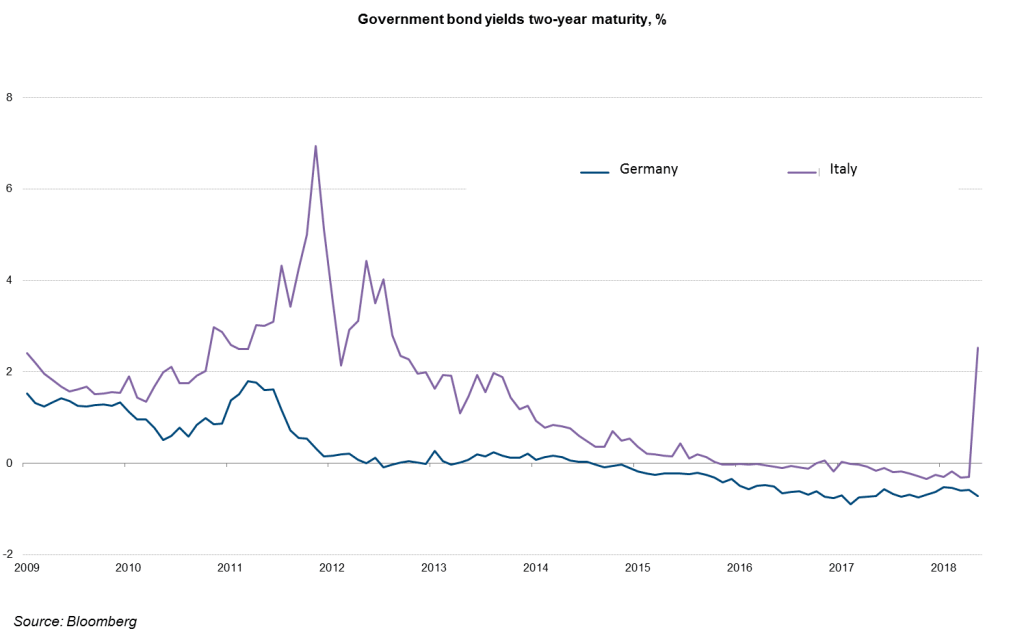

The heightened uncertainty over whether Italy will repay its debts and whether it will remain a member of the eurozone has led to a sell-off in securities. The key benchmark, the yield on two-year Italian government bonds, rose from minus 0.30% in early May to 2.50% on May 29 (source: Bloomberg).

Note: Past performance is not indicative of future development.

Stagnation leads to dissatisfaction

The starting point is the stagnating level of prosperity in Italy. The real gross domestic product per capita last year was at the level of 1999, at around 34,000 US dollars, adjusted for purchasing power, (Source: IMF). This stagnation has led to increasing dissatisfaction with the established parties and the EU. This resulted in gains for the two populist parties M5S and Lega in parliamentary elections last March.

… and to populism

In recent weeks, one could follow what it means when populist parties can determine government affairs. 1) increase in government spending, 2) tax cuts, 3) disregard of treaties with other countries (Eurozone regulations), 4) fiscal stimulus takes place in the “boom” phase of economic growth (real GDP growth of 1.5% in Italy in 2017 was very good.) Sounds almost like Trumponomics. The measures announced have shaken investors’ confidence because they are in conflict with low competitiveness, the high public debt level (2017: 131% of GDP, source: IMF) and the architecture of the Eurozone, whose survival depends on the good conduct of member countries.

It is likely that the new interim Prime Minister Carlo Cottarelli appointed by President Sergio Mattarella will not win the vote of confidence in Parliament. This will be followed by new elections in autumn with a similar result as in March. The statements during the election campaign will at least not be particularly trust-promoting.

Confrontation with the eurozone

For the long-term existence of the Eurozone further communitarisation steps are necessary. Several suggestions are at the table will be processed in tough negotiations. These include the upgrading of the European Stability Mechanism (ESM) to a European Monetary Fund (EMF) and the introduction of an EMU-wide guarantee scheme for bank deposits. With the statements of the two populist parties in Italy, further integrative measures have become (even) less likely.

Protection mechanism with horse foot

Compared to the Euro crisis 2011/2012, there is one important difference: Two bailouts funds have been created. 1) As part of the Outright Monetary Transactions (OMT) program, the European Central Bank can buy unlimited short-term government bonds in the event of a crisis. 2) The ESM (European Stability Mechanism) can provide loans and guarantees to countries that are limited in amount. The horse’s footstep in this case becomes obvious: it only gives support if a EU member country accepts the economic policy conditions associated with the aid (= austerity, de facto partial loss of state sovereignty).

Whatever it takes

The main burden for the unity of the eurozone continues to lie at the ECB. As far as she can, the European Central Bank will try to stabilize the situation. The rationale will be the guarantee for the functioning of monetary policy throughout the euro area. One has to think of the famous three words of ECB President Mario Draghi in the summer of 2012 (“Whatever it takes”), which managed to calm the euro crisis at that time.

In fact, the ECB can take its time with the targeted reduction of its extremely expansionary monetary stance: 1) Economic growth slowed significantly in the first quarter compared to the fourth quarter (0.4% quarter-on-quarter after 0.7%, source: Eurostat). 2) More importantly, at 0.7% annual inflation, the core inflation rate is very low (source: Eurostat) and will only increase slightly in the coming years in the most likely scenario.

The next meeting of the Governing Council of the ECB on 14 June therefore is particularly important. Market participants’ expectation that the press statement on the financial environment will be dim – with appropriate measures in the event of an escalation – is likely to be ample. As a reminder, the bond purchase program runs until at least September 2018 and can be extended if necessary.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.