the USA loses its position to a new superpower, i.e. Mexico. Surprise, surprise.)

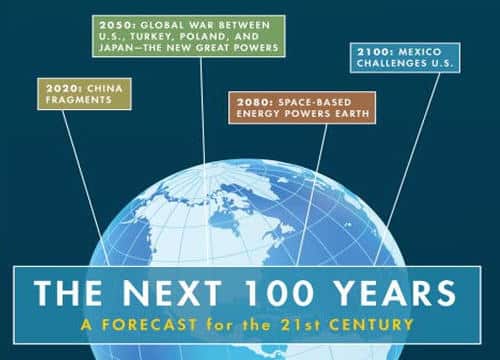

Looking into the future. (Screenshot The next 100 years)

One thing I did not like about the book was the abundance of overly animated details. Who cares whether a war 40 years from now will start on Thanksgiving. “Too many notes!” to use Emperor Joseph II’s legendary quote. However, what I found fascinating about the book was the methods the author used and the resulting robustness of his claim. It was a mix of history, geography, economy, and politics, all targeted at listening to the daily noise and distil from it the big trends of the future.

I had to think of this book when I saw a chart Dr. Jürgen Huber showed in his presentation at our Investment Day. The chart had been taken from a recent article in The Lancet, a renowned medical journal that in times of corona had become famous beyond its usual target audience: the US will take over its role as leading superpower from China again in 2100. Surprise, surprise.

Why am I telling you this? I am convinced that an asset manager has to work on the basis of a medium- to long-term outlook in order to be successful. He/she has to take a step back, suppress the daily noise and identify the themes and forces that drive society and the markets in the long run.

The quality of investment decisions, the demands posited to the product range or the future pool are driven by the very same forces. And as the economy of climate change has shown us – a driver we have identified for the coming years – the costs incurred in order to achieve a goal are the lower the earlier one starts taking action.

The Long and Winding Road

Following a similar methodology as George Friedman, except with a less challenging horizon of 10 years instead of 100 years, we have deliberately disregarded the daily ups and downs of the markets and focused on the big trends and drivers that will set the course for the coming years. So, what are our methods?

-

Top Down Macro

-

Scenarios – digital participation of our team(s) – external experts – discussion among our experts – in-house view / asset allocation / strategic effects

-

Bottom Up

The point of origin of our outlook was a classic mix of bottom-up and top-down analysis.

-

Bottom-up scenarios:

On the basis of a traditional PESTEL analysis, a group of EAM investment experts identified the themes which it believed to harbour the potential to drive the financial markets in the coming years. The focus in doing so was clearly heuristic.

We prioritised the width of ideation over analytical rigour (“is this a driver, a risk, or a scenario?”). Subsequently, we described all ideas we had come up with in mini-scenarios, reduced to their respective core. This served as basis for further analysis. From our point of view, the advantage of this method is its width. It produced numerous opinions on a variety of themes and drivers.

-

Top-down scenarios:

At the same time, two groups, consisting of investment experts from a diverse range of investment classes and headed by our chief economist, Gerhard Winzer, were developing self-contained, consistent macro scenarios.

Both groups generated their scenarios independently from each other so as to maintain a high bandwidth of arguments discussed. The upside of this method is that one obtains inherently consistent scenarios that allow for the assessment of consequences further down the line (e.g. return estimates), and that one also recognises very easily how and why scenarios differ from each other.

The junction where the scenarios deviate are the liminal areas where the findings from the bottom-up and the top-down analyses can be fruitfully synthesised. The question of whether austerity will play the same role in the attempts to get a grip on the vastly increased government debt due to corona as it had been playing in the ten years before corona can only be meaningfully discussed if one takes into account how the interest of the median voter has shifted in the past ten years.

It therefore comes as no surprise that we have identified “shifts in political economy” as one of the big themes for the coming years.

The findings of the top-down and bottom-up analyses were then processed in a survey that made it possible to include experts from the entire EAM across departments and borders in the formation of an opinion.

One of the positive outcomes of the corona crisis has been to realise how normal and inexpensive it has become to exploit the possibilities of digital communication. “Digitisation” is also a big theme for the coming years. The result of all this preparation that about 20 of our EAM investment experts had been working on intensively for several weeks was the basis for our longterm outlook.

The Big Day

On our Investment Day, we presented the input from the various streams and discussed them at length. In addition to the usual suspects like CEO, CIO, asset class heads and local EAM CIOs as well as all those who had participated in the preparatory work, those experts who were able to provide the best contributions also attended, having been given a limited number of tickets by our asset class heads.

With so many participants the Investment Day had of course been subject to thorough planning.

- Our CEO, Heinz Bednar, launched the event with his assessment of the asset management industry and the crucial developments in the coming years.

- Our CIO (i.e. me) summarised the results from our team survey and the preparatory work as a first draft of the bigger picture.

- This was followed by a presentation of the macro scenarios by the respective teams and an extensive Q & A session.

- Contributions from our external experts followed next. Professor Dr. Jürgen Huber started off with a pointed, thesis-driven outlook on the coming years, followed by Peter Berezin, Managing Editor of BCA Research, who presented a holistic view.

- On the basis of this information, our experts discussed the effects on markets and asset classes on two separate panels.

- As last event on the agenda, our CIO summarised the results and laid out an agenda for the next steps. After the Investment Day is before the Investment Day, as we know.

What’s next?

A long-term outlook is important for an asset manager. It is reflected in many strategic decisions on a corporate level such as the optimal product range, the creation or expansion of the right know-how for the years to come, and the expected return and the underlying strategic asset allocation. It will be our task to look at all these areas against the backdrop of our outlook in the coming weeks and months. This way we can make the most of the arduous and instructive process of the past weeks.

One of the results will be to share our insights of that day with our clients to the best of our abilities. We will be doing this through a series of blog entries in the coming weeks. We hope you will enjoy reading them as much as we enjoyed developing this body of knowledge.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.