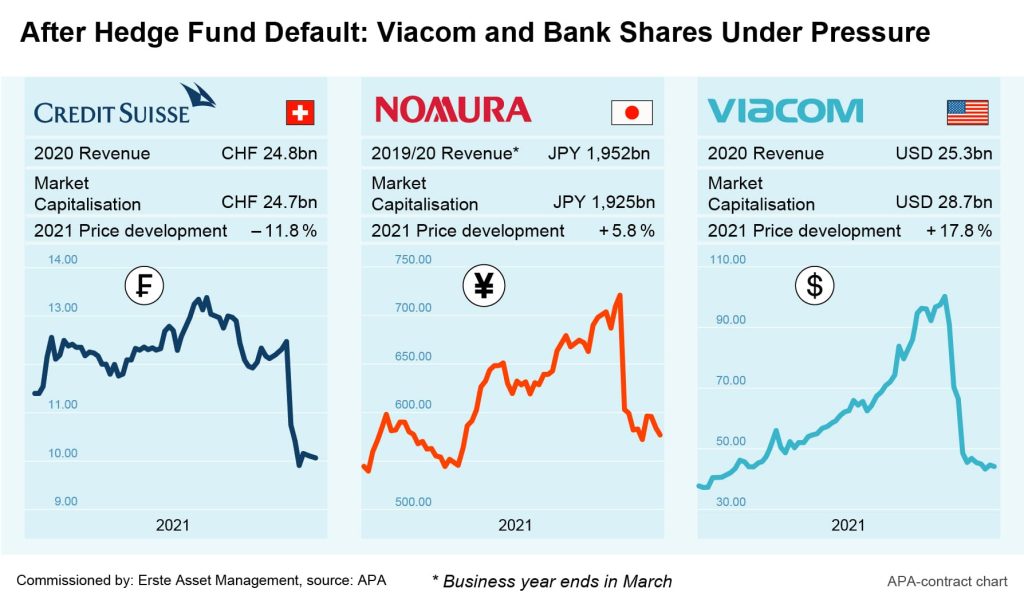

The US hedge fund Archegos Capital’s default is causing a big stir and is likely to cost several major banks dearly. Most recently, Credit Suisse warned of high losses because a hedge fund had not fulfilled its margin calls – which, according to insiders, is Archegos. The bank now expects charges of CHF 4.4bn in connection with the default and fears a loss of about CHF 900m in Q1. On the stock exchanges, the shares of numerous banks had recently taken a massive hit following the difficulties.

The Archegos Capital hedge fund, owned by the investor Bill Hwang, had invested heavily in US stocks and in some dubious Chinese technology stocks. The fund was a client of numerous respectable investment banks, buying the respective shares through them, sometimes with money borrowed in the billions. The shares were deposited with the banks as collateral for the credit lines. With the purchases on credit, the fund also drove up the prices of “its own” shares, in some cases substantially. ViacomCBS, for example, was at times one of the most successful US stocks.

After the US media group increased its capital, however, Viacom shares fell again and the banks demanded additional collateral for the credit lines from Archegos Capital. However, Archegos was unable to meet these margin calls. According to media reports, Hwang sought a solution with the banks, but failed. As a result, the fund stumbled and collapsed.

According to the media, the lending banks could not agree on an orderly liquidation of the fund. Some of the banks began to sell the shares deposited as collateral. Deutsche Bank, reports claim, was able to sell a block of shares worth USD 4bn. According to the bank, it came out of the deal with Archegos unscathed. Goldman Sachs, Morgan Stanley and Credit Suisse are also said to have sold blocks of shares. The sales triggered further share price losses, partly in a chain reaction, and some banks are likely to have lost out.

Fund’s default causing billions in losses for investment banks

According to media reports, the size of the share bundles held by Archegos is said to have amounted to USD 20bn to 30bn. Analysts estimate that the losses across the industry amount to up to USD 5bn or even more. According to financial circles, Goldman Sachs, Morgan Stanley, UBS and Deutsche Bank are likely to have suffered only minimal losses. However, Credit Suisse and the Japanese financial group Nomura are likely to have been severely affected. Nomura had recently warned of possible losses of about USD 2bn.

Consequences have already been drawn at Credit Suisse. The hedge fund debacle is already the second failure this year for Switzerland’s second largest bank. Previously, Credit Suisse had already taken a hit from the British-Australian financial conglomerate Greensill Capital’s bankruptcy. As a consequence, Brian Chin, CEO Investment Bank, and Lara Warner, Group Chief Risk and Compliance Officer, now lose their jobs, while the executive board is foregoing bonuses. In addition, the bank is suspending the repurchase of its own shares and plans to cut the dividend. The rating agency Standard & Poor’s has already reacted and lowered its rating outlook for Credit Suisse from “Stable” to “Negative”.

