The use of energy has driven human development. For example, over 150 years ago, the discovery of fossil fuels brought about one of the greatest changes in human history. The energy available suddenly multiplied. More and more machines could be powered by it, cars and lorries could be built, electricity could be generated, and plastic could be produced. Life became easier in many areas.

But only for a short while. The unchecked burning of fossil fuels produces massive amounts of CO2. In the meantime, these have thrown our planet’s climate system out of balance. The climate and nature are in crisis, and with them a future worth living for people on the planet is on the line.

Unchecked global warming is deadly. For us humans and for nature. The resulting climate damage will be so enormous that future generations will be severely restricted in the way they live. Hundreds of millions of people will lose their livelihoods and their homes. Future generations will have to invest a large part of their lives in coping with this damage. Distribution wars and enormous weather disasters will make life as we know it today impossible. That would be the most expensive way at all levels.

Nature is under pressure

In interaction with global warming, we are experiencing a dramatic loss of biodiversity. We are destroying, polluting, and overexploiting species and habitats at a record pace. This can be seen in the decline of mammals, birds, amphibians, reptiles, and fish. On average, the populations studied declined by 69% between 1979 and 2018.

As a result of the way we produce and consume products, we take more from nature than it can provide or regenerate. The provision of energy plays a decisive role in this. In turn, weakened ecosystems provide fewer and fewer services that are essential for human survival. For example, the earth can only absorb smaller and smaller amounts of CO2. The climate crisis is intensifying, which can lead to irreversible “tipping effects”.

Climate problems and energy waste

Two thirds of Austria are powered by imported fossil energy – more precisely, by oil from countries like Kazakhstan, Nigeria, and Saudi Arabia and natural gas from Russia. Many billions of euros flow out of the country for this and finance the local political systems and problems there.

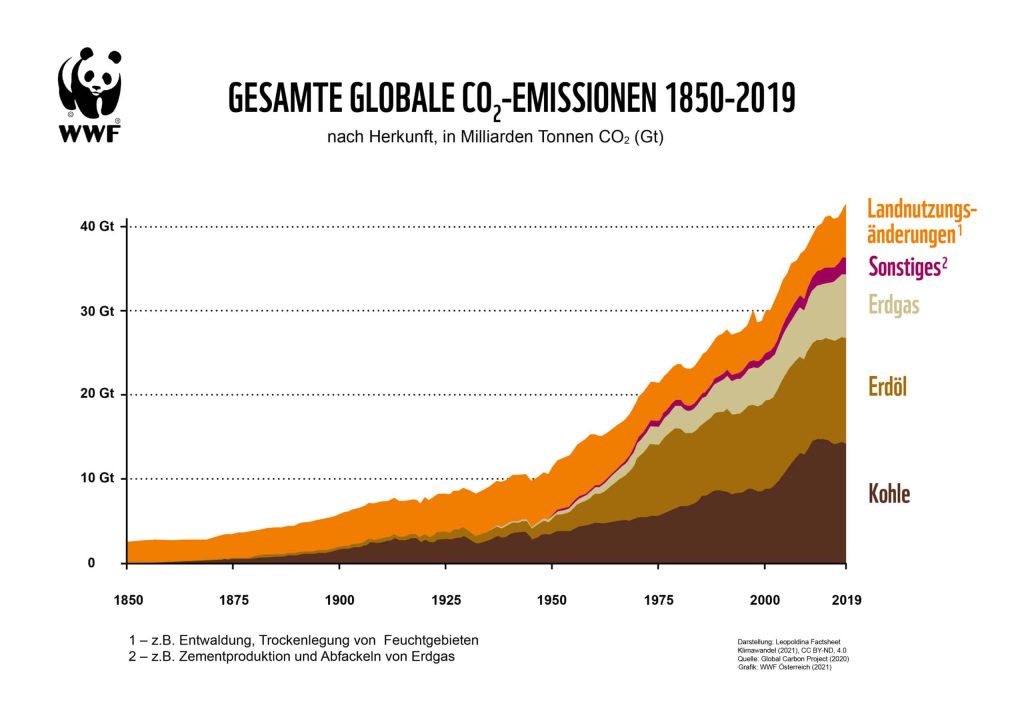

Total global CO2 emissions 1850-2019 by origin, in billions of tonnes of CO2 / Changes in use of land, Other, Natural gas, Crude oil, coal

1 – e.g. deforestation, draining of wetlands

2 – e.g. cement production and flaring of natural gas

In total, 85% of Austria’s greenhouse gases come from the combustion of oil, natural gas, and coal. The high consumption of energy increases massively due to inefficient use. The enormous amount of energy wasted is exemplified by buildings, where knowledge and materials (would) have been available for decades to at least halve energy consumption. The mobility and industry sectors are also among the core drivers of energy consumption with many opportunities for savings.

The WWF concept: less and more efficiently used energy, and more environmentally sound, renewable energy

It is not possible to fully cover the current, wasteful energy consumption with renewable energies. And it is just as impossible to replace the current petrol and diesel vehicles 1:1 with electric ones. Nor does it make sense to heat buildings intensively and continue to lose a lot of energy through leaky windows and thin exterior walls.

Consumption must be reduced in all these areas. To this end, we must invest in energy-saving technology, materials, and infrastructure and consciously avoid unnecessary short-haul flights, short car journeys, or overheated reception areas. Cycle paths and public transport must be expanded. Buildings need effective thermal insulation and modern windows to keep the heating energy in the house. Electrically powered cars and trucks need to be further developed and also used as electricity storage. In industry, an investment offensive is required, for example to switch to speed-controlled electric motors or efficient compressed air systems.

Although by European standards, renewable energies in this country are well developed at over 30%, there is still a long way to go to achieve 100% environmentally sound, renewable energy for electricity, heat, and fuels. The expansion has to be implemented quickly and cannot be at the expense of nature. Both are possible.

Only if we think of climate and biodiversity as a unity will we be able to solve the challenges and ensure a future worth living for us humans.

This article is part of the ESGenius Letter on the topic of the Energy of the Future. The other articles with information and insights on sustainable energy use can be found here.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.