Christian Gaier, senior fund manager of government bonds of emerging markets

The 4th BBVA Latin American Local Markets Conference in London gave me the chance to speak in detail with some local Latin American representatives. In the following, I would like to share some of the insights I gained from these conversations and the narratives that may affect 2018.

Latin America (LATAM) had a great year in 2017, but 2018 is set to be slightly different. Selectivity will be key in assessing opportunities on the continent in 2018. In countries like Brazil, Columbia, and Chile, we expect the respective easing cycle to come to an end, while in countries like Argentina and Mexico the market focus will be on the development of inflation. With elections coming up in Brazil, Colombia, and Mexico this year, political risk will fuel volatility. Also, international trade ties within NAFTA and Mercosur are subject to negotiations.

Risks mainly stem from the tightening by FED, ECB and BoJ

The risk themes in 2018 are mainly based on the tightening of liquidity by the FED, the ECB and the Bank of Japan, on a stronger USD, and on higher real interest rates that could weigh down the growth potential on the continent. Lastly, one also has to bear in mind China’s managed slowdown in economic growth and its effect on international trade and commodity prices.

Uruguay is the newcomer

Uruguay, a newcomer in international local markets issuing its first nominal bond in 2017, proved to have done its homework. Uruguay offers one of the most attractive macro profiles in Latin America. Its yield remains attractive, which is why it represents a good investment opportunity within the context of emerging local currency funds. The country managed to decouple from its neighbours Argentina and Brazil and has attracted foreign direct investments building new industries. It has invested in public infrastructure, which in turn has created jobs and generated potential for future prosperity. Politics appear stable compared to its peers, and based on institutional stability indices like rule of law, democracy and corruption, the country is ahead in almost all statistics in the region.

Brazil in a year of transition

Brazil has been the great recovery story of recent years since the crisis-ridden 2015. It has experienced a drastic decrease in inflation to all-time lows, and the central bank cut key-lending rates from 14.25% in 2016 to 6.75% on 7 February, with the end of the easing cycle in sight. Given the corruption scandals in recent years, the presidential and national congress elections on October will be of central interest for the market participants.

Mexico and Trump

The same focus on presidential and congress elections will be the case in Mexico in July. The economy in the country is under pressure due to President Trump’s protectionist measures and to the ongoing renegotiations of the NAFTA agreement that increase the uncertainty for the Mexican economic model. The economy is in transition, with the government and the private sector making efforts to diversify the country’s export destinations. In recent months, the economy has seen good support from local demand; also, a trend has emerged with the service sector gaining importance as a growth driver.

Peru with good fundamentals

Another story I want to focus on is Peru. The country has seen good fundamentals, with the primary sector losing importance with regard to its contribution to the gross domestic product (GDP). The economy has shown signs of becoming more independent of commodity exports and the commodity price cycle. From our point of view, the expansion by supporting downstream integration of the value chain is one of the core economic development stories in the emerging markets as in the long run it leads to prosperity. We will be closely monitoring fiscal consolidation and the development of institutions.

Venezuela not investible

For us as a local currency investor, Venezuela which is in a severe recession and undergoes a substantial national crisis, is not investible. The currency is not free convertible and the country is rated by international agencies as default.

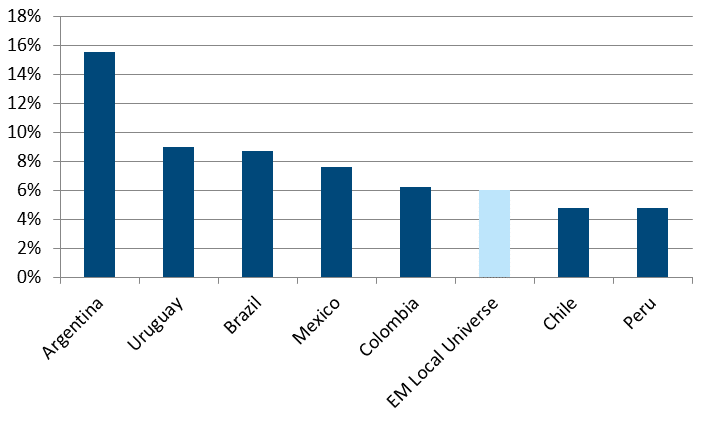

Latin America is the high-yield region in the emerging markets local currency universe

In summary, Latin America is the high-yield region in the emerging markets local currency universe. We can see a similar picture when looking at the hard-currency spreads. This high carry compensates for the risks taken when investing in LATAM.

Yield overview of local currency bonds of selected Latin American Countries:

Data as of 31 January 2018; Source: Bloomberg

Please note: the ratio “yield” equals the average yield of the securities issued by the respective countries before any costs; please note that this ratio is not equivalent to performance. The ratio “yield” is not a good estimate for the future performance (i.e. the development of the value of the bonds). The above-cited numbers do not account for any fees reducing returns such individual account or depositary fees or taxes.

If you would like to participate in the Latin America story, we actively invest in the region and manage the risk in the following products:

https://www.erste-am.at/en/private-investors/funds/erste-bond-local-emerging/AT0000A0AUE0

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.