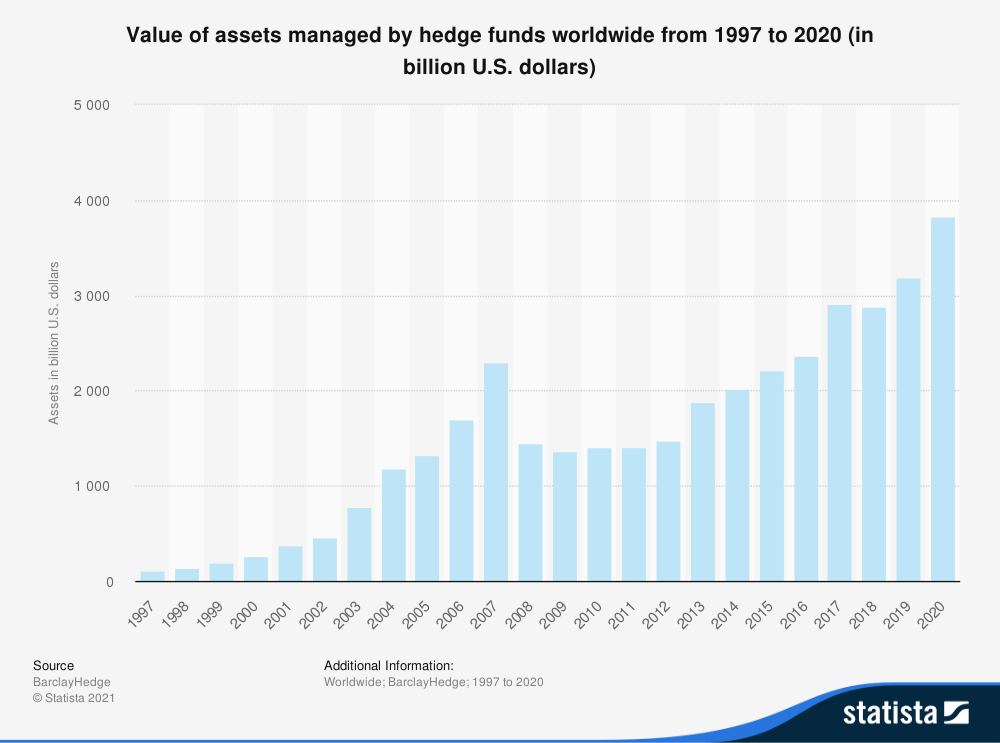

Financial market regulators are currently busy discussing how such bankruptcies could be prevented in the future. US Treasury Secretary Janet Yellen also wants to have the risks to the financial system posed by hedge funds examined more closely. To this end, a specially created group of experts is to be revived. Archegos Capital was run as a “family office”, a kind of exclusive private manager for its own assets only. Since Hwang theoretically invested only his own money, he was subject to less strict guidelines than other hedge funds investing client money. It is possible that the US Securities and Exchange Commission (SEC) will now tighten its rules here – and if it turns out that Hwang had also invested other people’s money, he would be in trouble with the regulators anyway.

Bankruptcies of major hedge funds are not a new thing

Archegos Capital is not an isolated case: Individual spectacular hedge fund bankruptcies have made big waves in the past. For example, the Russian crisis in 1998 and the default of Russian government bonds led to the near-bankruptcy of the Long-Term Capital Management (LTCM) hedge fund. Since the fund’s extensive investments posed further dangers to the financial markets, the US Federal Reserve had organised a capital injection of more than USD 3bn at the time with the help of a consortium of banks, which saved the hedge fund. The former star investor Bernard Madoff’s hedge fund also made it into the headlines, after Madoff fooled his prominent investors into believing that they would receive high returns by means of a kind of pyramid scheme.

Hedge funds have often been criticised in the past because a failure of their sometimes risky investment strategies can trigger chain reactions in the financial sector and the markets. However, hedge funds also fulfil economic functions. They can take on greater risks than traditional funds via a wide range of alternative financial instruments and investments, as they can hedge the risks within the fund.

Hedge funds often take on a key role with their alternative investment strategies

Hedge funds often bet on rising prices in one market segment, while betting on falling prices in another through derivative instruments or short-selling. To do this, hedge funds might sell borrowed shares that they only want to buy and return later at a lower price. Hedge funds also often use leverage techniques in order to achieve large returns with a small investment through additional borrowed money.

In this way, they can also offer their investors high returns with higher risk. The alternative strategies of hedge funds also enable them to generate returns even when the stock market is moving sideways. Some pension funds therefore also invest a small part of their investment portfolio in hedge funds in order to diversify, as a counterbalance for more traditional investment positions.

In the market, hedge funds also more or less assume the risk for other players who want to hedge against risks. They provide liquidity so that risk can be traded like a commodity. Some asset managers, such as BlackRock, are also directly involved in numerous listed companies on a large scale, with billions of dollars from their their clients invested in assets.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.