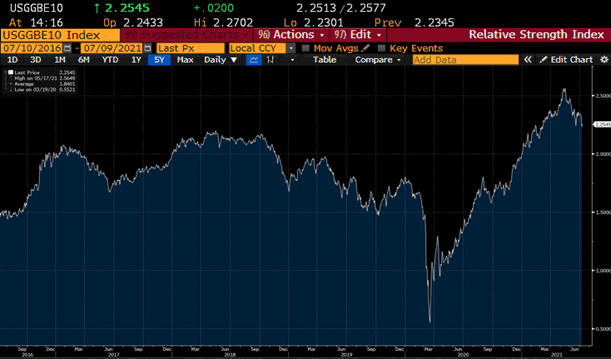

At the beginning of June, I wrote about how inflation became the dominating concern for equity investors. Barely a month later, the picture seems to have changed significantly. Inflation expectations in the US and the Eurozone peaked in May and have declined from there. Long term yields, especially in the US, fell even more sharply, thereby lowering real yields (=nominal yield–inflation rate). Cyclical and value stocks are being sold off and defensive growth stocks like Apple, Google or Microsoft jumped to new record highs. So what happened?

Strong H1 and trend reversal in May

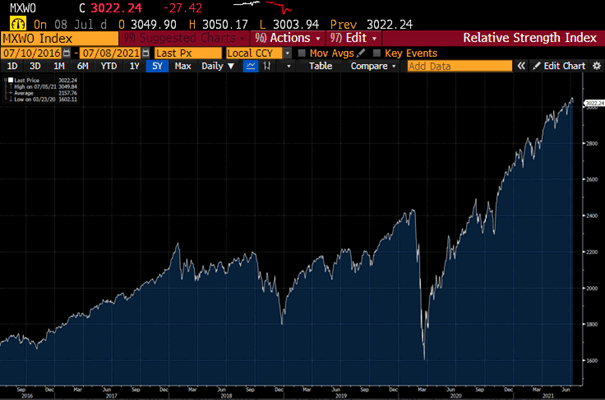

All in all, equity markets had a superb performance in the first half of the year. All major US indices advanced by double digit percentage points, and the same was true for MSCI World and broad European indices like the Eurostoxx 50 or the Stoxx 600. There were various reasons for this solid performance, most of which are still in place. Fiscal and monetary policies remain very loose, making sure that consumers have enough money to spend and can borrow cheaply. Vaccination in the developed world gained speed ahead of the summer season, which now makes cross-border travel possible for many. Pent-up demand is driving corporate earnings, which in turn leads more and more companies to raise their capex budget in order to increase production and to be more efficient.

The steady progress towards life returning back to normal was especially beneficial for cyclical and value stocks, since earnings of such companies react more quickly to an improved economic environment (s. also https://blog.en.erste-am.com/how-are-global-equity-markets-doing/). Until June, these sectors outperformed significantly, helped by an increase in long-term yields, higher inflation expectations, and a steepening yield curve, which measures the difference between long-term and short-term yields. A steeper yield curve is seen as a sign of strong economic growth prospects.

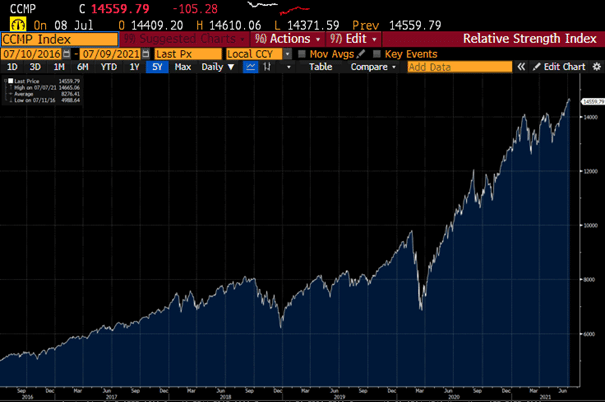

However, the dominance of the value style came to a halt in mid-May as market participants started lowering their inflation forecasts. For months, the Fed tried its best to assure investors that elevated levels of inflation will only be transitory and eventually these efforts started to bear fruits. Even though US CPI data – a commonly used measure for the inflation rate – increased even further in May, the market took it with ease and bond yields fell. Lower yields led to a revival in growth stocks especially in the US and the tech-heavy Nasdaq index aimed for new all-time highs after having underperformed the S&P 500 since the start of the year.

