Hopes for an economic recovery, but also the latest inflation fears, have recently fuelled the price rally on the commodity markets, with prices for crude oil and industrial metals continuing to soar. Several metal prices recently rose to multi-year highs; the exception being gold, which is continuing its correction.

Oil prices continued to benefit in February from the prospect of rising oil demand in the event of an economic recovery. Demand, for example, should benefit significantly from normalizing global travel after lockdowns are lifted around the world. According to its last monthly report, OPEC also expects global oil demand to increase in 2021.

The continuation of the expansive monetary policy recently announced by US Federal Reserve Chairman Powell also had a positive effect: the price of North Sea Brent crude oil, which is considered an important benchmark, recently climbed above USD 67 per barrel on the futures market, reaching a 13-month high.

Cold snap in USA and Russia providing additional support for oil prices

In addition to the expectation of an improving economy, some special factors are likely to support crude oil prices, one being a strong cold wave in the US, which gave oil prices an additional boost in February. Freezing temperatures led to extensive production losses and delivery problems in the American oil industry. In Texas, the cold spell brought practically all refinery operations to a standstill, and in Russia, production recently also declined due to arctic temperatures.

The further development of oil prices will probably also depend on the production discipline of the OPEC countries. The oil cartel and its ten cooperation partners (OPEC+) last agreed in January on a largely stable production level for February and March.

Copper price continues to climb towards all-time high

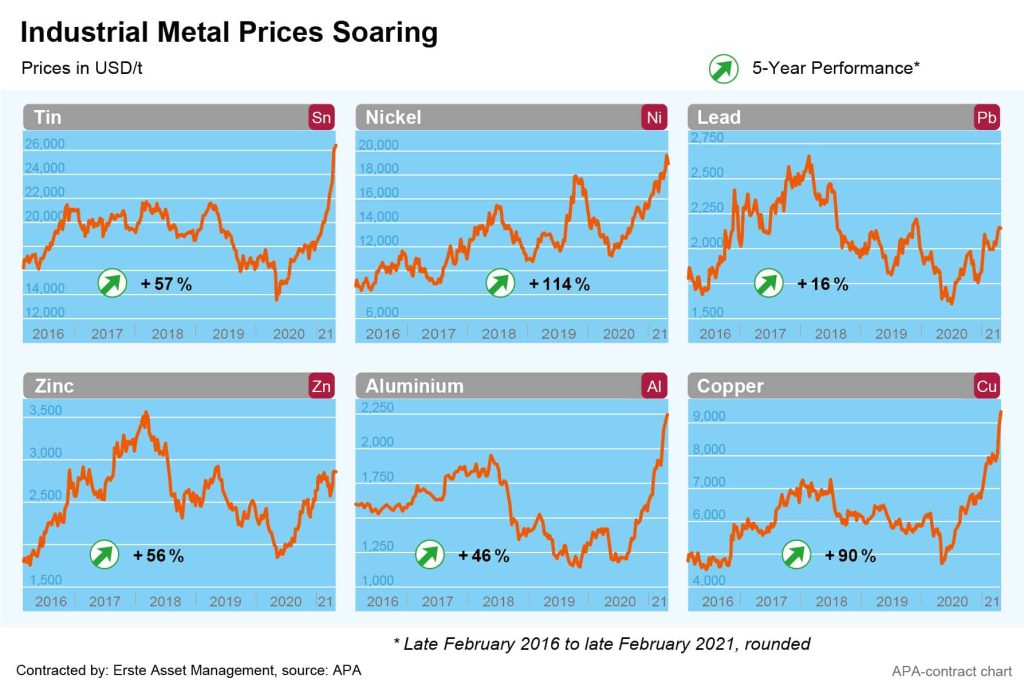

Key industrial metals also continued their price rally with the prospect of an economic recovery and related increasing demand. In February, the price of copper on the futures market intermittently rose to around USD 9,500 per tonne and is thus continuing the ascent towards its all-time high of just under USD 10,200 from 2011. Since its collapse in March 2020 following the escalation of the Corona pandemic, the copper price has thus more than doubled within a year. In February alone, copper recorded the strongest monthly price increase in more than four years.

Copper prices are currently supported by excess demand. According to the latest data from the International Copper Study Group (ICSG), there was a supply deficit of around 590,000 tonnes in the first 11 months of 2020. The Corona-related closures of many copper mines have had a noticeable impact on copper production – notably in the second quarter, at 3.5 per cent reduction year-over-year. According to the ICSG, this was offset by a strong increase in copper demand from China in the previous year.

