At the kick-off for the World Cup finals on 14 June, Russia will move to the public limelight for four weeks. There are numerous reasons for a closer look at Russia, its economy and its equity market beyond the current events in sports: the recovery of the oil price, the renewed tightening of sanctions, and the re-election of President Putin as well as the rise in US interest rates and the recent strength of the US dollar have shifted the economic backdrop and the framework for investors.

The Russian economy has moved past the recession of 2015/2016, which had been largely triggered by a slump in oil prices and the related drop in domestic purchase power. This year and in 2019, the economy should grow by about 1.8% according to current forecasts. Whereas a number of emerging economies have been negatively affected by the rise in US interest rates and the appreciation of the US dollar, Russia is in a better shape dealing with these challenges. The country has been running a current account surplus and its fiscal budget is broadly balanced. Total debt has generally fallen over the past years, with government debt amounting to only 17.5% of GDP.

Significantly lower growth rates than in the years prior to the financial crisis

However, the solid macroeconomic figures should not gloss over the fact that the long-term growth momentum of the Russian economy is subdued. Current growth projections imply that the Russian economy will be growing only at half the speed of the global economy – in stark contrast to the years prior to the financial crisis, when the country was in the fast lane. Whether this will change during “Putin 4.0” remains to be seen. The new government and the reform goals as expressed in the president “May decrees” are signalling limited willingness to reform.

There are no signs of loosening sanctions by the West. In fact, the opposite is the case: the USA has imposed new sanctions, which among other things have led to another bout of depreciation of the Russian currency. So far, the negative effects of the sanctions have been partially absorbed by the fluctuations of the price of oil and other commodities, but in the long run the sanctions’ impact will be clearly negative for the Russian economy. From an investor’s perspective, the last round of US sanctions is particularly negative given that for the first time listed companies and their international operations have been targeted.

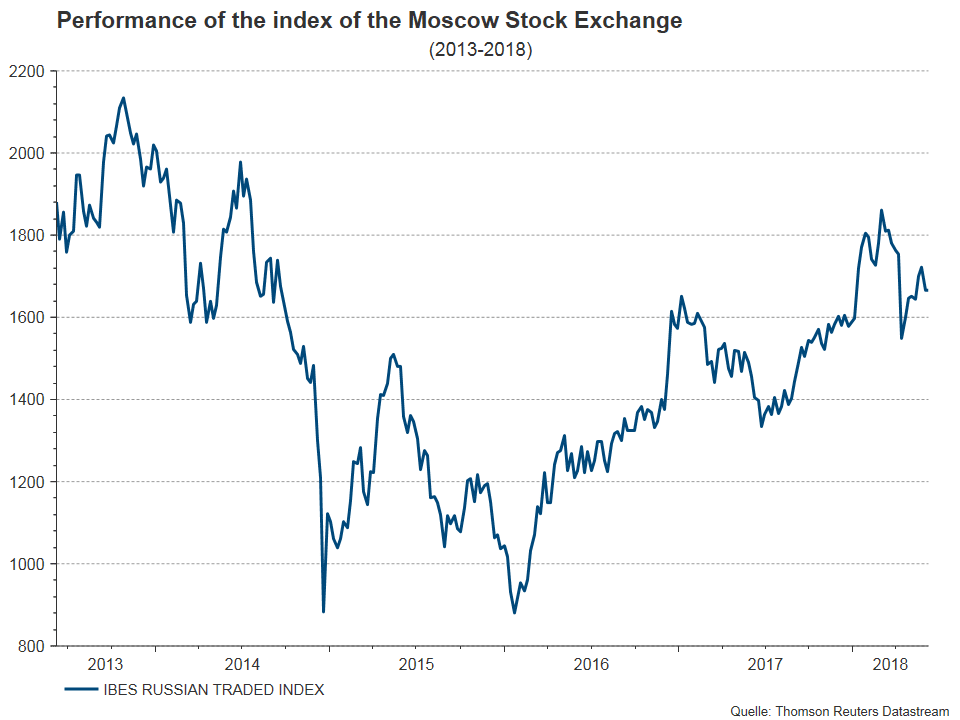

Note: Past performance is not indicative of future development.

This situation notwithstanding, the overall outlook of Erste AM for the Russian equity market is positive. At a PE of about 6x based on forward looking earnings, the market commands an attractive valuation. The valuation discount relative to other emerging markets is clearly above 40%. Also, the Russian equity market offers a dividend yield of more than 6%, which is bolstered by both earnings forecasts and foreseeable dividend policy.

Allocation of Russian equity fund ESPA STOCK RUSSIA

At the moment, we prefer export-oriented companies with healthy balance sheets that can maintain profit growth also in a difficult environment. These are mainly listed companies in the energy and commodity sector that benefit from the weak rouble and offer investors a high dividend yield.

| Benefits for the investor: | Risks to be aware of: |

|

|

*Commonwealth of Independent States

Caption:

Visit of Russian President Vladimir Putin to Vienna on 5 June – Wreath Laying at the Russians Memorial on Schwarzenberg Square (Schwarzenberg Square) with Austrian Foreign Minister Karin Kneissl

Warning notices according to the Austrian Investment Fund Act of 2011

| Due to the composition of its portfolio, ESPA STOCK RUSSIA may be subject to elevated volatility, which means that the shares of the fund may experience significant fluctuations within short periods of time.

ESPA STOCK RUSSIA may invest significantly in derivative instruments (including swaps and other OTC derivatives) as defined by sec 73 of the Austrian Investment Fund Act of 2011. |

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.