The Fed meeting

At the time of the FOMC (Federal Open Market Committee) meeting in June, 10-year yields in the US had already been declining for about a month and growth stocks were closing in on their performance gap vs. value stocks. The Fed hit a surprisingly hawkish tone, saying that inflation could potentially end up higher and more sticky than previously anticipated. Policymakers raised their inflation and GDP growth forecasts for this year quite substantially. Also, Fed members signaled that they now expect two rate hikes by 2023, whereas they did not forecast any until 2024 previously.

The market needed a couple of days to digest this news but in the end decided to continue where it left off before the Fed meeting: long term yields declined further, cyclicals were sold off, and defensive growth stocks gained. To understand the reaction, it is worth highlighting again that just about a month ago, inflation was viewed as THE number one fear on the market. Investors were worried that the Fed would ignore high inflation data for too long and that it would then be too late to rein in unintended price increases in a timely manner. The Fed did in no way sound alarm, but by pulling forward its rate hike forecast, market participants were relieved that the central bank is NOT ignoring the problem and stands ready to act.

Now as it often happens, the market went from one extreme to the other. While we started off with fears of (hyper-)inflation, the Fed`s hawkish tilt seems to have been enough for some to assume that policymakers will in no way let inflation run loose and that monetary policy will be tightened sooner rather than later, which will hurt economic growth and will shorten the economic cycle. Basically, this is what the sharp decline in 10-year US yields, the flattening of the yield curve and lower inflation expectations are telling us.

Risks to growth

Currently, there are three main risks to the economy. The first is the above discussed tightening policy of the Fed. I do not believe that this risk is real. Yes, the Fed upped its inflation and growth forecast for this year and pulled forward the expected timing of a first rate hike to 2023, but this should not come as a big surprise in light of the strong inflation data we have seen recently. Also, the central bank barely made any changes to its forecasts beyond 2021 and more importantly, it did not make notable changes to its labor market expectations. The Fed has a dual mandate, and its chief Jay Powell puts great emphasis on developments on the job market. Therefore, one should not assume a significant tightening in monetary policy before employment comes close to pre-pandemic levels, which is still further away.

The second risk is the spread of the delta variant. This does indeed pose a tail risk, should the virus force a new wave of lockdowns in the coming months. Current data seems to suggest that while the delta virus is more infectious than its predecessor, thanks to the improving rate of vaccination, the infections do not necessarily result in hospitalization or death. If it stays this way, this risk will also likely prove to have been exaggerated.

The third theme is about peak growth. As last year`s pandemic induced economic shock was very sharp and very fast, the recovery which followed mirrored the same traits. While it is true that growth rates for both GDP and earnings should come down from here, it is worth noting that the world economy and also corporate earnings are expected to remain in healthy expansionary territory for quarters to come (s. also https://blog.en.erste-am.com/falling-economic-momentum-is-not-bad-news/).

Is this the end of the reflation trade?

Most likely not. As discussed above, the recent decline in long-term yields seems to discount too many risks to growth. The only thing which is certain is that growth rates for GDP and corporate earnings have peaked or will do so soon – but that in itself does not mean, that we could not see solid growth above trend for the coming quarters. Supportive fiscal and monetary policy, as well as vaccination and pent-up demand will be key drivers. Tactical factors could have also played a role in the recent increase in bond prices (when bond prices increase, yields decline), as many investors did not want to hold fixed income securities back when inflation was their main concern.

