The sentiment of the financial market participants has deteriorated in the past months, with the losses across numerous asset classes in the year to date seemingly the driving factor. Now we have to ask ourselves: are we at the outset of a new trend, or is this just a case of increased volatility? The general decline in prices has gone in conspicuous tandem with the increase in three important financial market ratios:

- US Treasury yields

- the oil price, and

- the US dollar

Also, the movement affected mainly countries with high inflation and high current account deficit.

Increase of key-lending rates priced in by the market

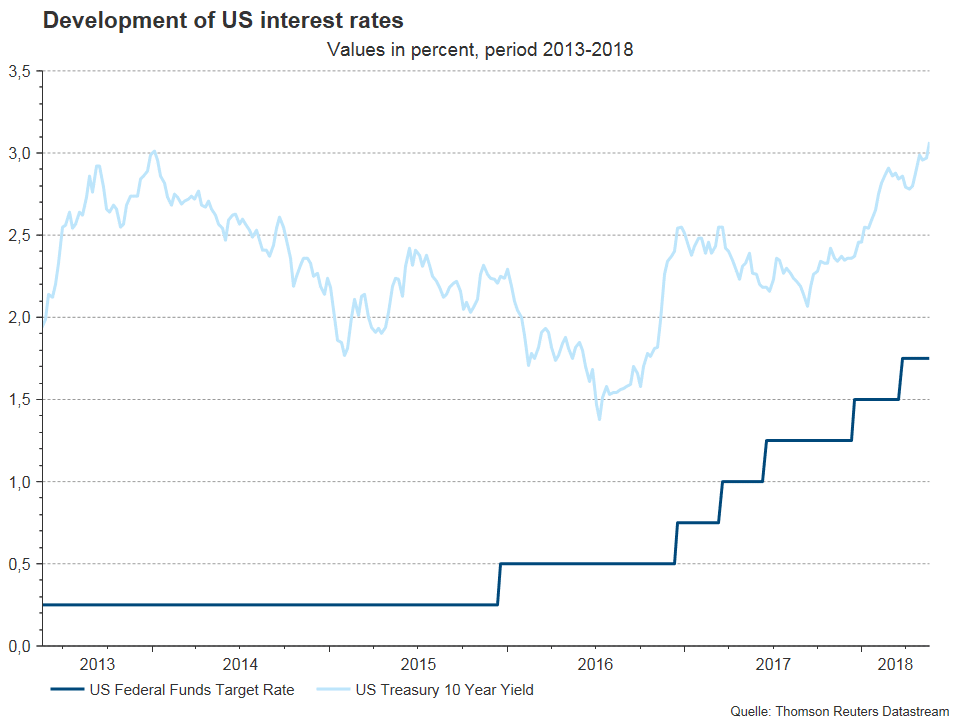

The real neutral interest rate is estimated to amount to 0.45% in the USA (Laubach / Williams, Federal Reserve Bank of San Francisco. This is the interest rate that affects inflation neither in a dampening nor in a supporting fashion. By adding the inflation target of the Fed of 2%, we arrive at the nominal neutral interest rate of 2.45%. The Fed itself assumes a value of 2.9%, which it wants to reach by the end of 2019. A key-lending rate (i.e. Fed funds rate) of 2.7% is already priced in for the end of 2019. By comparison, the current Fed funds rate is within a target band of 1.50-1.75%. This means the majority of the expected rate hike is priced in. In terms of the important benchmark, the 10Y yield of the US Treasury bond, this means a stabilisation within a band of 3-3.25% (currently 3.07%; source: Bloomberg, as of 17 May 2018). This holds as long as inflation is not rising.

Mild inflation pressure

Generally speaking, the central bank can act cautiously as long as the underlying inflation remains low. The recently published inflation data have suggested only mild inflation pressure for many countries in the developed economies. In line with this scenario, many central banks have been signalling a wait-and-see stance in the past weeks, with the exception of the USA, where the increase in inflation is more profound. The inflation benchmark preferred by the US central bank (i.e. the core PCE deflator) was at 1.9% in March, i.e. close to the inflation target. Also, labour costs increased by 2.7% p.a. in Q1 (source: Bloomberg), up from 1.4% p.a. at the end of 2009. The core statement of the US Fed at the beginning of May was that the goals of full employment and 2% inflation had been reached and that the inflation target was symmetrical. This basically means that inflation rates of slightly above 2% will not accelerate the path of interest rate hikes. At 1.5%, average inflation has been below this target only slightly in the past ten years. However, an increase in US inflation could drive 10Y yields up further. At the moment, the so-called break-even point in the 10Y segment is already 2.19%, which means that the achievement of the inflation target by the Fed is already priced in.

