Climate change has become a mainstream issue of society as an omnipresent topic. The risks and opportunities associated with climate change have an impact on all regions and economic sectors. To ensure that climate factors do not remain a marginal topic when investing, we have included them at the centre of our decisions relating to fixed-income assets (corporate bonds).

Integration into the investment process

In order to standardise the consideration of climate opportunities and climate risks and make them as accessible as possible, we have placed them at the heart of the investment decision and integrated them into the investment process. This comes with the upside that climate factors are visible, standardised, and comprehensible. It also emphasises the universal importance of climate targets in our fixed-income funds.

Another important factor is that the investment process is applied to all our fixed-income funds. This means that all our corporate bond funds reflect climate factors, regardless of whether a fund already takes other ESG criteria into account or not.

In order to achieve this goal in the best possible way, we have not just expanded our investment process in one place, but in three. This approach allows for the analysis of climate factors from different angles and for their incorporation at various points in the process. These three approaches are made up by:

- An avoid list

- The expansion of our quantitative models

- A quintile approach at fund level

We will briefly discuss these three approaches below.

Excursus: What is an investment process?

An investment process is about structuring investment decisions. This process helps to reconcile various market aspects, quantitative models, and the qualitative assessments by the portfolio manager. The aim is ultimately to take better and more comprehensible decisions, seize opportunities, and minimise risks.

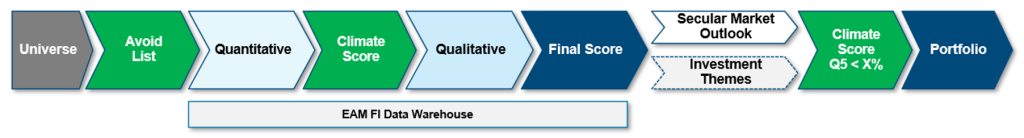

The chart illustrates the investment management process for our fixed-income funds. The three steps highlighted in green have been added to accommodate climate risks and opportunities into the process. Source: Erste Asset Management

1. Avoid list

The avoid list stands at the very beginning of the investment process and is the first filter to keep climate offenders out of our funds. This is an exclusion of companies that engage in particularly climate-damaging behaviour. These companies are excluded from the outset and are therefore not even given the chance to make their way into our funds. To this end, our internal Responsible Investments team has drawn up a list of companies that generate a large proportion of sales from the extraction or processing of coal.

These roughly 300 companies are not included in the investable universe and are instead excluded as particularly harmful climate offenders. Since, as already mentioned, the investment process is applied to all our credit funds, not a single company on this list is in any one of our funds.

2. Quantitative approach

The second and probably most complex variable that we have adjusted in order to make our investment process climate-proof is the expansion of our quantitative models.

Previously, the quantitative approach would consist of three models that attempted to analyse the attractiveness of investment opportunities from different perspectives. These three models are a factor model, a rating model, and an excess spread model. Without going into detail for any of the models here, we can say that they are aggregated to form an EAM fixed-income quantitative score. This means they provide an indication of whether an issuer appears attractive or unattractive from a quantitative perspective.

The aspects of climate opportunities and climate risks had previously not been mapped onto any existing model. In order to analyse issuers from a climate perspective, our Responsible Investments team has therefore developed its own climate score. The climate score maps a company’s climate factors from various aspects that are typical for the company’s respective industry.

In order to make its way into the fixed-income quantitative score (EAM Fixed-Income Quant Score), four rather than three models are now aggregated. As a result of the expansion, the weighting of the other models has been reduced in the final Quant Score in favour of climate factors. This means that the climate effect of each company can now also be quantified. In practice, companies with a poor climate score thus become quantitatively less attractive and climate leaders improve in the quantitative ranking.

Excursus: What is the climate score?

The climate score is based on three pillars: an aggregated environmental factor score, the historical trend in C02 emissions, and an environmental score. For the aggregated environmental factor score, environmental risks and opportunities that are typical for the industry of each company are quantified. This includes factors such as biodiversity or water consumption on the risk side and factors such as sustainable energy on the opportunity side. The historical trend of CO2 emissions takes into account the absolute emissions of a company as well as the intensity of emissions relative to the company’s sales volume. The environmental score is a weighting of environmental indicators provided by third-party partners.

These three indicators are then aggregated into a climate score and scaled in a range of 1 to 10. Companies with a score of 10 can be classified as climate leaders, and companies with a score of 1 as climate offenders.

You can read more about the climate score in this blog post 👉 Climate Score: How we can identify sustainable leaders and laggards – Erste Asset Management (erste-am.com)

3. Quintile approach

We set the final variable at fund level, with a so-called quintile approach. Here, too, the climate score and the extent to which each individual fund is exposed to environmental risks play a decisive role.

For this approach, we divided the companies into quintiles on the basis of their climate score. The first quintile therefore contains the companies with the highest climate score, whereas the fifth one contains the companies with the lowest score.

We now take a bird’s eye view of each fund and calculate the percentage of companies per fund that are in the fifth quintile. Let’s assume a fund has invested in 100 companies with equal weightings. According to the climate score, 10 of these companies are particularly bad and in the fifth climate score quintile. As a result, the fund has 10% exposure to the fifth quintile.

The goal of this approach is to keep the proportion of companies in the fifth quintile below a certain threshold and thus minimise the exposure to climate risks at fund level. Conversely, this means that companies with a better climate score are increasingly represented in the fund and climate opportunities are thus actively taken.

Conclusion: minimise climate risks – seize climate opportunities

To summarise: we have integrated climate factors into our investment process at various points. This allows for climate risks and climate opportunities to be presented in a better and more comprehensible way. They are therefore not just a side issue but are at the core of the investment decision.

We should like to point out again that the investment process applies to all fixed-income funds, regardless of a fund’s other ESG classifications. Our clients can therefore be sure that climate risks are actively minimised and climate opportunities are actively seized in all our fixed-income funds.

Info

You can find out more about our sustainably managed bond funds on our website. There you can also search specifically for sustainable fixed-income funds.

This article is part of the July 2024 issue of our ESGenius Letter. All other articles in this issue, as well as previous versions of our sustainability publication ESGenius Letter, can be found on our website.

👉 Read now

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.