It is well known that it often takes years to build trust but only seconds to destroy it. This proverbial wisdom was painfully reminded to the global banking sector in March, so that at present also the non-word “financial crisis” is doing the rounds again.

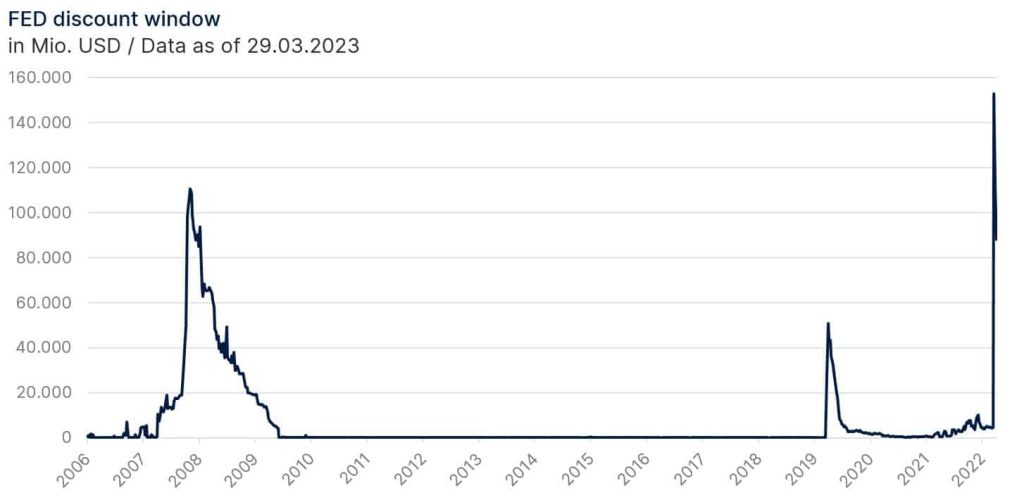

The extent to which the financial system was or is under pressure in March is shown by the increase in the FED discount window shown below. This instrument allows commercial banks to obtain additional liquidity at short notice and thus avoid any liquidity bottlenecks in times of high uncertainty. The volume borrowed even exceeded the level of the great financial crisis and yet a financial crisis 2.0 would be too broad in our view. Unlike back then, the current crisis of confidence is based on individual cases and not on widespread problems in the banking sector.

Hardly any of us had heard of Signature, Silvergate or Silicon Valley Bank before the turmoil – the three collapsed institutions were active in the high-risk segment of start-up and crypto financing. A comparison with a universal bank does not seem appropriate in view of the narrow field of activity of the banks, but in the case of Silicon Valley Bank, it was still the fourteenth largest bank in the US and therefore one rightly wonders how it could have come to this.

One reason is definitely the relaxation of banking regulations for regional banks initiated by the Trump administration in 2019, which is now taking its revenge. Another reason is the business model itself – in the case of Silicon Valley Bank, the name said it all, because the institution benefited massively from the tech or startup boom in recent years and therefore grew almost ten times faster than the industry average. Obviously, the structures in the bank did not grow at the same pace, because viewed from the outside, the failure of risk management is otherwise almost inexplicable. Due to its concentrated business focus, SVB had over 90% of its deposits unsecured and was also invested in long-dated bonds on a large scale and without any interest rate hedging.

The massive interest rate increases of recent months caused the supposed book losses to rise enormously, so that the first large withdrawals of asset values set the ball rolling, or ultimately the bank run – the bank also had to realize accumulated interest losses in order to service the deposits. The withdrawal of $42 billion in a single day shows how quickly any mistrust spreads in the digital age (aided by social media). Even if the Fed was able to prevent a conflagration by taking the decisive step of guaranteeing all bank deposits for a limited period of time, uncertainty remains high and unfortunately it was not possible to prevent the crisis from spilling over into Europe.

(Dis)Crédit Suisse

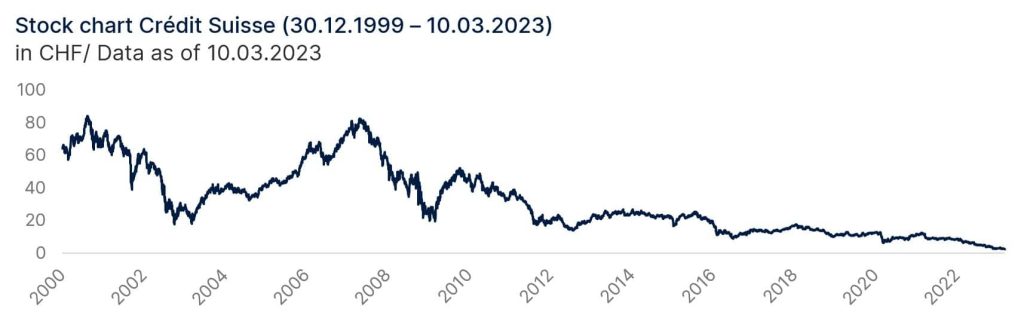

As with the US institutions, the crisis at Crédit Suisse, which is rich in tradition, is also homemade. However, the major Swiss institution was not put in trouble by the latest interest rate hikes, but by a widespread loss of confidence that began years ago. The list of scandals Crédit Suisse has been involved in over the past few years is particularly long and could well be the subject of a detective story. Just remember the uncovered shadowing of a renegade manager, billions in losses due to windy hedge fund transactions, potential money laundering for a Bulgarian cocaine trafficker, or allegations of fraud against the country of Mozambique or a former Georgian prime minister.

