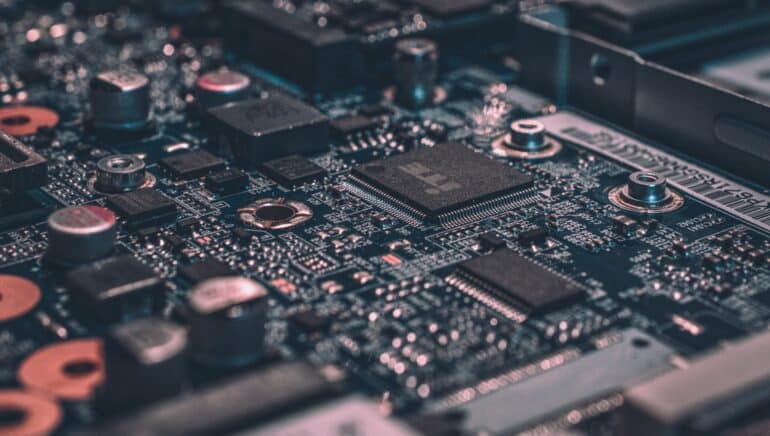

The global semiconductor shortage could further slow down the automotive industry’s long-awaited recovery. Thus, the microchip crisis has recently been a dominant topic of conversation among industry representatives at the Shanghai auto show. The director of the Chinese Automobile Dealers Association, Jia Xinguang, expects only slight improvement for the second half of the year, but no solution to the problem. Automotive big player Volkswagen is also bracing itself for a continuing tight supply.

Car manufacturers worldwide are currently struggling with shortages of semiconductors. Volkswagen, for example, recently closed its production at the Emden plant for a fortnight because of the supply crisis. Ford also recently halted production in some plants because of the manufacturing bottlenecks. Hyundai stopped production at a plant in South Korea from 7 to 14 April.

Digital transformation and lockdowns driving global chip demand

The chip crisis was triggered by the outbreak of the Corona pandemic in early 2020. Lockdowns and quarantine measures around the world as a result of the pandemic led to an enormous boost in digital transformation. The home office boom, for example, led to a strong increase in laptop demand and, as a consequence, in demand for computer chips.

At the same time, the extensive restriction of leisure activities to people’s own homes also drove demand for consumer electronics from televisions to video game consoles. Finally, the shift of work and leisure activities into the digital world has also increased the demands put on existing internet infrastructure. Demand for memory chips for servers and data centres has risen sharply. All in all, according to market researchers at Gartner, sales of semiconductors worldwide had risen by a good 10 per cent to USD 466bn in 2020.

The automotive industry itself was not affected by this right from the start: Initially, the industry struggled with in-house problems such as pandemic-related plant closures. But when car manufacturers were ready to ramp up global production again, a new problem arose: semiconductor manufacturers around the world were working at full capacity and producing at full speed for the electronics industry. The computer chips needed for cars were suddenly in short supply.

The computer industry is likely already feeling the consequences of the global chip shortage. According to a report in the Japanese business newspaper “Nikkei” in April, the supply bottlenecks at Apple are already affecting the production of laptops and tablets, although Apple itself has not yet confirmed such problems.

Currently, no end to the strong demand and the chip shortage is in sight. Trends such as the digital transformation of working environments or autonomous driving are likely to increase demand even more, market researchers expect. In addition, certain factors such as a chip production breakdown in Texas after a cold spell and subsequent power outages in the US state have exacerbated the situation.

Capacities of chip contract manufacturers at the limit

The manufacturing bottlenecks shone a harsh light on the large contract manufacturers of semiconductors, the so-called foundries. This is because numerous chip manufacturers such as AMD, Nvidia or Qualcomm operate as “fabless companies” without their own production: they design and sell their chips; however, the production itself is commissioned from the foundries.

The third group in the chip market are the integrated device manufacturers, or IDMs, where the whole chain from design and production to distribution is done in-house. But even prominent IDMs like Intel outsource some of their production to the large contract manufacturers. Many prominent chip companies are thus themselves affected by the chip crisis, as the foundries are currently working at the limits of their capacity and can no longer keep up with demand.

This has created a kind of global distribution battle for the services of the foundries. Two large Asian manufacturers are in the limelight: the Taiwan Semiconductor Manufacturing Company (TSMC) and South Korean electronics corporation Samsung. Globally, only these two companies can currently produce the particularly densely packed chips based on the so-called five-nanometre technology.

Market leader TSMC in particular has recently profited greatly from the chip shortage and grown its profits surprisingly strongly in Q1, to TWD140bn (roughly EUR 4bn). One of the company’s largest customers is iPhone manufacturer Apple. TSMC now wants to invest USD 100bn in expanding its production within three years.

The much smaller chip contract manufacturer Globalfoundries is taking a different approach and seeking cooperation with its customers. The US company wants to invest USD 450m in its production facility in Dresden, a third of which is to be provided by customers such as Infineon or Bosch. The customers can reserve capacities through advance payments or invest directly in production facilities. According to information from news agency Bloomberg, the group could also soon raise further capital through a possible IPO.

US President Biden invites companies to crisis summit

Meanwhile, even politicians have to react to the chip crisis. The semiconductor shortage not only affects important industries, but also parts of critical infrastructure. Thus, the US government invited the executives of nearly 20 large affected companies to a summit meeting in April to discuss possible strategies. US President Joe Biden wants to support US semiconductor production and investments to promote the production of critical goods with at least USD 100bn.

The semiconductor crisis also likely was a major topic during Japanese Prime Minister Yoshihide Suga’s inaugural visit to Joe Biden earlier this month. In view of the supply bottlenecks within the chip industry, the US and Japan are planning an agreement on the supply of critical semiconductor components, according to a report in “Nikkei”.

Invest in technology shares by investing the ERSTE STOCK TECHNO fund

The technology equity fund ERSTE STOCK TECHNO offers an opportunity to participate in the development of technology shares (see chart). The fund management team focuses on high-quality, high-growth companies, the majority of which are based in the USA. The semiconductor industry is currently weighted at around 14% in the fund. The investment process takes into account environmental, social, and governance factors.

In addition to the long-term trends towards digitalisation, recent reports from various semiconductor suppliers such as ASML (which supplies foundries such as TSMC and Samsung Electronics) give clear indications that the high demand for computer chips will not be a short-term effect. “The order books of the suppliers are well booked, and they are also working flat out on additional deliveries. Strategic considerations regarding security of supply from the perspective of Europe and the USA are added to this,” emphasises Bernhard Ruttenstorfer, Senior Fund Manager of ERSTE STOCK TECHNO.

An investment in technology shares provides the investor with the chance of attractive gains, but at the same time he/she has to bear in mind the often elevated price fluctuations and the resulting risk of loss. We recommend a holding period of at least six years. By signing up for a fund savings plan (s Fondssparen),you can start with regular contributions of as little as EUR 50.

Legal note:

Prognoses are no reliable indicator for future performance.

The global semiconductor chip scarcity that began last year is still wreaking havoc on many businesses after more than 18 months. After more than 18 months, the worldwide semiconductor chip shortage that began last year is still creating havoc on many firms. For more information visit us – https://oricus-semicon.com/