At a glance

• Netflix and Paramount are battling it out to acquire Warner Bros.

• The potential deal is also meeting with negative reactions

• Concerns from competition authorities are another obstacle

• Shares in takeover candidates are mostly rising

• Shares in the bidding companies are mostly falling

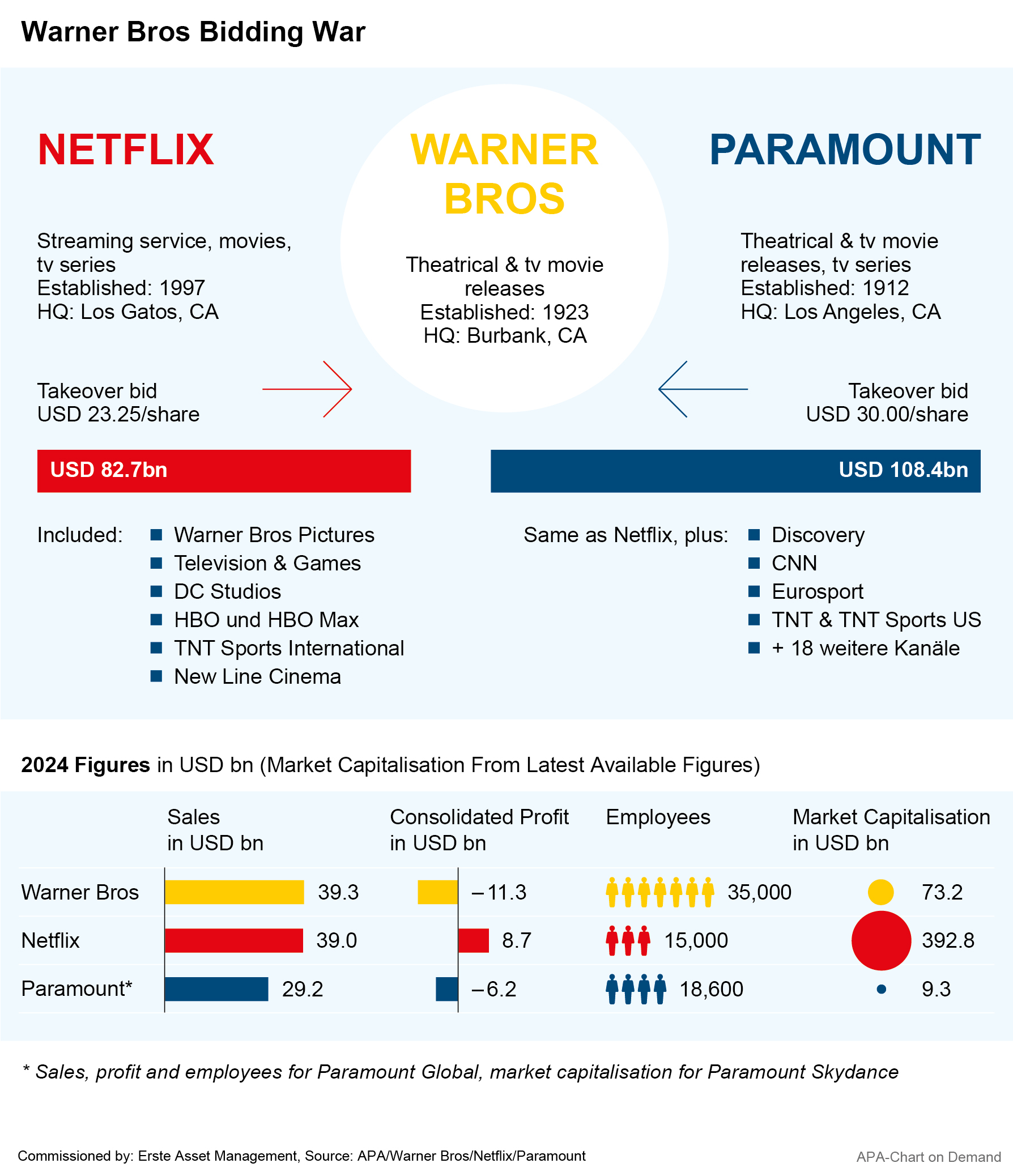

The bidding battle for the Warner Bros. Discovery media group has recently intensified further. After streaming provider Netflix recently reached an agreement with Warner Bros. to take over large parts of the group for USD 83 billion, fellow bidder Paramount is now making a hostile counteroffer directly to shareholders.

Paramount is offering 108.4 billion dollars in cash for the entire Warner Bros Discovery group. Netflix had already agreed a takeover of Warner Bros’ studio and streaming business with Warner last week, but without the TV channels that are currently still part of it, such as CNN. The Netflix offer consists of cash and shares.

