Global real gross domestic product (GDP) growth is expected to cool from 4% in the first quarter to around 2% in the current quarter. One reason for this is the weaker expected economic growth in China, the world’s second largest economy.

Growth momentum in China cooling off

The dynamics of global real economic growth are strongly influenced by the development of GDP in China. After the pandemic-related opening measures at the end of 2022, GDP in China showed a V-shaped recovery with growth approaching 12% quarter-on-quarter (annualized) in the first quarter.

Growth indicators released for April (retail sales, investment and industrial production) point to a marked slowdown. The estimate for the current quarter is around 4%.

Low growth in the USA and in the Euro zone

For the USA, the aggregate of economic indicators points to continued low growth below potential. After quarterly real GDP growth of 1.1% (annualized), the estimate for the current quarter holds at 1%. In the month of April, retail sales increased after declines in the previous two months. Overall, private consumption grew strongly in the first quarter. Growth early in the second quarter suggests that consumers will continue to support GDP growth in the second quarter.

Industrial production continued to recover from the Q4 2022 slump, but the level is still slightly below the November level. In the construction sector, there are increasing signs of stabilization. For example, the NAHB index, a key sentiment barometer, has been rising since the beginning of the year. In the first quarter, residential investment still reduced GDP.

Growth in the euro zone was confirmed with an increase of 0.3% (annualized) quarter-on-quarter. The GDP components have not yet been published. However, the 0.6% (annualized) contraction in industrial production in the first quarter suggests a contribution to growth in the service sector.

Pressure for further key interest rate hikes remains in place

At the same time, employment in the euro zone increased by 2.4% (annualized) quarter-on-quarter. The labor market thus remained tight. In March, the unemployment rate reached an all-time low of 6.5%. Thus, the mismatch between a tight labor market and weak economic growth remains in the euro zone as well. The result is a deterioration in labor productivity and increasing pressure for higher unit labor cost growth.

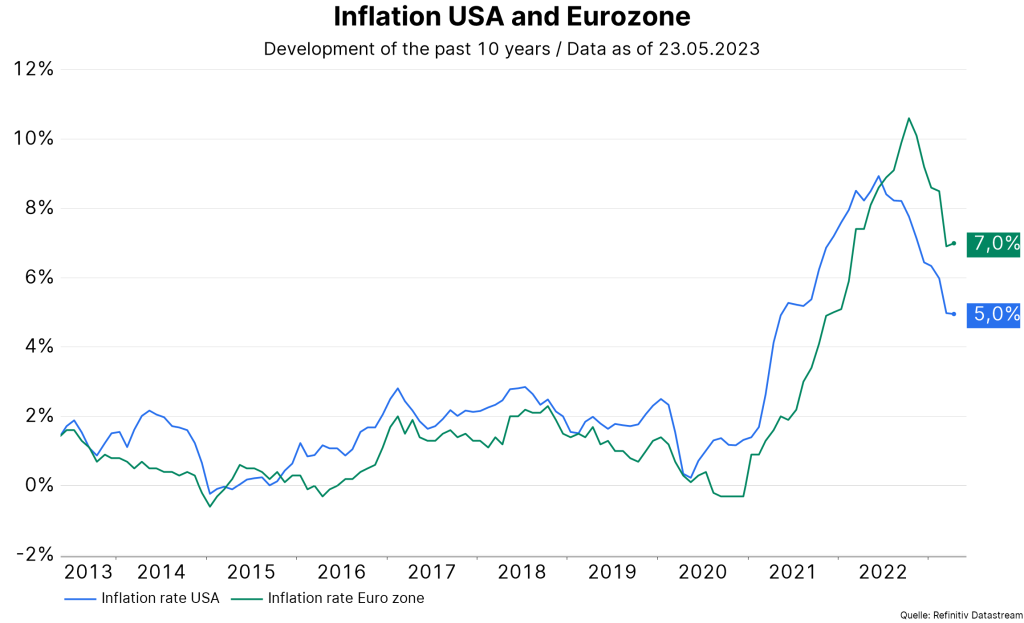

The latter is an important determinant of long-term inflation developments. Consumer price inflation was confirmed at 7.0% y/y for the month of April. The European Central Bank thus remains under pressure to raise key interest rates further. The main refinancing rate currently stands at 3.75%. However, the further tightening of lending guidelines and the further decline in demand for credit reduce the potential of total future interest rate hikes.

Growth risks

At the same time, in the USA, the Conference Board’s Leading Index declined for the thirteenth time in succession, once again pointing to recession risks. In addition, the numerous survey-based reports from the regional central banks (NY Fed, Philadelphia Fed) are tending toward weakness.

In Germany, the ZEW index (for expectations), an important barometer of investor sentiment, fell for the third month in a row. Between October and February, the index showed a strong recovery, influenced primarily by the sharp drop in energy prices. In the meantime, sentiment has clouded over again.

On the market side, the ten-year yield on US government bonds is around 0.6 percentage points below the two-year yield. This describes a so-called inverse yield curve and is a reflection of a restrictive monetary policy with the associated recession risks. However, the market is increasingly focusing on the possibility of a technical bankruptcy of the USA.

Negotiations on debt ceiling

In June, the USA will probably reach the limit above which the Treasury is not allowed to increase the debt any further (debt ceiling). This means that the USA would not be able to service its financial obligations. Negotiations between US President Joe Biden and Speaker of the House of Representatives Kevin McCarthy on Tuesday night again ended without a result.

The problem is the pronounced polarization of the two parties, the Democrats and the Republicans. A technical bankruptcy of the US would trigger a strong uncertainty, because the government bond curve is the most important reference for the entire global financial market.

The working assumption is a further postponement of reaching the debt ceiling by a few months. Any timely agreement between the two parties would likely involve significant government spending cuts. Technically, this would have a dampening effect on the economy, which would help monetary policy in reducing inflation. In addition, as in the eurozone, there has been a further tightening of lending standards and a decline in the demand for credit.

Mainly because the various measures of underlying inflation have fallen more in the US than in the eurozone, unlike the ECB, the US central bank may pause in the rate hike cycle in June. The upper range for the effective key interest rate is currently 5.25%.

Conclusion

On the positive side, published growth indicators are consistent with a “soft” landing. That would mean weak economic growth, falling inflation and a foreseeable end of key rate hikes. This scenario currently appears to be reflected in market prices.

On the negative side, the full effect of the key rate hikes on growth will only become visible with a considerable time lag. Moreover, the decline in inflation may be too slow or inflation may stabilize above the central banks’ inflation target. Because economic growth in the developed economies is already meager, not much is missing for a contraction. Recession risks remain uncomfortably high.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.