The list could go on – in fact, Crédit Suisse lost its “credit” with clients long before the SVB, and recent events merely broke the already full camel’s back. It was thus a demise in fast motion, as is also vividly illustrated by the share price trend shown below, which ends before the collapse of SVB.

The now forced merger with the larger UBS would presumably have taken place over time even without the recent uncertainties on the market. Only time will tell whether the takeover becomes a particularly lucrative deal for UBS or a potential billion-dollar grave. For the financial sector, the elephant wedding was enormously important, because as a globally active and networked bank, Crédit Suisse was definitely systemically relevant and thus also “too big to fail.” The new UBS has already been dubbed a monster by the Swiss media – at 1.6 trillion euros, its total assets are more than double Switzerland’s economic output, which means that the monster bank will also potentially be “too big to bail out.” It is to be hoped that this is only a theoretical risk.

As already mentioned, the approach of the supervisory authorities in the USA, but also in Switzerland, was extremely fast and, above all, decisive. Greater damage was avoided as a result. However, the recent price turbulence at Deutsche Bank has shown that the crisis of confidence is anything but over. Central banks now face a particularly difficult task – in addition to the mandate of price stability and full employment, financial stability must now be maintained.

Was that it?

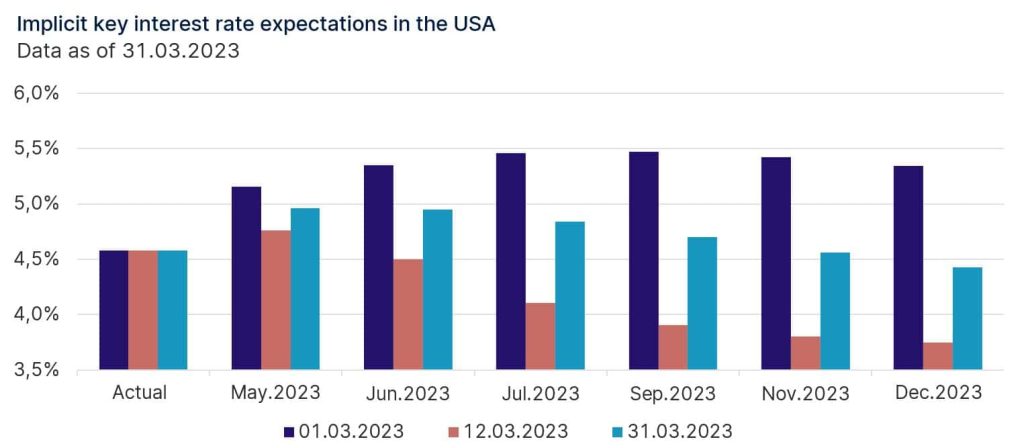

In light of the uncertainties in the financial sector, market expectations regarding key interest rate policy also changed dramatically. In the short term, there was speculation that the FED would no longer make an interest rate move in view of $600 billion in unrealized interest rate losses in the US financial system. Fed Chairman Jerome Powell even openly admitted that this option had been discussed in the run-up to the last Fed meeting – but high inflation and the solid labor market still justified a small rate hike of 25BP. Christine Lagarde, who also raised the key interest rate in March by a further 50bp to 3.5%, took the same line. In retrospect, both succeeded in cautiously tightening monetary policy without fomenting additional uncertainty.

A too abrupt halt to the key rate hikes would probably even have been interpreted by the market as an alarming signal with regard to the financial system and, moreover, the inflation dynamic has probably not yet been banished. Therefore, the fight against inflation has not completely receded into the background, but it is now no longer the sole and primary driving force behind the upcoming interest rate decisions. Regardless of this, the end of the interest rate hike cycle has in any case come closer.

This is also shown by the market expectations for the US key interest rate listed on the next page, which have changed massively within one month. Whereas at the beginning of March the market still expected a key interest rate of 5.5% at the end of the year, this fell to 3.7% immediately after the collapse of the SVB and most recently settled at 4.5%.

Whether the interest rate cuts expected in the second half of the year will actually materialize is doubtful in our view – but the central banks will have to become more cautious. On the one hand, the turbulence in the financial sector requires a more cautious interest rate policy and, on the other hand, banks will become more restrictive in lending on their own initiative in view of the high level of uncertainty. Even before the collapse of the SVB, banks were significantly tightening lending guidelines in both the USA and Europe, and this will continue with renewed momentum.

How strong the negative effect on the economy will be is difficult to assess, but recession risks have definitely increased in light of recent events. However, the global economy has proven time and again in recent months that it is now thoroughly crisis-proof. For seasonal reasons, the upcoming spring could well provide positive economic impetus, and the ongoing recovery in China will also provide additional impetus in the short term.

Conclusion: Better than expected

Notwithstanding the recent turbulence, both corporates and the global economy are currently proving to be extremely robust. Even a cursory glance at the capital markets would not allow any conclusions to be drawn about the recent increase in volatility – both global equities and bonds have been trading slightly higher since the turn of the year. In addition to the performance, the fact that bonds and equities are finally providing diversification in the portfolio again is also encouraging. However, the fluctuation intensity was enormous and is likely to remain high – a solid portfolio construction is therefore much more important than trying to chase daily developments.

As already mentioned, there is likely to be some sand in the economic gears, but the economy has been able to cope well with all crises recently.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.