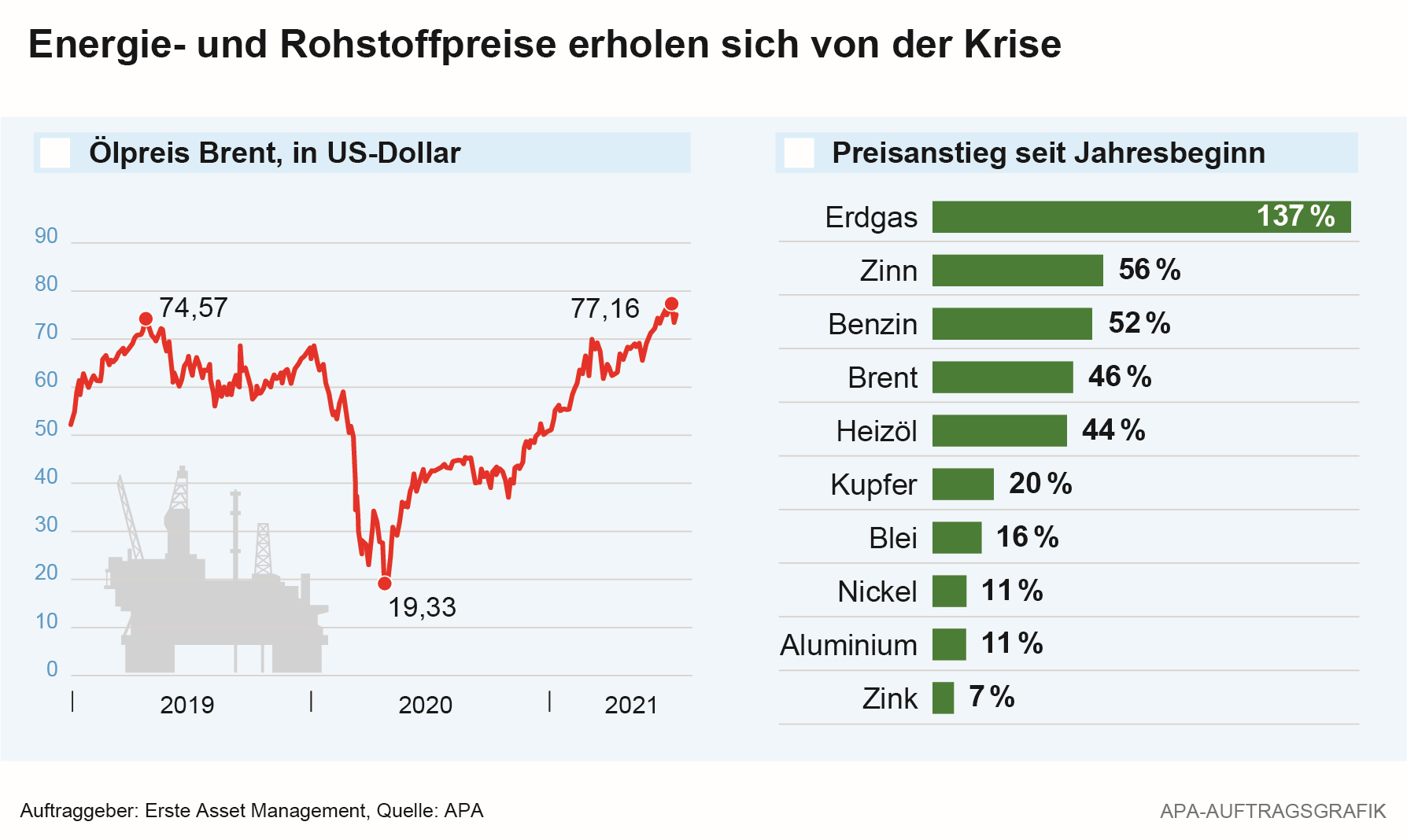

All in all, I view the decline in yields and inflation expectations as an overreaction which should correct over time as growth concerns ease. When this happens, certain value sectors like banks will have a lot going for them: long term yields will rise along with real yields and the yield curve will start to steepen again. Also, inflation expectations will likely rebound from current levels if inflation data continues to surprise to the upside and the oil price stays at elevated levels.

On a 12-month basis, I would even make the case that after the recent correction in cyclicals and the depressed base of certain market movers which correlate positively with cyclical and value stocks (e.g. long term yields, real yields, inflation expectations, steepness of the yield curve), the upside for these type of stocks even improved. The big question going forward is the one of timing: at what point in time will solid economic data and high levels of inflation lead to higher long-term yields again? In the short term, chances are high that the market will ignore such data as it has been doing since mid-May with the argument that inflation is only transitory, the Fed will act if necessary and there are many risks to growth on the horizon. Until this is the case, most investors will position themselves for an uncertain low-growth environment which will result in the buying of defensive growth stocks like the big US tech or healthcare companies and safe-haven government bonds.

The good news is that so far, the decline in cyclicals went hand in hand with new all-time highs in defensive growth stocks. While there is strong movement beneath the surface on a sector level, broad indices like the S&P 500, the Nasdaq index or the European Stoxx 600 are trading around record levels. A balanced portfolio stays warranted, with a tactical overweight in defensive growth but improved upside for value stocks in the longer term.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.