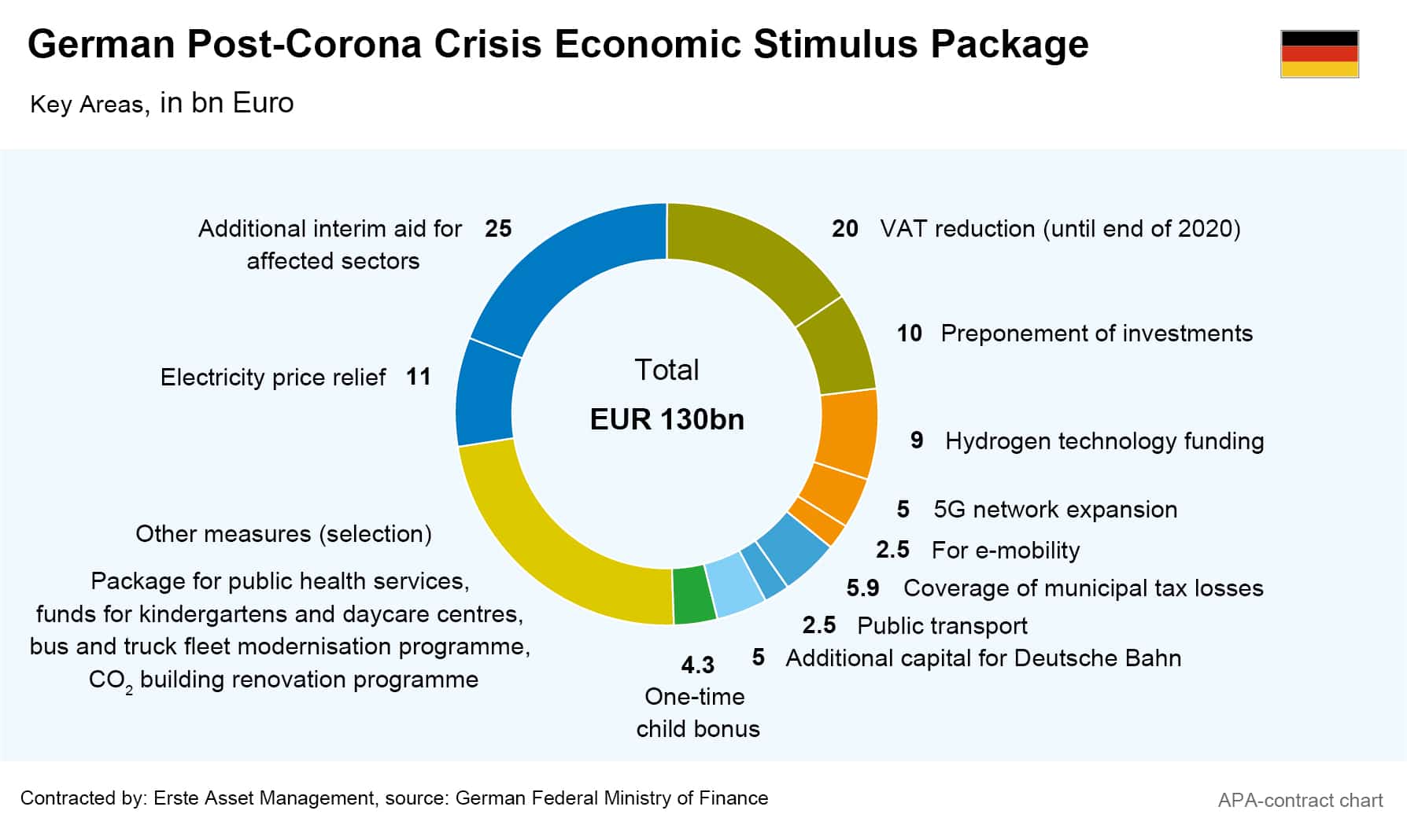

With a massive economic stimulus package, Germany’s government intends to cushion the consequences of the coronavirus crisis. On Wednesday evening, after days of tough wrangling, the leaders of the coalition agreed on an economic stimulus package for 2020 and 2021 to the tune of EUR 130bn.