Appreciation of the US dollar

The divergence of inflation and central bank signals between the USA and other countries is in line with the recent appreciation of the trade-weighted US dollar. At this point, the US dollar is back at its level of the end of 2017. While we continue to expect broadly-based economic growth and the mild normalisation of the monetary policy also in other important countries and regions (Eurozone, UK, Canada), we also stick to our scenario of the US dollar moving sideways this year after its depreciation in 2017.

Rising interest rates mainly have two effects:

- Deteriorating valuations of other asset classes

- Deteriorating credit quality due to higher credit costs

Increased valuations

Years of low interest rates have caused substantial inflows into asset classes with a higher promised yield. This in turn has led to generally falling yields, narrowing spreads, and rising valuation metrics. Generally, higher valuations go hand in hand with lower future returns and with a stronger degree of susceptibility to correction. Rising interest rates mean an increase in the attractiveness of (credit-) risk-free interest rates, i.e. US Treasury bonds. At the same time, the attractiveness of investment alternatives falls. For this situation to balance again, i.e. in order to achieve an increase in risk premiums (i.e. spreads) required, the prices of other asset classes come under pressure. If the basic assumption of a stabilising 10Y US yield holds and global economic growth remains strong and broadly based, equities will remain more attractive than government bonds (or in the USA, Treasury bonds).

Rising credit costs

Credit costs are rising. This is of course negative for companies and governments with high debt (in US dollar). If earnings growth and GDP growth remain strong, the increase in interest expense can be covered.

Growth: stabilisation in the current quarter

Real global economic growth has weakened in Q1 2018 vis-à-vis Q4 2017. This has triggered worries that sustainable weakening could ultimately result in recession. The indicators published in the past weeks, such as the purchasing managers’ indices for April, suggest an economic stabilisation in the ongoing quarter. Our model estimates (the “nowcasts”) also indicate continued, strong growth above potential that is broadly based, although growth rates are lower than in Q4.

Appreciation of the US dollar and key-lending rate hikes in the emerging markets

Rising US rates are particularly negative for countries with high external financing needs, i.e. a high current account deficit. It is no coincidence that especially Turkey and Argentina have recently come under pressure with current account deficits of above 5%.

Countries with such elevated financing needs in US dollar are faced with an increasing interest burden when the US dollar appreciates. Indeed, the emerging currencies have come under particular pressure by the US dollar. Generally, a weakening currency comes with positive and negative effects. Among the positive effects is the fact that it supports net exports in the medium term. At the negative end, the attractiveness of real and financial investments decreases from the perspective of foreign investors as long as the currency continues to weaken. When the depreciation is excessive, the pressure on the central bank rises to hike rates in support of the currency. Most recently, the Argentinean central bank has tried to stabilise its currency with drastic rate hikes – so far, successfully. If the falling exchange rate leads to inflation, the pressure to raise rates increases further. If successful, the restrictive monetary policy can stabilise the currency, but unemployment rises. If the currency cannot be stabilised, there is also the option of selling foreign exchange reserves. However, falling reserves are detrimental to the rating of a country. Even though typical features of emerging economies still exist, we have seen a structural improvement in many countries over the past years: low inflation (central banks with inflation targets), floating exchange rates (no US dollar peg), fewer external (current account deficit) and internal (high budget deficit) imbalances, higher share of local currency bonds (debt taken out in domestic currency).

Higher oil price due to US sanctions against Iran

The oil price has embarked on a rising trend. Generally speaking, demand growth is currently above supply growth. At the same time, inventories have fallen drastically. But the most important reason for the increased oil price is the fact that the US sanctions against Iran could lead to a decline in oil exports. The higher oil price eats into the purchase power in the oil-importing countries and thus presents a risk to growth.

We can see our base case scenario of a gradual normalisation of the interest rates confirmed. Real global economic growth remains strong – albeit slightly lower than in Q4 – and broadly based. At the same time, inflation is low and rising only gradually, with central banks cautiously reducing their expansive stance (N.B. the US Fed more swiftly so than the other central banks). This abandonment of the “Goldilocks” scenario induces elevated price fluctuations and the adjustment of spreads due to increasing US interest rates. In this base case scenario, we continue to prefer risky asset classes such as equities and US corporate bonds with low ratings (high-yield) and local currency bonds from emerging markets.

Legal note:

Prognoses are no reliable indicator for future Performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.