At a glance

• AI hype remains the dominant topic

• US budget dispute resolved

• Peace negotiations between Ukraine and Russia

• Nvidia impresses with strong results

The market has recently been wavering between hope and scepticism with regard to AI. In November, concerns about markets running too far ahead briefly prevailed. However, the temporary weakness in prices did not last too long – driven by renewed expectations of a possible US interest rate cut in December (which actually followed last week), prices quickly reversed course.

Artificial intelligence remains the dominant topic on the capital markets, both in a positive and negative sense. While hopes for future productivity gains fueled prices over the course of the year, these hopes briefly gave way to skepticism in November. Almost all media outlets – from small regional newspapers to renowned financial journals – discussed the possibility of an “AI bubble”. The mere fact that “everyone” is talking about it tends to argue against a speculative bubble. Investing in securities involves both opportunities and risks.

Note: Please note that an investment in securities entails risks in addition to the opportunities described. The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

Anatomy of a speculative bubble

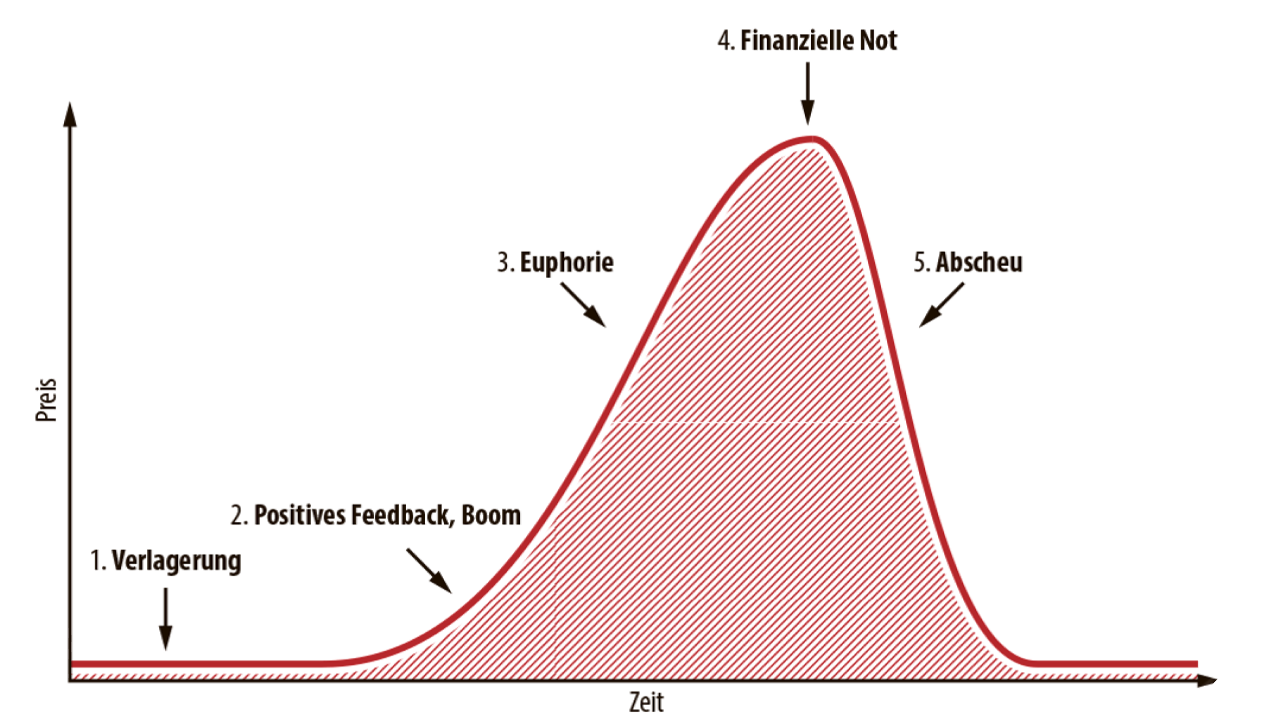

One of the most famous speculative bubbles dates back many centuries, when the well-known tulip bulb bubble burst in Holland in 1637. The phenomenon of speculative bubbles has therefore been known for a long time, yet there is still no accepted definition or even a sound method for recognizing them. Economist Charles P. Kindleberger attempted to model the “ideal-typical speculative bubble” and describes it in five phases, as shown below.

According to this model, the first phase is a shift phase, in which external events can fundamentally change the markets. According to Kindleberger, this is followed by a credit-financed boom phase, which leads to absolute euphoria among investors. In this phase, market participants act irrationally, and market prices significantly exceed the real value of the investments. The turning point – when the first doubts set in – is often initiated by interest rate increases, and finally “disgust” sets in, where sheer panic among market participants leads to a decline in price gains.

Applied to the current market phase, some of these points certainly apply. AI is revolutionary in nature – the shift in investments is in full swing and we can certainly speak of an investment boom, albeit one that is not credit-financed. A certain euphoria is also evident in some sub-segments – second-tier companies in particular seem to have lost their sense of proportion in some cases. With regard to the overall market or the tech giants, we do not see any signs of a bubble – valuations are above average, but corporate profits are also rising disproportionately.

Nvidia delivers once again!

Setbacks such as those seen in November are no surprise given the high valuations and could, or will, be even greater if profits disappointed. However, predicting this is anything but reliable. The current picture is different – Nvidia’s figures remain good, with annual revenue and profit growth in excess of 60%.

In addition, the general investment environment remains constructive – corporate profits are rising, the economy is growing, and we are in a cycle of interest rate cuts. We are therefore confident about the coming months. We expect this to be accompanied by increased volatility, i.e. fluctuations. A balanced portfolio structure is the order of the day. Please note the opportunities and risks associated with investing in securities.

How is asset management positioning itself?

The general investment environment remains positive—corporate profits are rising, the economy is growing, and we are in a cycle of interest rate cuts. We are therefore confident about the coming months. However, we also expect these months to be accompanied by increased volatility, i.e., fluctuations. A balanced portfolio is therefore the order of the day, and we continue to focus on this in our asset management activities.

Despite the positive long-term outlook, we are currently “only” neutral toward risky securities such as stocks and alternative investments in our asset management activities. On the one hand, as mentioned above, we expect further fluctuations on the equity side. On the other hand, we see a consolidation phase for gold and commodities following the rapid price developments of the current year. When selecting themes, however, we are still focusing on the momentum of the technology sector, which we are playing via the technology stocks theme block in our Autopilot portfolios.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.