Note: The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

Trump confidants are also behind Paramount offer

The bidding battle also has a political component, as several confidants of US President Donald Trump are behind Paramount and its bid. Paramount was acquired just a few months ago by the family of Larry Ellison, the software billionaire and Oracle founder known as a Trump supporter. According to media reports, Paramount had previously assumed that it would be able to prevail at Warner due to its good relations with the White House, but Warner’s management decided in favor of the Netflix offer.

Paramount is now making some changes that could improve the chances of success. Warner management had criticized, among other things, that the original Paramount offer also included 24 billion dollars from the sovereign wealth funds of Saudi Arabia, Abu Dhabi and Qatar. These would now waive their right to have a say in the business, for example through a seat on the board of directors.

It initially remained unclear exactly how much money would come from Affinity. Kushner is married to Trump’s daughter Ivanka. In response to questions from reporters in the White House about Kushner’s involvement in the deal, Trump said that he and his son-in-law had never spoken about it. He is not a big friend of either Netflix or Paramount Skydance. “I know those companies very well. I know what they do (…). I have to look at what kind of market share they have (…) neither of them are great friends of mine,” Trump said at the White House.

Note: Past performance is not a reliable indicator of future performance.

Note: Data as of 11.12.2025, Market Capitalisation from latest available figures = 11.12.2025

Deal also meets with negative reactions

The Ellisons – Paramount is now led by Larry’s son, film producer David – want to quickly grow in size with the acquisition of Warner Bros Discovery. With the streaming service Paramount+, their group is currently only one of the smaller players in the market. Meanwhile, Netflix has more than 300 million customer households worldwide and Warner’s HBO Max has 128 million subscribers according to the latest figures.

The Netflix deal met with many negative reactions in Hollywood. Among other things, there are fears that the streaming giant will continue to release Warner Brothers films in cinemas, but then stream them much faster – which could cost movie theaters money. In its own business, Netflix has always prioritized streaming over cinemas, even for elaborate productions, which has annoyed some filmmakers. David Ellison now says that Paramount wants to save Hollywood.

What’s next for news channel CNN?

The bidding war also has a political dimension because Warner Bros. Discovery also owns CNN . The news channel, which often reports critically about Trump, is a thorn in the President’s side. He regularly accuses the broadcaster of spreading false news without providing evidence and reporting on him in a biased manner. On Wednesday, Trump himself intervened in the takeover battle for Warner Bros and openly demanded in front of reporters at the White House: “CNN should be sold”.

There have already been changes in the newsroom at Paramount broadcaster CBS following the purchase by the Elisson family. However, after the CBS program “60 Minutes” recently broadcast an interview with Republican MP Marjorie Taylor Greene, who had switched to the camp of Trump critics, Trump complained that the new owners were no better than the old ones.

Concerns about dominant market position

Trump also speculated at the weekend that the size of Netflix could become a problem in the competition review – and said that he would be personally involved in a decision on whether to approve the deal. But Democratic politicians also expressed concern about the dominant position in the streaming market that would be created by the merger. Democratic Senator Elizabeth Warren, for example, spoke of a “nightmare” for competition. Netflix argues that the streaming market alone should not be considered, but that the providers also compete for viewers’ attention with video platforms such as YouTube and TikTok.

During an appearance at an investor conference a few hours after the Paramount offer, Netflix co-chief executives Ted Sarandos and Greg Peters expressed their conviction that they would get the deal across the finish line in the end. Netflix promised Warner a contractual penalty of 5.8 billion dollars in the event that the takeover should fail due to concerns from competition authorities.

Paramount’s offer to Warner Bros. Discovery shareholders to buy their shares for 30 dollars each will initially run until January 8, but could be extended.

What does the bidding war mean for investors?

On the stock market, Warner Bros shares have recently risen sharply, driven by the takeover battle. Since the beginning of the year, Warner’s share price has almost tripled. Over the past month, the shares have risen by a good quarter and were last trading at $25. The shares of the two potential acquirers fell significantly over the same period: Netflix shares fell by around 17 percent to around $92, while Paramount Skydance shares lost around 12 percent to just under $15 (note: past performance is not a reliable indicator of future performance).

This corresponds to a pattern that can often be observed on the stock markets. Several studies show that after a takeover bid is announced, the shares of the takeover candidates typically rise, while the shares of the bidding company statistically perform weaker or even fall.

The prospect of positive synergy effects, larger market shares, and more efficient corporate structures as a result of the acquisitions is often offset by concerns that the offer may be too expensive, that the synergy effects are overestimated, and that the merger will involve considerable costs for the integration of the acquired company. A bidding war naturally caused even greater fears that the successful bidder would pay too high a price.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.