This historic measure is intended to revive the economy and consumer spendings and avert a severe recession resulting from the corona pandemic. Germany’s Chancellor Angela Merkel spoke of a good result and a courageous response to the crisis. Vice Chancellor Scholz summed the results up saying: “We want to emerge from the crisis with a bang.”

Government issues surprising temporary VAT cut

The core of the package is what the government calls a temporary reduction in value added tax. From July to December, VAT is to be lowered to 16 per cent from the previous 19 per cent. The move came as a surprise to many, as there has never been a VAT reduction in Germany before. The temporary nature of the tax cut is intended to motivate consumers to bring forward planned purchases or not to postpone them until later.

The surprising reduction was received with mixed feelings. Dietmar Bartsch, deputy leader of the left-wing parliament faction, described the program as generally “incredibly expensive” and the temporary VAT reduction as “economically absurd”. Tax expert Stefan Bach of the German Institute for Economic Research, on the other hand, praised the VAT reduction for its fairly even distribution effect – provided, however, that companies also pass on the VAT reductions to their customers. Unfortunately, previous studies on the effects of tax cuts in Europe do not provide any clear results to rely on.

Companies from sectors that have been particularly hard hit by the crisis will also be supported: interim aids to the tune of a maximum of EUR 25bn are planned, according to the resolution paper. The aim is to prevent a wave of bankruptcies among small and medium-sized enterprises. In addition, the German federal government, together with the states, wants to compensate for the trade tax loss of municipalities, which is estimated at EUR 11.8bn, costing the federal government 5.9 billion.

The package’s goal is to boost innovation and climate protection

Another key point of the crisis package is sustainability. Environmental protection and future technologies are to be promoted significantly. For instance, the decision was made against a premium for low-emission gasoline and diesel cars, while significantly higher premiums will be granted for electric cars. Climate protectionists welcomed this step, however, the automotive industry was predictably disappointed, having expected additional purchase incentives for cars with modern, low-emission combustion engines as well. Shares of several car manufacturers temporarily reacted to the decision with significant losses.

The package is also intended to promote public transport. Thus, an additional EUR 5bn are to be made available to Deutsche Bahn to increase its equity capital. In addition, EUR 2.5bn in aid is planned for local public transport. Citizens are also to receive support for electricity costs. To this end, the EEG levy for the promotion of green electricity plants is to be reduced from 2021 by means of subsidies from the federal budget.

A one-off child bonus of EUR 300 per child is to be paid out with the child benefit. And finally, the package also aims to help forests and the lumber industry with an additional EUR 700m. The money is to be made available for the reforestation, conservation and sustainable management of forests.

Economists praise the government decisions in first reactions

The economic stimulus package gives the economy and experts hope for a rapid recovery after the corona crisis. The initial reactions of companies and economists were generally favourable. The industry association BDI stated that the government’s announcement constitutes a “strong signal to citizens and companies” that the package will “significantly mitigate the recession”. Employers’ Association President Ingo Kramer said that the resolutions were a “contribution rapidly leaving the crisis behind”, while the German Association of Skilled Crafts (ZDH) called the package a “remarkable response to an unprecedented crisis”. The president of the Ifo Institute, Clemens Fuest, also praised the package as well thought-out and balanced, while the head of the German Council of Economic Experts, Lars Feld, told the Handelsblatt newspaper that he was “pleasantly surprised”.

In any case, expectations for the economic stimulus package are high, as the latest economic data from Germany continue to paint a bleak picture. German industry has recently seen orders plummet at record speed. In April, 25.8 per cent fewer orders were received than in the previous month, the Ministry of Economics announced on Friday. This marks the strongest decline since the statistics began in 1991.

In its current forecast for this year, the German Central Bank expects a 7.1 per cent decrease in economic performance. However, its outlook is now more positive, thanks in part to the economic stimulus package, the central bank announced on Friday. For 2021, the central bank’s economists expect 3.2 per cent growth, and in 2022 real GDP is expected to increase by 3.8 per cent

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.