The copper price should also benefit from the expectation of an economic recovery and thus also a recovery in demand. Copper is by far one of the most important industrial metals and is used in numerous goods, from household wares to industrial plants, for pipes, tubes, precision parts and much more. Copper price is therefore considered a good early economic indicator.

Other industrial metals have also been able to make strong gains recently in the light of a potential economic upturn: nickel prices recently rose for the first time in almost seven years to over USD 20,000 per tonne, doubling over a five-year period.

According to the International Nickel Study Group (INSG), the nickel market recorded its highest supply surplus in seven years in 2020; however, the INSG expects a significant recovery in demand this year. Nickel demand has also recently been driven primarily by China’s strong growth. According to INSG, 54 per cent of global nickel demand is accounted for by China alone, compared to 5.5 per cent in 2000.

Commodity prices should also benefit from the demand of financial investors who want to hedge against looming inflation with commodity investments. The background to this is the recent sharp rise in US bond yields, which had fuelled fears worldwide of rising interest rates and prices in an expected economic upswing.

Gold price suffers from rising bond yields

The gold price, on the other hand, has recently suffered from rising yields and price gains on the stock markets. Both make investing in gold – which is crisis-proof but yields no interest –less attractive by comparison. Gold price thus retraced significantly this year after its strong rise. The price of a troy ounce was at 1,747 dollars at the end of February, suffering a monthly loss of more than 6 per cent, the biggest monthly loss since 2016.

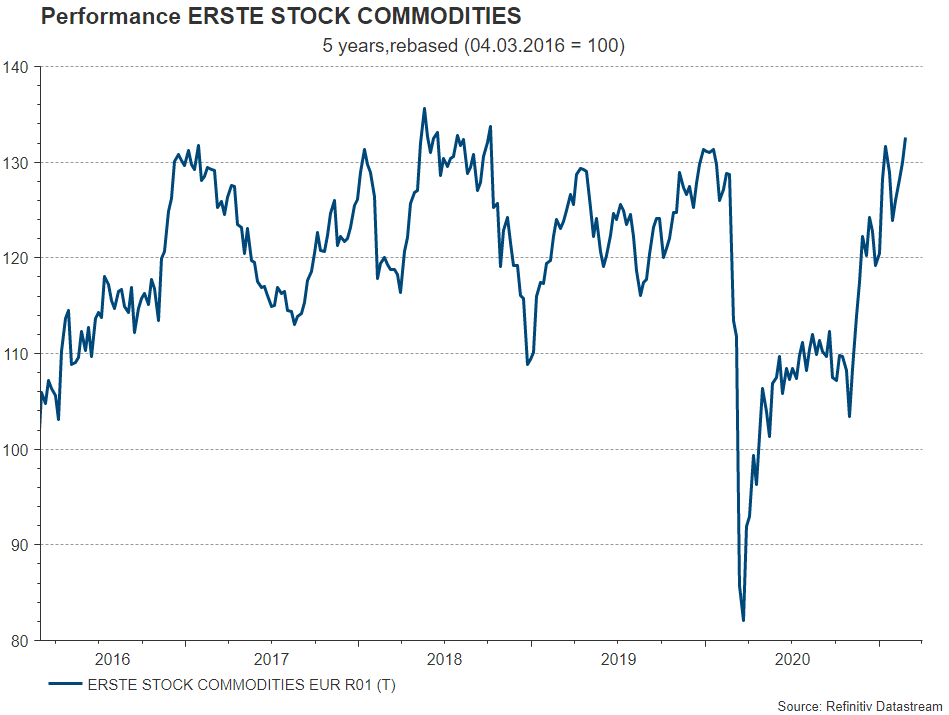

Investing in commodity companies with ERSTE STOCK COMMODITIES

The ERSTE STOCK COMMODITIES equity fund offers the opportunity to profit from a continuation of the recovery in the commodities sector. Companies from the oil and natural gas sector and related equipment, refinery and transport companies currently represent more than half of the fund’s assets. In addition to oil stocks, companies from the metals and mining sector, the steel industry, the paper and building materials industry and gold mines are also represented in the fund. This ensures diversification across a large number of shares and sectors, which is also advantageous from the point of view of the fundamentally higher volatilty of such shares.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.