The success stories surrounding the use of incretin-based weight loss products originally developed for diabetics to fight obesity have led to a veritable run on these drugs. Initially triggered by testimonials from well-known personalities like Tesla founder Elon Musk and a number of Hollywood celebrities who publicly raved about effortless weight loss after using these products, the hype has now snowballed into a mass phenomenon.

Pharmaceutical companies such as Eli Lilly and Novo Nordisk can barely keep up with the enormous demand and are reporting supply bottlenecks. On the stock markets, the boom in weight loss products has recently generated strong gains for pharmaceutical companies.

👉 What you will read in this article

Market could grow strongly

According to experts, the market for weight loss drugs could grow to several hundred billion dollars in a few years, as the number of overweight or obese people is increasing rapidly. According to current data from the Robert Koch Institute, more than half of adults in Germany are overweight. The latest Eurostat survey from 2019 shows a similar picture across the EU.

Accordingly, high hopes are being pinned on the promising incretin drugs. Pharmaceutical companies Eli Lilly and Novo Nordisk currently control a large share of the market, but several other companies also either already offer corresponding drugs or have them in the pipeline.

Experts also warn of potential side effects

The active ingredients in the drugs, incretin mimetics, were originally developed for the treatment of diabetes. They mimic the function of incretins – intestinal hormones that increase the production of insulin after food intake and thus stimulate the satiety centre in the brain. This reduces the feeling of hunger, resulting in a significant weight loss effect. However, experts also warn of potential side effects and a possible yo-yo effect: some studies have shown that the effect only lasts as long as the product is taken.

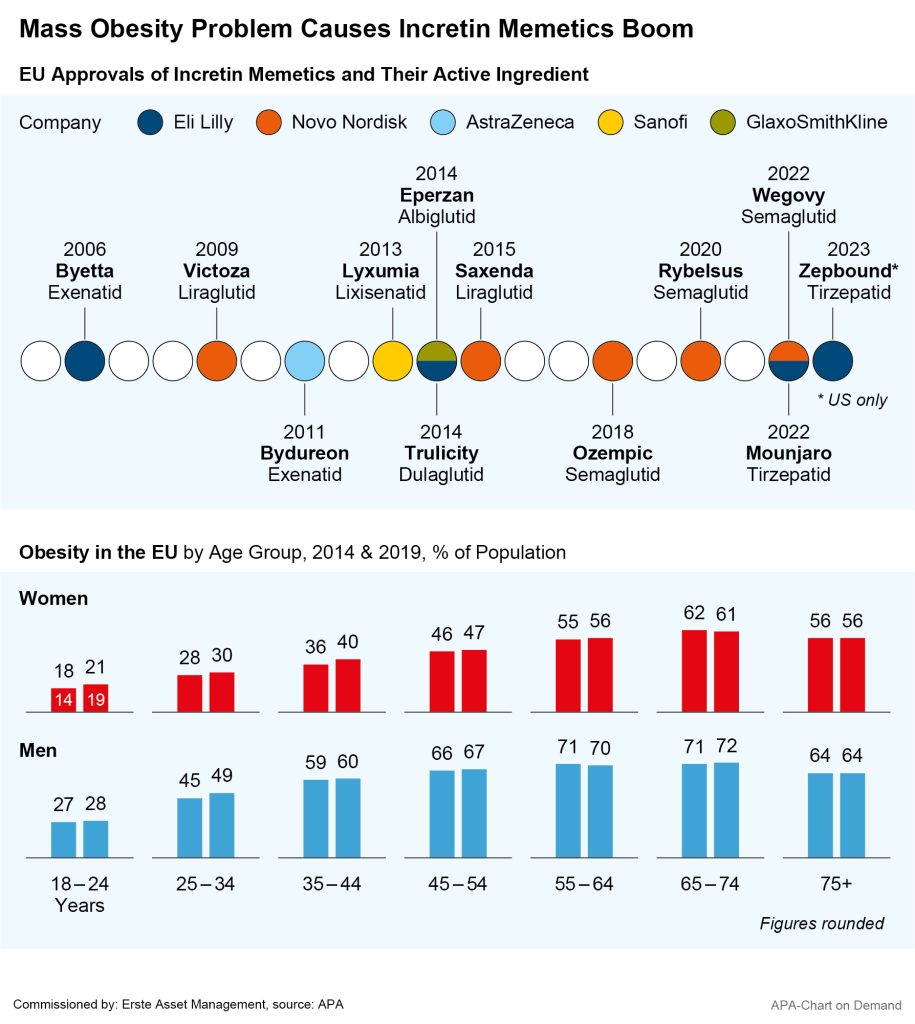

One of the first commercially available incretin mimetics products was the drug Byetta manufactured by US pharmaceutical company Eli Lilly. The drug, based on the incretin active ingredient exanatide, was approved in the US in 2005, and in the EU the following year. In 2009, Novo Nordisk released the drug Victosa, which is based on the incretin active ingredient liraglutide.

