As part of the IMF and World Bank annual autumn meeting, numerous (virtual) events were being held on the topic of emerging economies. Let us summarise the most important issues and findings for emerging markets investors.

The biggest risks perceived for the emerging markets are less of an idiosyncratic (i.e. individual) and, not surprisingly, more of a global nature. Above all, the normalisation of the monetary policy, driven to a large degree by the US central bank Fed, will affect the emerging financial markets. This goes in tandem with worries about inflation and the interest rate hikes that have already started. It is followed by the global energy crisis, the so-called commodity super-cycle, and concerns about economic growth, which are largely derived from the reorientation of the Chinese economic policy.

Change of course in China’s economic policy

The change of course in China’s economic policy along the lines of the Common Prosperity maxim is expected to cause economic growth in China to slow down possibly below +5% per year in the coming two to three years. The participants at the annual meeting expect the Communist Party to intervene more prominently again in the politico-economic arena. The Party has already announced stronger fiscal stimuli. So far, however, nothing specific has materialised. The goal is to double GDP per capita in the coming 15 years. We are yet to see relations between the USA and China improve. Instead, we do notice a solid degree of scepticism across the aisle in the USA, even after Trump. That being said, the attitude of investors vis-à-vis China is generally positive.

Global interest rate hikes make refinancing harder for emerging economies

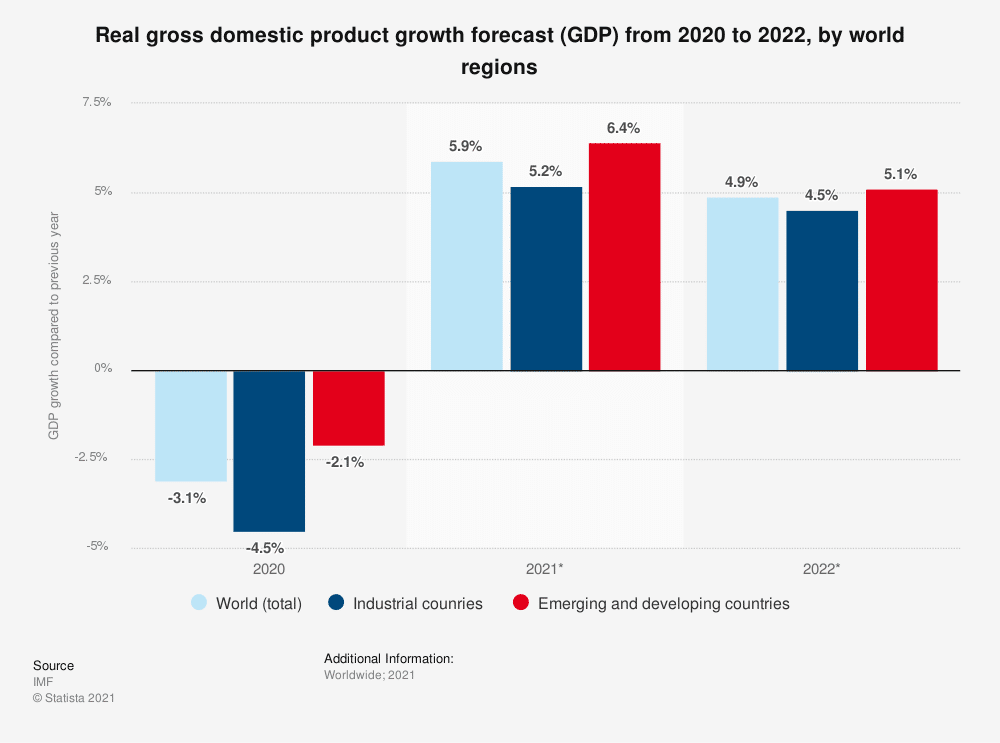

Global interest rate hikes make refinancing harder for emerging economies. The covid crisis has caused debt levels to rise in most emerging economies, but the absolute numbers are below industrialised levels. The level is considered administrable and not problematic to the system. Moratoria of payments by states and companies are not regarded as immediate risk. At the meeting, almost all emerging economies presented programmes aimed at cutting their debt. At the moment though, only oil-exporting countries have wiggle room for tax incentives. As for monetary measures, many emerging economies are ahead of the developed economies and have already started their cycle of interest rate increases. For example, the Russian central bank reacted to the high rate of inflation by raising its interest rates by an unexpectedly substantial degree in October.

Successful refinancing on the local market

Emerging economies can – and do at increasing rates – successfully resort to local capital markets for refinancing. Real interest rates remain negative especially in Latin America.

The frontier markets, a new segment of emerging markets, seem largely over-invested. Those are relatively small, less liquid markets. In this segment, investing has to be done very selectively. Here, energy exporters have a more interesting risk profile.

Left populism in Latin America

In Latin America, we can see a tendency towards left populism, as substantiated by the recent presidential elections in Peru, Ecuador, and Nicaragua. The imminent elections in Columbia and Chile are also likely to swing left. To be fair, the aforementioned countries have/had been run by weak governments with insufficient representation in their respective parliaments, which are strongly fragmented. This results in a lack of leadership on the one hand, and in a reduced risk of traumatically unorthodox economic policies on the other hand.

Unfortunately, the G20 common framework (i.e. debt reduction programme for the poorest debtors) has remained rather without bite so far. Here, there is a clear need for acceptance and technical understanding. In an investor survey, all emerging markets asset categories were considered under-invested. From a technical perspective, this aspect should be an advantage.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.