When the US inflation numbers were released for May 2021, many market participants were surprised by the drastic increase in the consumer price index. In May alone, it was up 0.6%, which is substantial – especially when we take into account that in the previous months, inflation had been fundamentally insignificant.

As a consequence, many economists started to scrutinise inflation data and found that, with a share of 30%, used cars were the prime “culprit” in this trend. For the first time, new cars had the chance of gaining value instead of losing it after a certain period of operation.

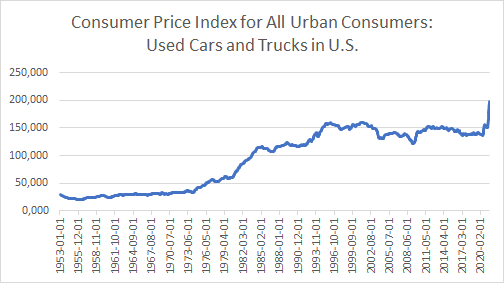

Consumer price index for used cars in US

Index 1982-1984=100 U.S. Bureau of Labor Statistics, Federal Reserve Economic Data, own graphic

There are numerous reasons for the strong price increases. The vehemence of the process is also remarkable.

The first reason is the covid-19 pandemic. When businesses came to a halt in April 2020, so did demand for rental cars. Many rental car companies were forced to reduce their fleet or, in some cases, sell it altogether to keep the balance sheet structure viable. Overnight, used car prices fell off a cliff.

As the vaccination programmes are making progress, rental car companies have started to build up their fleets again. The customers began to book individual, safe itineraries off the beaten path due to the still existing, latent risk of infection. This caused an uptick in demand for cars.

New cars are becoming scarce

The car manufacturers are having a hard time filling this increase in demand – as I know from first-hand experience.

As a father of two, I know that the demand for toys remains relatively constant over the life of a child. However, the toys themselves and the means of transport are growing alongside the child. Whereas the suitcase of the average father shrinks over time, children grow. Therefore, we decided to buy a new car this year.

Normally, you would expect the delivery of a new car within four months. In our case, we have to wait for eight months. The car dealer told me that many components suppliers are way behind their production targets. Given that many production lines had to close during the lockdown and these parts now have to be produced to close the gap, the sector cannot provide the usual delivery frequency while sticking to a just-in-time scheme. This is not only due to the often-quoted problem with outstanding deliveries of semi-conductors, but to issues across the entire supply chain.

Two to four million cars not built in 2021

Let us clarify this situation on the basis of some data. The production of a semi-conductor takes six weeks to three months, depending on the features. Taking also into account the fact that for this reason two to four million cars were not built in the first half of 2021, we find that there is a massive need to catch up. This gap will not be closed quickly.

Did you know that a modern, medium-sized car contained up to 1,400 computer chips? I did not. This number is going to increase further because of the development of self-driving cars and the trend away from a combustion engine towards electric vehicles.

This is also supported by the following chart, which compares the market of new cars with it used car counterpart. The new car market is slowly catching up and has also been on the rise since Q2 2021 as well.

The time has probably come for many car owners to buy a new car and/or to think about switching to a “clean” model. The climate plan of the European Commission (“Fit for 55”), which calls for the end of the combustion engine by 2035, forces the producers to rethink their strategy towards electric vehicles or alternative forms of propulsion.

New technologies will be available more easily and faster. Big cities have started to plant greenery in the inner urban areas due to climate change and to reduce the number of parking spaces.

CONCLUSION

The coming years will be very exciting, with the development making rapid inroads. Two things are clear: it will be sustainable and entail a quantum leap in technology. My old car has served me well in the past twelve years, but now it is time for a cleaner alternative.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.