In the following years, the two companies, as well as competitors such as AstraZeneca and Sanofi, launched numerous other weight loss products based on these and other incretin active ingredients. The incretin mimetics drugs originally developed for diabetics have now also been approved by health authorities in many countries as anti-obesity agents.

Eli Lilly expects further revenue growth thanks to its weight loss products

Weight loss products have recently provided pharmaceutical companies with strong revenue growth. Eli Lilly exceeded analysts’ forecasts for the financial year 2023, primarily thanks to the positive development of its incretin weight loss drug Mounjaro. The Group remains optimistic for the current financial year.

The next boom in demand is expected for Eli Lilly’s injectable weight loss drug Zepbound, which is based on the same active ingredient as Mounjaro. The US Food and Drug Administration (FDA) approved the drug a few months ago for people suffering from obesity and for overweight people with at least one weight-related health problem.

Overall, Eli Lilly expects its revenue to increase to between USD 40.4bn and 41.6bn in 2024. This would mean a further increase of around 20 per cent, after sales climbed to USD 34.1bn in 2023. Mounjaro alone contributed just under USD 5.2bn to total revenue in the previous year.

Weight loss boom made Novo Nordisk the most valuable listed company in Europe

Danish pharmaceutical company Novo Nordisk also profited further from the booming weight loss products, particularly from its injectable drug Wegovy. Following a jump in sales and profits of more than 30 per cent last year, Novo Nordisk is aiming for further strong growth. In the US, the Group plans to increase deliveries of its lower-dose Wegovy starter doses more than twofold compared to the previous months. This could allow more new patients access to the weight loss injection.

Wegovy, launched in the US in mid-2021 and in Germany in the summer of 2023, has helped Novo achieve record sales. Last year, Novo’s obesity-related revenue saw a 147 per cent surge. In total, the Group achieved a revenue of DKK 232.3bn (approximately EUR 31bn), an increase of 31 per cent within a year. Operating profit climbed by 37 per cent to DKK 102.6bn. For 2024, Novo expects sales growth of 18 to 26 per cent and an increase in operating profit of 21 to 29 per cent.

Note: Past performance is not a reliable indicator of future performance.

The stock market reacted to Novo-Nordisk’s good figures with a sharp increase in the share price, causing the company’s market capitalisation to break the USD 500bn mark and making Novo Nordisk the most valuable listed company in Europe – ahead of luxury goods group LVMH.

Roche enters the weight loss product market with acquisition

However, several other pharmaceutical companies have now also launched or are developing weight loss products. Swiss pharma giant Roche recently acquired the Californian company Carmot Therapeutics for USD 2.7bn, and with it a corresponding development portfolio. Carmot is also developing incretin active ingredients to fight obesity; three such active ingredients are currently being researched or have already been tested in trials.

German pharmaceutical company Boehringer is also currently conducting research in this area with its Danish partner company Zealand Pharma. While the drugs from Eli Lilly and Novo Nordisk are based on the imitation of intestinal hormones, Boehringer is researching an active ingredient that imitates a pancreatic hormone. Initial study successes have recently led to a sharp increase in Zealand Pharma share prices.

How to invest in healthcare shares

With the two equity funds ERSTE RESPONSIBLE STOCK GLOBAL and ERSTE RESPONSIBLE STOCK EUROPE, investors can invest in securities from the healthcare sector.

The advantage: In addition to stocks from the pharmaceutical and healthcare sectors, the fund also includes other sectors that are crucial for the economy, such as the technology sector, finance and industry. This gives investors the opportunity for attractive value growth with broadly diversified risk across several economic sectors.

Note: However, it is also important to be aware of the potential risks of an investment. The price of a fund can fluctuate significantly and there is a risk of capital loss.

The companies mentioned in the article, Novo Nordisk and Roche, currently the second and fifth largest, are particularly well represented in ERSTE RESPONSIBLE STOCK EUROPE. However, the securities are also currently part of the ERSTE RESPONSIBLE STOCK GLOBAL portfolio.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio.

Notes ERSTE RESPONSIBLE STOCK GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

Notes ERSTE RESPONSIBLE STOCK EUROPE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.